Deficits, Inflation, and De-Dollarization

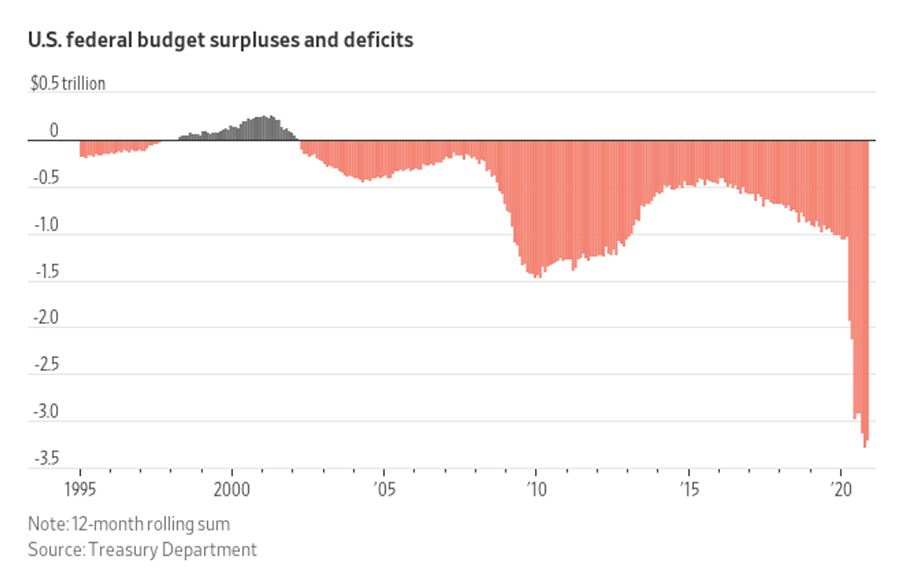

DEFICITS RACING AHEAD

For the first two months of the 2021 government budget year, October and November, the federal deficit ran just over 25 percent higher than the same period a year earlier, before the pandemic.

Associated Press:

“The Treasury Department reported Thursday that with two months gone in the budget year, the deficit totaled $429.3 billion, up from $343.3 billion in last year’s October-November period.

“The deficit — the shortfall between what the government collects in taxes and what it spends — reflected an 8.9% jump in outlays, to $886.6 billion, and a 2.9% decline in tax revenues, to $457.3 billion.”

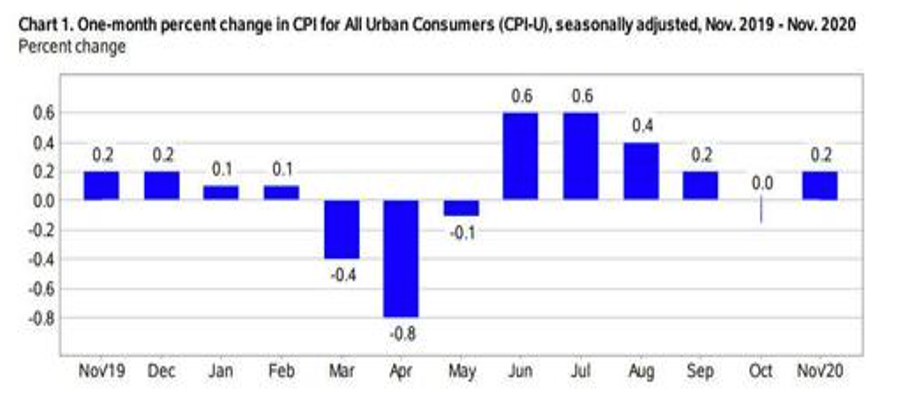

CONSUMER, PRODUCER PRICES INCHING BACK UP

The price inflation numbers are in for the month of November. After a drop into negative rates with the beginning of the COVID lockdown, the Bureau of Labor Standards reports that the overall Consumer Price Index is up 0.2 percent for the month. That outpaces the consensus expectation of 0.1 percent.

The so-called “core” inflation rate, all items less food and energy, increased 0.2 percent in November as well. The November Producer Price Index rose 0.8 percent, the steepest increase since the early days of the pandemic in February.

One other number we think important to keep an eye on, the 12-month food price index, rose 3.7 percent.

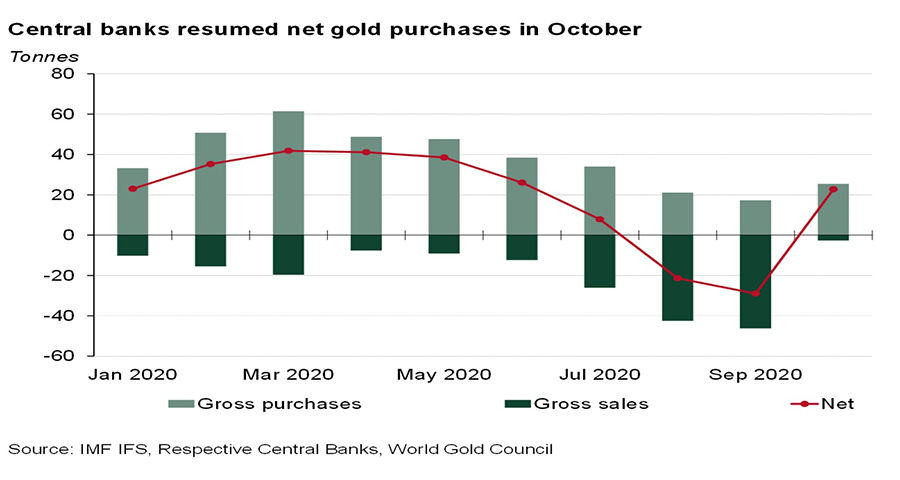

DE-DOLLARIZATION

After a slowdown during after the pandemic got under way, central bank gold buying appears to have resumed climbing.

World Gold Council:

“Following two consecutive months of net sales, central banks resumed buying in October: global official gold reserves rose by 22.8 tons on a net basis. Levels of buying remained consistent with the previous two months, but selling activity was far reduced.”

As we have underscored many times, central bank gold buying is part of a growing worldwide de-dollarization movement.

With many countries abandoning the gold standard during World War I, the still gold- backed US dollar became the world’s de facto reserve currency. That status was formalized after World War II.

Altogether, the Financial Times reminds us in a recent piece, the dollar has had about a 100 year run as the go-to currency. That is about as long as any reserve currency seems to last, it says:

“Before the U.S., only five powers had enjoyed the coveted “reserve currency” status, going back to the mid-1400s: Portugal, then Spain, the Netherlands, France and Britain. Those reigns lasted 94 years on average.”

We invite you to speak with a Republic Monetary Exchange gold and silver specialist to find out why owning precious metals is your first line of defense against deficit spending, rising prices, and global de-dollarization.