Charts and the Stampede to Gold

We’d like to step back from the daily reports of the wild swings and mounting losses in the stock market to let you ponder a couple of longer-term, big picture items. We think the two charts that follow are mostly self-explanatory, so we will just tell you what they represent and otherwise keep out commentary to a minimum.

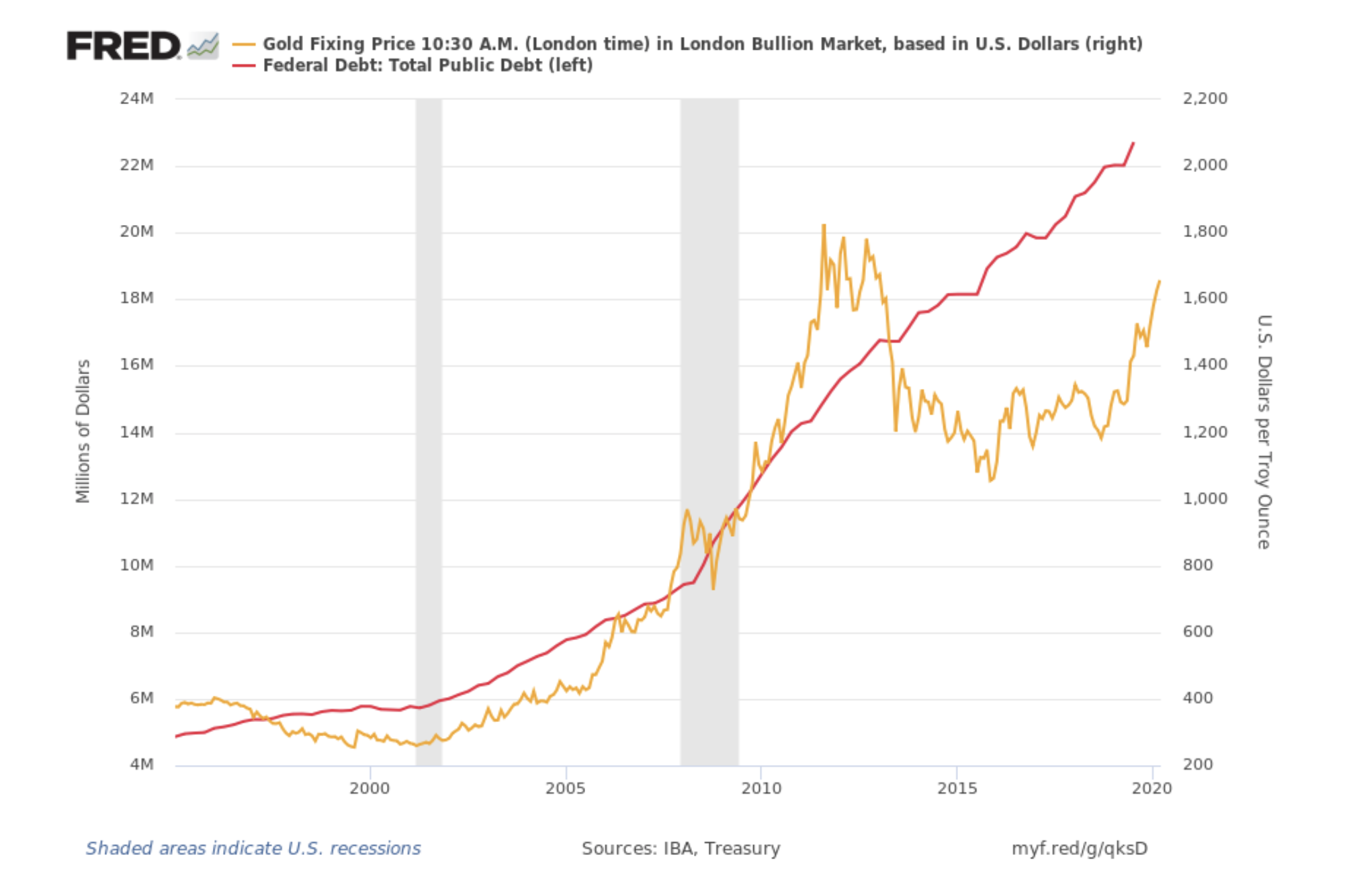

The first chart plots the relentless rise in the US federal debt (in red), now at $23.5 trillion dollars. Because the value of the dollar is subject to the debt as is the Federal Reserve’s willingness to create more dollars to keep the debt game going, you can see that for years the rising debt pulls dollar gold prices higher.

By the way, with businesses slowing down due to the Covid-19 pandemic, tax revenue will fall. It will fall further still if a payroll tax cut is implemented.

At the same time, government spending will rise at a relentless rate with new spending on health-related measures.

That means the red line will turn steeply higher. And pull the gold line along with it.

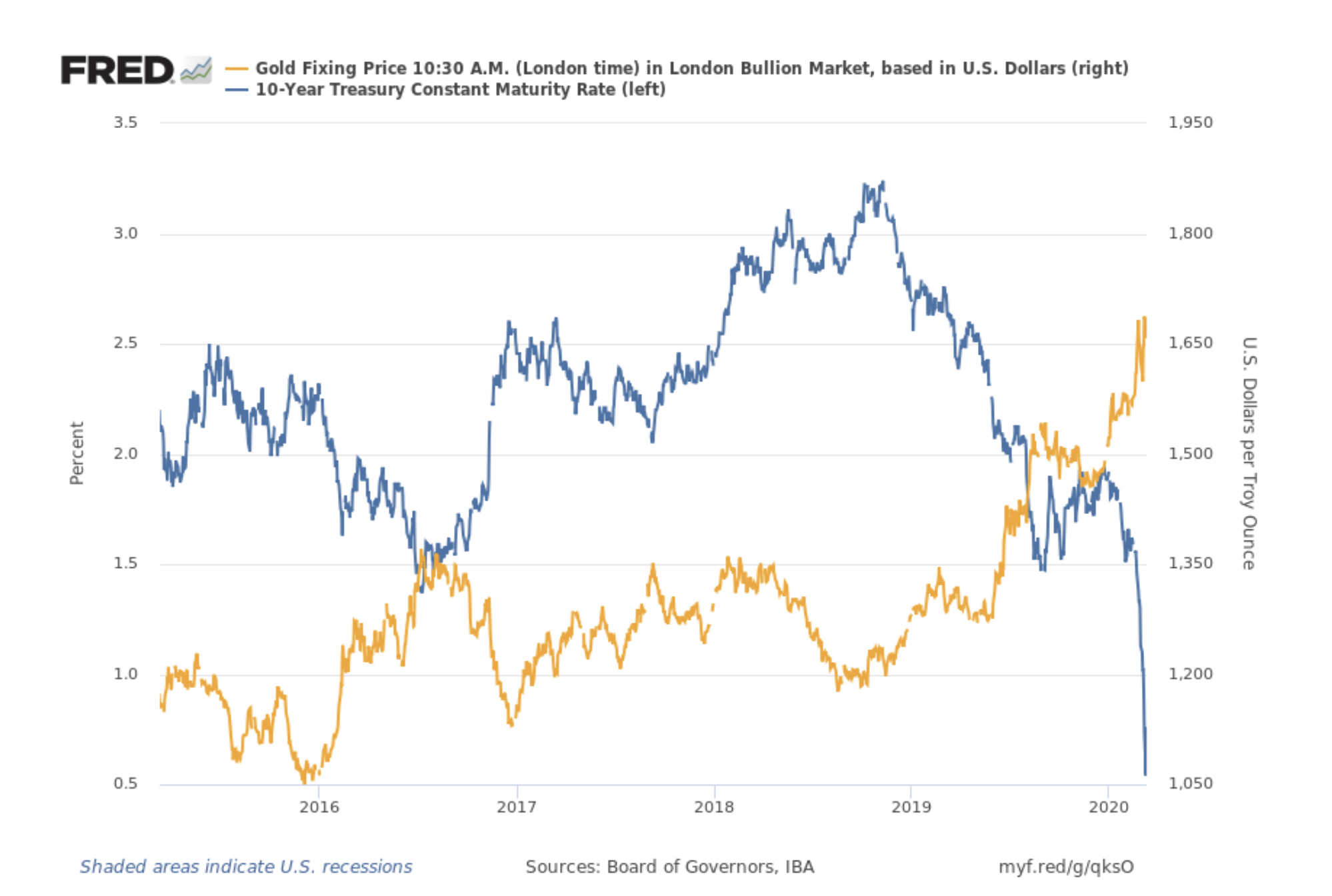

The next chart shows the US Treasury 10-year bond rate back to 2015 (the blue line) compared to the gold price over the same period. Their mirror image movement is impossible to miss. Over the period, as interest rates have ticked up, gold has paused or moved lower; as interest rates have fallen, gold has moved higher.

Plunging Rates

Now the Fed has forced interest rates to never-before-seen lows, with the 10-year yield actually dipping below 5 percent. Plunging rates in 2020 on the right side of the chart are impossible to miss. They foretell higher gold prices.

We would not like to have the job of persuading US Treasury bond buyers and auction bidders that loaning money to Uncle Sam for 10 years at for a paltry one-half a percent annual return is a good deal. Especially since it is clear that the Washington big spenders are going to have to borrow an additional trillion dollars or more each year for the foreseeable future.

A guaranteed loss is assured since it is the policy of the Federal Reserve to erode the purchasing power of the dollar at four times that rate each year.

It can sometimes take a while for critical masses of the people to wake up, but at some point, the guaranteed loss of purchasing power will become apparent to everybody and cause a stampede into gold and silver.

Why not beat the rush? Contact your Republic Monetary Exchange gold professional today.