The Doom Loop

Washington has us in the “Doom Loop”

Call it what you like. A vicious circle. A downward spiral. The point of no return.

I prefer to call it The Doom Loop.

Here’s an example. Suppose your business has to borrow a dollar to make 90 cents. You’re headed for big trouble.

Here’s a better example of the Doom Loop. Thinking to spur growth – increased productivity, more taxable activity – the government borrows and spends a lot of money.

But the growth doesn’t materialize. So it borrows and spends more.

Still, growth lags behind the rising debt. More borrowing and spending.

The hoped-for increases in productivity and therefor higher tax revenue fails to materialize.

But all the borrowing has a cost. Debt compounds. Compounding debt means more borrowing despite lagging growth.

Now we’re in the Doom Loop.

And that’s the situation Washington has gotten this country into.

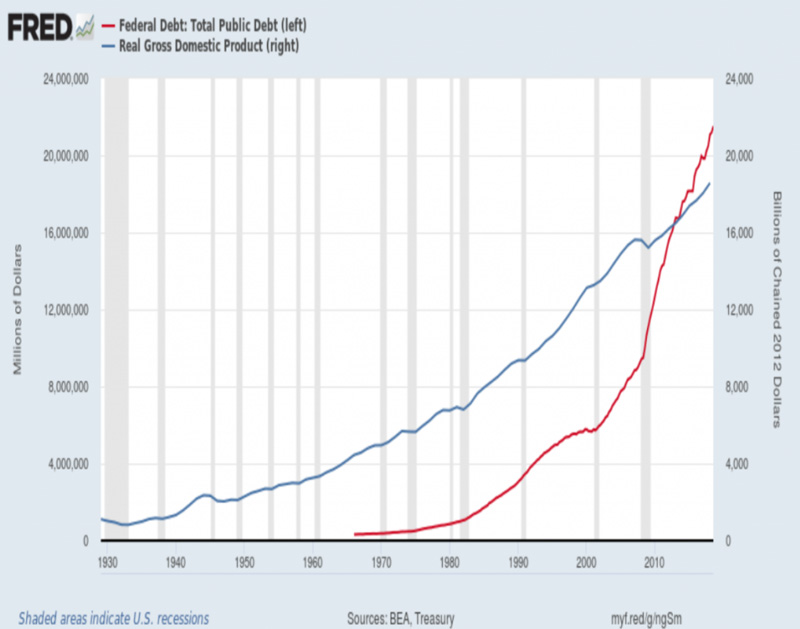

US debt has passed total US productivity.

We reached the crossover point in the fourth quarter of 2012, at the end of Obama’s first term, when the debt surpassed the GDP for the first time since the World War II era.

US GDP at the end of 2012 was $16.24 trillion. US debt was $16.43 trillion.

Soaring National Debt

Today the national debt has climbed more than a trillion dollars past the nation’s total productivity. 2018 GDP was $20.89 trillion (an update of the 2018 estimate is due out in days). The national debt is $22.03 trillion.

Take a look again at the chart we provided in our recent post It’s When… Not If! It shows US Debt in red blowing right past US GDP. And the debt is climbing at a steeper rate.

Economists talk about the marginal productivity of debt: How much growth do you get for each additional dollar of borrowing?

Again, suppose your business has to borrow a dollar to make 90 cents. You’re in the Doom Loop.

Economist Keith Weiner has formulated this into an economic law: If the marginal productivity of debt is less than 1, the economy is not sustainable.

To the extent there is any acknowledgement of this problem in Washington, the stock answer from both Republicans and Democrats has been, “We’ll grow our way out of it.”

Except we haven’t.

We are ten years into the current economic expansion. The average length of an economic expansion is just over three years. The odds of the current expansion continuing are slim, the signs that the economy is slowing are plentiful.

The Doom Loop is a global phenomenon. The IMF says that global debt is now equal to $184 trillion which is 225 percent of global GDP.

How can you escape the Doom Loop?

Don’t expect the government to deal with the problem. When President Trump’s advisors showed him graphs of the coming “hockey stick” debt spike, he merely shrugged, “Yeah, but I won’t be here.”

Economist Weiner says, “It is time for gold to enter the mainstream monetary discussion. Interest rates and the marginal productivity of debt do not fall when there is a free market in money and credit. And the market will choose gold, if it is free to do so.”

But you can choose gold. Speak with an RME associate today to find out how to protect yourself from the Doom Loop. Simply call our office, (602) 955-6500, and you will be connected to one of our knowledgeable gold and silver professionals.

Politicians and government will not choose gold. Printing money is a source of power. It is a major means of vote-buying.