Gold Rallies Friday on Bleak Economic Jobs Data While Dollar Falls

Bleak Economic Jobs Data: U.S. Labor Force Adds Fewest Workers in Six Years

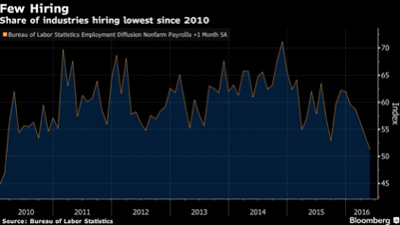

The jobs data was more negative than even the most pessimistic growth projections, according to Bloomberg analysts. Average estimates put the number of jobs added to the U.S. labor force for May at 150,000. The reality was shockingly short at only 38,000 jobs added. The weak job growth was across all industries, but was particularly felt in factory, manufacturing, and those vulnerable to weak overseas markets. The number of part-time employees who want full-time work rose nearly 500,000 from April. The unemployment rate is now at 4.9%.

Why this matters to precious metals investors:

Much of the slowly returning confidence in the economy is misplaced, as data like this indicates. A weak labor market is indicative of a struggling economy. Gold prices have seen some pull back the past couple weeks, but the rally this week shows it has potential to rise higher if the economy continues to slow. It is a prime buying opportunity before prices rise again.

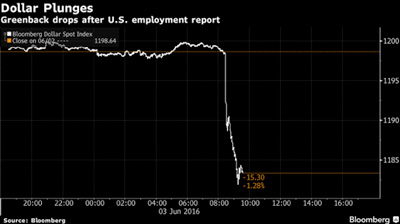

Dollar Plunges Lowest Since December and Stocks Fall While Gold Soars – Will The Fed Change Policy?

Gold closed $30 up on Friday while stocks and the dollar fell. The reason for this was primarily due to the weak job growth that the U.S. Bureau of Labor released on Friday with only 38,000 jobs added in May – the lowest since November 2010. This data shook the markets and made many question the strength of the economy and labor market. Confidence in the economy has been tentatively returning, but as this new data shows, much of that was likely based on false flags and hopeful thinking. One currency strategist has said that the dollar correction is over and that it has a weak future.

It also has many wondering if the U.S. economy is strong enough for the interest rates hike that the Fed chair Janet Yellen announced for June. Some analysts are advising to scale it back and warning that it would strain the economy too much.

European Central Bank officials met this week to discuss interest rates and Greece. A decision on diverting more funds to Greece was postponed, but they decided to maintain negative interest rates.

Why this matters to precious metals investors:

The indicators are pointing towards a slowing economy. Demand for safe haven gold will continue to go up, as it has been in 2016. Gold prices will rise in tandem against the plunging dollar. Silver prices were also up as silver continues its stellar performance this year.

G-7 Annual Summit Meeting Discuses Slow Global Economy and Refugee Crisis

The annual two-day summit took place in Japan this week, bringing together leaders from the United States, Japan, Canada, Italy, France, Germany, and the United Kingdom, as well as two of the heads of EU institutions. The main topics for discussion were concerns over the state of the world economy, the refugee crisis, and cyber and maritime security.

Japanese Prime Minister Shinzo Abe compared the current global economic conditions to those of the 2008 financial collapse. Emerging economies are struggling, and their sluggish growth may last some time yet, according to Japan’s cabinet chief. Economic slowdown in China is impacting many nations’ economies and oil prices and commodities have been falling. Abe called for fiscal stimulus and flexible monetary policy from world leaders, but has been meeting resistance from the U.K. and Germany.

Why this matters to precious metals investors:

The U.S. job data and weakening economy are not the only thing that are impacting gold’s rally this year. The malaise is impacting all of the world’s economies and grinding growth to a near halt. Countries like China that are seeing significant downturn are increasing their gold holdings to stave off potential crisis.

We Are in a No-Growth Global Economy, Says OECD Secretary-General

The Organization for Economic Cooperation and Development is an inter-governmental, global institution that strives to “improve the economic and social-well being of people around the world” by advising governments on monetary and social policy. The OECD’s macroeconomic assessment this week revealed the economy’s recovery from the 2008 financial crisis to be disappointingly weak. The International Monetary Fund (IMF) published a similar report in its quarterly World Economic Outlook.

Why this matters to precious metals investors:

The OECD’s and IMF’s assessments are in opposition to what Federal Reserve chair Janet Yellen and ECB chair Mario Draghi have been saying about improving economies. However, Yellen and Draghi are the chiefs of central banks with control over interest rates and policy decisions. The statements put out by them have more impact on the economy than reports from independent agencies like the OECD, but because they have their own policy agendas, they must be taken with a grain of salt. The OECD assessment echoes the concerns from the G-7 Summit leaders and points towards an ominous future.

Here are some articles from the web discussing the topics in this week’s post:

Bleak Economic Jobs Data: U.S. Labor Force Adds Fewest Workers in Six Years

Read Here

Dollar Plunges Lowest Since December and Stocks Fall While Gold Soars – Will The Fed Change Policy?

Read Here

G-7 Annual Summit Meeting Discuses Slow Global Economy and Refugee Crisis

Read Here

We Are in a No-Growth Global Economy, Says OECD Secretary-General

Read Here

As always, I encourage you to speak with your broker at RME for more market updates. Expert brokers are available Monday-Friday from 9 AM- 5 PM or by special appointment after hours. Call today at 602-955-6500 or toll-free at 877-354-4040.