China Adds 10 Tons of Gold to Its Reserves in December

it’s China’s Turn…

Just last week we reported to you on Russia’s aggressive gold acquisition.

We wrote, “Russia, seeking to protect itself from a dollar crisis, continues to reduce its holdings of US Treasury bonds while beefing up its gold stock at an accelerated pace. The Bank of Russia, the central bank, bought 8.8 million troy ounces of gold in 2018, increasing its total gold holdings by 14.9 percent.”

Now we have the latest from China.

After a two-year lapse in reporting on additional gold reserves, China now shows it added ten tons of gold to its reserves in December. That’s the first reported increase since October 2016.

Like Russia, China’s gold acquisitions can only be described as aggressive. From 1,054 tons in June 2015, it now boasts reserves of 1,852.

In other words, China has grown its official gold holdings by 75 percent in 3½ years.

As you might suspect, China’s has reduced its investments in US Treasury debt at the same time. From August 2017 until October 2018, that part of its portfolio shrunk by five percent.

Bear in mind, that these numbers from the People’s Bank of China reflect official state holdings. But many observers agree that there has been a tremendous flow of gold into private hands in China as well, mostly from Europe and the West.

Meanwhile, China is experiencing its slowest economic growth since 1990. The official growth number for China in 2018 is nevertheless positive, up 6.6 percent. (That’s still about twice the expected 2018 US GDP growth rate.)

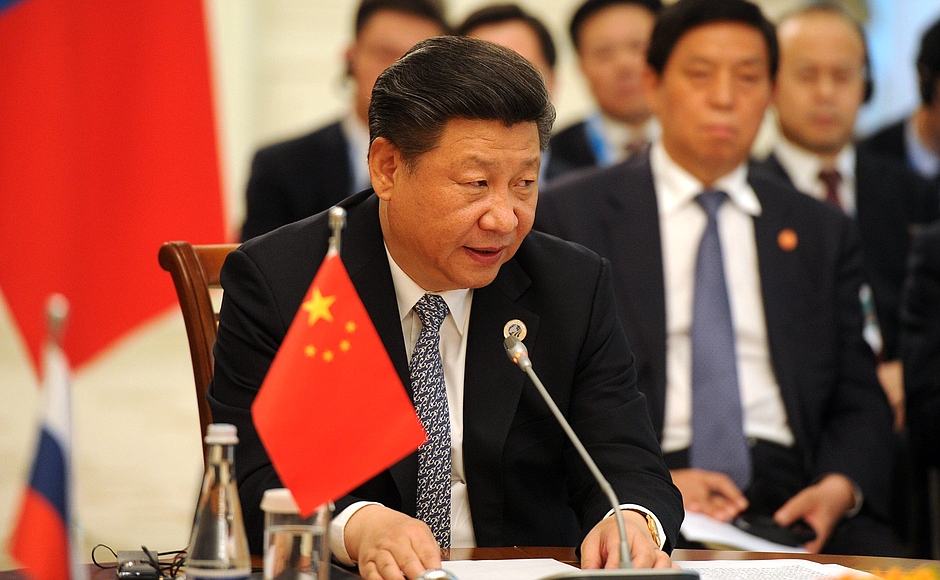

A deterioration of US-China trading relations threatens to suppress China’s growth even more. President Xi has even warned his countrymen recently against “black swan” (entirely unexpected) and “gray rhino” (visible, but underestimated) economic developments.

Slowing growth strikes fear in the heart of China’s leaders. The single greatest concern of Beijing’s party bosses is of a restive population, now used to an improving standard of living. At this stage of its development, widespread unemployment among the urbanized populations would rock the nation to its core.

Should Beijing feel the need “stimulate” its slowing economy, it has a trillion dollars of resources in the form of US Treasury instruments that will be the first to be spent.

We offer that observation without further comment now, but will will have more to say about China’s impact on the dollar in days and weeks to come.

For now, we will just note that your best protection against our own black swan and gray rhino events is ownership of precious metals.