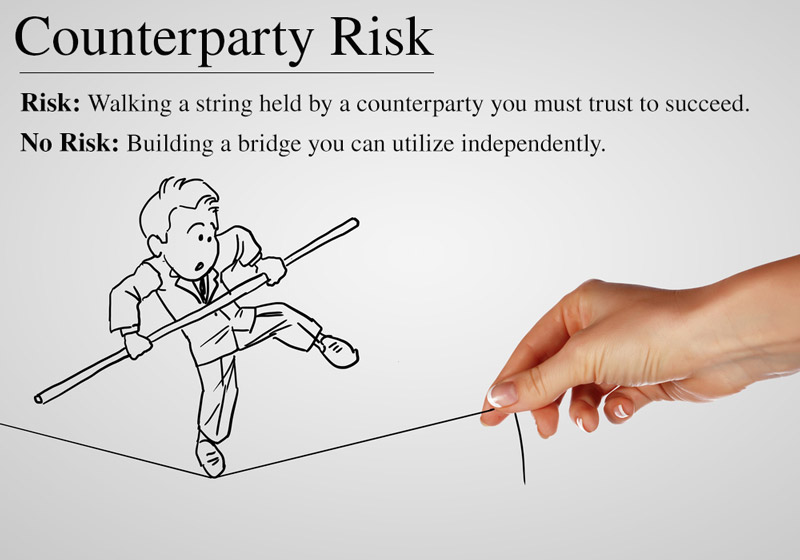

Counterparty Risk

One thing about gold, a defining characteristic that cannot be emphasized enough, is that it does not rely on some one else’s performance or promise.

Gold can be physically held in your hands, under your own control. There can be zero separation between yourself and your wealth– no banks to rely on, no brazen boardroom executives at the company of the stock you own. Simply put, owning physical gold is without counterparty risk.

The same is of course true of silver, which, like gold, has a long and shining monetary history.

What is counterparty risk?

It is the risk of nonpayment, default, and bankruptcy by individuals, companies, financial exchanges, institutions, and banks – quite apart from the risk of the Fed’s fiat dollar.

Gold (and silver) are the only monetary assets that are not someone else’s liability. They are not dependent on someone else’s solvency, promises to perform, or honesty. Their value does not depend on the endorsement or propriety of any state or state institution.

It is a wonderful thing for people’s promises to be reliable, for institutions to be vigorous fiduciaries of their clients’ interest. The modern world with all its miracles is built on the assurance that people will meet their obligations, fulfill their contracts, and respect others’ property.

When this environment of trust begins to fray, sophisticated civilization itself is at risk.

I mention this for two reasons: the monetary authorities sense of obligation to the users of its currency unit is nowhere in evidence. And debt – personal, corporate, and governmental – has reached unsustainable levels.

Although charged with maintaining the value of the currency (price stability), the Federal Reserve’s dollar management has an arbitrary and incompatible objective: a two percent annual inflation rate. At that rate, the Fed is destroying half the value of its currency in 35 years. Why save?

As for debt, corporate debt is higher than when the trouble hit the fan at the end of 2008. Low grade debt has exploded. The number of BBB bonds has more than tripled.

And you know about government debt.

We saw in 2008 how liquidity and solvency problems cascade from one counterparty to another, from insurance company to hedge fund to bank. It is in environments like this that counterparty risk becomes crucial.

Proliferating counterparty risks lead wise investors to the safe haven of gold. But its unique advantage only applies to physical precious metals, the gold and silver coins and bullion that you own outright and have taken into you own possession. It does not extend to paper gold, stock and other representations of gold ownership, commodity contracts, or ETFs.

Speak with an RME associate today to find out how to profit in uncertain times and protect your portfolio with gold and silver. Simply call our office, (602) 955-6500, and you will be connected to one of our knowledgeable gold and silver professionals.