45-Year Anniversary of Fiat Currency Replacing Gold

Just Over 45 Years Ago the U.S. Left the Gold Standard – What Has Happened Since?

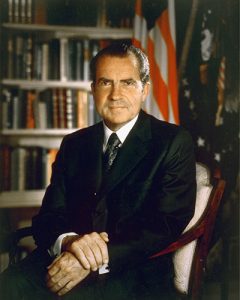

We just passed the 45-year anniversary of fiat currency replacing gold. 45 years ago – August 15, 1971 – President Nixon declared the end of the United States’s decades long, gold backed monetary system and replaced it with the current fiat system. The gold standard had ensured that something valued and physical – gold – was giving value to the dollar rather than paper, government promise, and digital manipulation. At the time gold was $35 an ounce. Today it is $1,350 an ounce.

Nixon’s strategy was originally designed to be a temporary measure. He claimed it was to combat nefarious “international money lenders” who were waging war against the U.S. dollar. In reality U.S. spending on the Vietnam War was creating a massive budget deficit and soaring inflation. Both foreign governments and private investors saw the potential for dollar devaluation and immediately began flocking to gold.

What this means for investors: Nixon’s promise that the dollar would not decline was proved false. The dollar plunged. Within nine years of leaving the Gold Standard, gold had climbed from $35 to $850. Since 1971, there have been market upheavals, economic crises, and currency collapses around the globe due to speculation and manipulation of fiat money. Gold has real value, and that value will always protect wealth during uncertainty and crisis when printed paper becomes worthless.

The Fed’s Announcement and How It Affects the Gold Bull Market

This week the Federal Reserve’s minutes were released from their latest meeting. Many investors were hoping the Fed would at last turn hawkish and announce an interest rate hike. However, the announcement was much more timid than these investors would have liked. The announcement was rather that an increase might be appropriate soon with no indication of specific date. Gold initially fell after the Wednesday announcement, but rose again Thursday on the uncertain nature of the announcement. Peter Grandich, the self-styled “Wall Street whiz kid”, later wrote that gold is in the early stages of its biggest bull market ever.

Silver is also likely going to ride the same bull market run as gold. The ratio between gold and silver is narrowing. It’s up more than gold so far for the year and could still have a ways to run.

What this means for investors: Many strategists have been saying for months that gold and silver are entering new bull markets. The summer is historically a slower period for precious metals, and as we enter autumn, prices could start to see more movement. Gold and silver are both up over 26% for the year, and have a ways to climb still. Price dips after announcements like the one last week are an optimal time to diversify an investment portfolio with both gold and silver.

Lord Rothschild Is the Latest Elite Banker to Increase Gold Holdings

The Rothschild name has been synonymous with speculative banking and furtive, elitist power for well over a century. This week Lord Rothschild called the current monetary policy of central banks around the world the “greatest experiment in monetary policy in the history of the world” as they attempt to force stimulus into economies through low and negative interest rates.

In his half-yearly financial report for his fund, RIT Capital Partners, Rothschild outlined the impending global risks. These risks were primarily the UK vote to leave the EU, the sluggish economic growth in China, tensions in the South China Sea, conflicts in the Middle East, the U.S. presidential election, and recent terrorist attacks in Germany, France, Belgium, and the U.S.

Along with outlining geopolitical and economic risks, the banker stated that he was increasing his gold holdings due partly to the increase in declining yields. He reduced pound sterling holdings due to the pound’s post-Brexit crash, and was also somewhat reducing U.S. dollar holdings.

What this means for investors: Many hedge fund managers and bankers are increasing gold holdings in their portfolios and preparing for a future of uncertainty and crisis. Gold protects wealth when fiat currencies fail. It could be an ominous sign when the world’s most powerful and influential are turning to gold.

Is the Stock Market Approaching a Stall? Why One Expert Thinks So

Art Cashin, director of UBS floor operations at the New York stock exchange, warned this week that even as stocks are hitting new highs, the market could be about to stall. At first look it might seem contradictory. Cashin thinks that it is possible people have simply not realized the stall approaching yet because of the gradual nature it has arisen.

The markets are also still awaiting economic data from the UK to see how hard it was impacted by the Brexit vote in June. Currently the British 30-year bond is yielding less than the U.S. 10-year after the Bank of England cut interest rates last year.

What this means for investors: When the stock market bubble finally bursts, investors will start flocking to gold. The current trend the markets are in are unusual in that the stock market is hitting highs even as gold continues to make gains. Gold will be a safe haven for investors when the market finally stalls, as Cashin predicts it will soon.

Subscribe Now to Get the Gold Market Discussion Delivered Direct to Your Inbox

Watch: Silver is on the Rise

Watch this latest video with Arizona Sports host and RME Endorser Ron Wolfley

Here are some articles from the web discussing the topics in this week’s post:

45 Years Ago This Week the U.S. Left the Gold Standard – What Has Happened Since?

Read Here

The Fed’s Announcement and How It Affects the Gold Bull Market

Read Here

Lord Rothschild Is the Latest Elite Banker to Increase Gold Holdings

Read Here

Is the Stock Market Approaching a Stall? Why One Expert Thinks So

Read Here

As always, I encourage you to speak with your broker at RME for more market updates. Expert brokers are available Monday-Friday from 9 AM- 5 PM or by special appointment after hours. Call today at 602-955-6500 or toll-free at 877-354-4040.