The Price of Gold Relative to the Value of the Dollar in the Last Year

The Price of Gold Relative to the Value of the Dollar – CHART

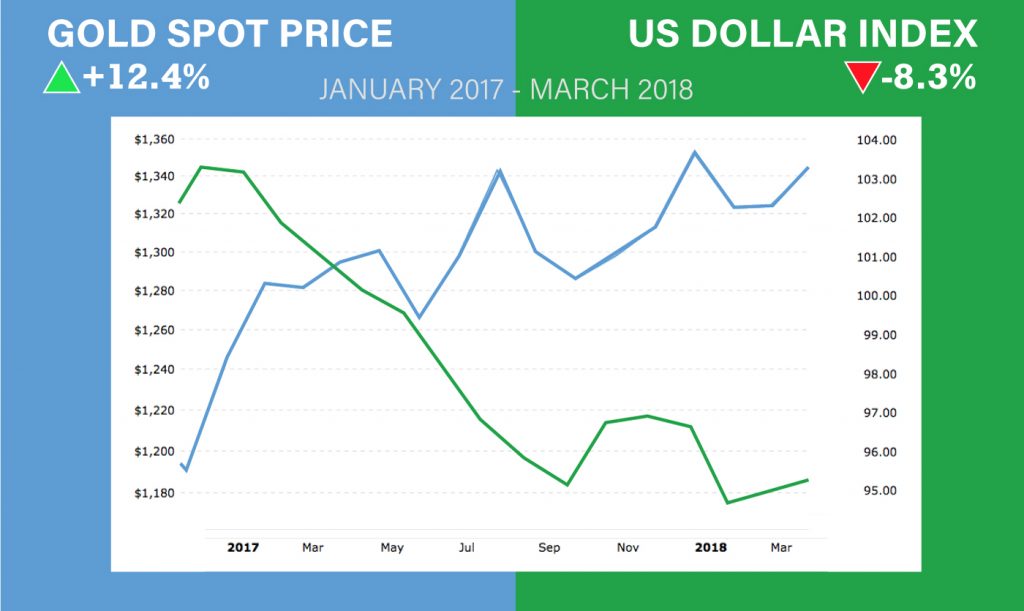

This chart depicts the price of gold relative to the value of the dollar over the last 15 months. The price on the left is the movement in gold prices since January of last year until last month. The right side shows dollar index level. What it reflects is that the value of the dollar is declining in terms of the price of gold (the dollar illustrated by the green line and gold by the blue). In dollar index terms, gold spot price has gone up, while conversely in gold price values, the dollar index has declined.

What this means for investors: The dollar index is going to be up against a significant amount of pressure ahead. Rising interest rates and raging debt are going to lead to further dollar decline. Gold and the dollar move inversely, so as the dollar takes heat, gold becomes more desirable. The interest payments alone on U.S. debt is approaching $800 billion. As interest rates go up and the debt expands, the dollar is going to be further devalued.

Gold Price Up and Down This Week

Gold prices were stuck this week. On Wednesday, it had its highest close in a week after rallying over $1,350. Gold had started the week just under $1,350 and closed just over $1,350. Inflation concerns, tension with China over trade, and carrying over geopolitical fears prompted gold’s gains. Some of the fear trade abated by Friday, and gold prices slipped from the Wednesday highs. The prospect of higher interest rates also helped the dollar recover, which put some resistance on gold.

Gold prices were stuck this week. On Wednesday, it had its highest close in a week after rallying over $1,350. Gold had started the week just under $1,350 and closed just over $1,350. Inflation concerns, tension with China over trade, and carrying over geopolitical fears prompted gold’s gains. Some of the fear trade abated by Friday, and gold prices slipped from the Wednesday highs. The prospect of higher interest rates also helped the dollar recover, which put some resistance on gold.

What this means for investors: It was a relatively quieter week for gold than it has been in recent weeks. However it is still holding on to its gains it has made this year. As long as the dollar finds some resiliency, it will continue to face headwinds. Metals are holding on though, and sitting poised for a break out.

Silver Rallies This Week and Looks Poised to Go Higher

Silver’s movement this week gave silver bulls optimism for the metal approaching a break out point. The white metal hit an 18 month high this week reaching $17.35. It was up from Monday’s open of $16.66 and finished the week at $17.15. Silver prices have been stuck relative to gold in recent months, so the rally this week bodes well for both metals.

Silver’s movement this week gave silver bulls optimism for the metal approaching a break out point. The white metal hit an 18 month high this week reaching $17.35. It was up from Monday’s open of $16.66 and finished the week at $17.15. Silver prices have been stuck relative to gold in recent months, so the rally this week bodes well for both metals.

What this means for investors: Silver, being cheaper, is always more volatile than gold. It has more industrial uses than gold, which can drive prices. Investors are seeing more potential for silver right now to break out right now, and took advantage of the buying opportunity last week while prices were still low. The gold-silver ratio also narrowed this week to its lowest level in a few months.

The Gold Repatriation Trend Continues as Turkey tries to Move Further from the Dollar

This time Turkey is repatriating its gold reserves that previously had been stored in the U.S. Germany recently repatriated its foreign-held gold and other countries such as Hungary have made similar moves. Meanwhile Russia, China, and India have been ramping up gold reserve accumulation. Turkish president Erdogan further said that the country’s debts “should be in gold rather than the dollar.”

This time Turkey is repatriating its gold reserves that previously had been stored in the U.S. Germany recently repatriated its foreign-held gold and other countries such as Hungary have made similar moves. Meanwhile Russia, China, and India have been ramping up gold reserve accumulation. Turkish president Erdogan further said that the country’s debts “should be in gold rather than the dollar.”

What this means for investors: Not only are these countries moving further towards gold, but they also are attempting to move away from the dollar. China announced recently as well the launch of the petro-yuan to challenge the petro-dollar for oil trade. The U.S. dollar has been the medium of exchange for crude oil for decades, and the petro-yuan challenges the dollar’s dominance in the crude market.

Stay Connected to the Markets. Subscribe Now to Get the Gold Market Discussion Delivered Every Sunday Directly to Your Inbox!

As always, I encourage you to speak with your broker at RME for more market updates. Expert brokers are available Monday-Friday from 9 AM- 5 PM or by special appointment after hours. Call today at 602-955-6500 or toll-free at 877-354-4040.