Driving the New Gold Bull Market!

Three Things You Must Not Miss!

It’s impossible to separate three of the most powerful drivers of the new gold and silver bull market. They are joined at the hip and travel together.

First is the dangerous trajectory of geopolitical events – trade and currency wars, and their usual accompaniment, hot wars. From the Persian Gulf to Hong Kong and the South China Sea, which we wrote about that in our last post, Global Tensions, to other hot spots few people are watching, international confrontations will play a key role in driving gold prices much higher.

Next, we look at the US dollar. Nothing is as fundamental to the bull market as the mismanagement of the dollar, on the fiscal and monetary fronts. The government’s spending and debt, and the Federal Reserve’s monetary schemes grow more unhinged with each passing day. They are on a collision course with reality. We have written about them often and intend to update you soon on the Fed’s latest bond-buying program.

This new move of desperation, Quantitative Easing IV, is another round of what we call for convenience “money printing.” Were it not for out-of-control US borrowing and spending, the government would never have had to abandon the gold standard, to begin with. The Fed provides the means for the government to pull off its money-printing sleight of hand with schemes like this new QE.

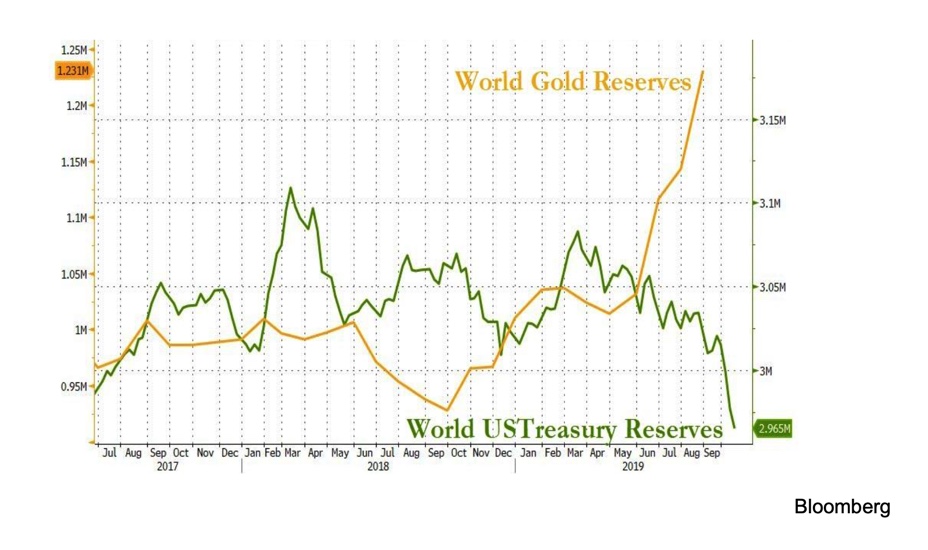

The third of the trouble triplets is the deterioration of the global dollar reserve standard. We have written about the movement of foreign central banks away from maintaining their own reserves in US dollars, which has been the almost universal global reserve currency since the end of WWII. Now central banks are falling all over themselves to replace their dollar reserves with gold. This, too, we have written about before. See here, here, and here.

Much of the reporting we have done on central banks moving out of dollars and into gold has focused on China and Russia. But now, ominously, Germany has gotten into the act, adding gold to its reserves for the first time in more than two decades.

Bull markets are born in fits and starts. But this new gold bull market is already underway. These three factors – worsening geopolitics, the government’s dollar debt and monetary mismanagement, and the ending of the global dollar standard – are a pretty heady fuel for our gold bull market.

We knew Germany had gotten the message when it announced in 2013 that it would call home the gold it had stored with the US. That was like an alert depositor making withdrawals from a troubled institution before the bank run gets going in earnest. But now Germany is making it respectable for purported US allies to begin moving from dollar reserves into gold.

We hope you’ve gotten the message, too.

If not, speak with an RME Gold professional today. They are prepared to help you make gold and silver a part of your portfolio in a safe and secure way that will provide you with peace of mind.