Watching the Fed’s Actions in 2019

The Fed is on the Razor’s Edge

We enter 2019 on the financial razor’s edge.

One wrong move, one little slip by the Federal Reserve, and the money supply and price inflation could explode.

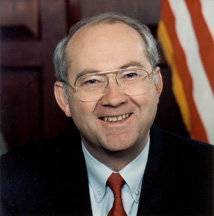

That’s not just my view. I’m citing the views of a former chairman of the Senate Banking Committee. In a Wall Street Journal article this week, former Senator Phil Gramm and a co-author, an economist at Texas A&M, spell out just how vulnerable we are to a monetary policy error by the Fed.

They write, “A small error by the Fed in following market interest rates could cause a large change in the money supply.”

For those of us familiar with the Fed’s 105-year track record of policy errors, that is not a comforting thought. In fact, the Fed seems to have missed every major turn in the economy in its history, especially big ones like the exploding of the 2008 housing bubble.

Just to refresh your memory, neither Ben Bernanke nor Alan Greenspan saw the housing bubble when it was in formation. And when it burst, Bernanke expressed the view that it wouldn’t seriously affect the economy.

Wouldn’t seriously affect the economy? The unemployment rate doubled as eight million American lost their jobs, four million homes were lost in foreclosure, and 2.5 million businesses went under.

The authors trace today’s extreme vulnerability to the Fed’s decision to pay banks for keeping deposits with the Fed, a component of Quantitative Easing. “When the subprime crisis caused financial markets to freeze up in 2008, the Fed responded by pumping liquidity into the banking system. It also did something that was not widely discussed at the time and even a decade later is almost never taken into account: It started to pay interest on reserves, in essence paying banks not to lend.”

Imagine that. With millions of businesses shuttering their doors, with billions of Americans out of work, instead of doing the works that banks are supposed to do, ferreting out credit-worthy borrowers and lending money that fuels growth, the Fed induced the banks to park assets with the Fed, and paid them a risk-free interest return to do so.

That is a demonstration of absurdity not seen since FDR ordered crops plowed under and farm animals slaughtered, even while millions of impoverished Americans desperately needed affordable food.

“[T]he danger posed by the Fed’s bloated asset holdings and the resulting massive level of excess bank reserves is that with a full-blown recovery now under way, the demand for credit will accelerate and force the Fed to move quickly to raise interest rates on reserves or sell securities to sop up excess reserves,” writes Gramm

The prospect of the Fed losing control is outsized during this juncture of stock market volatility, new interest rate regimes, trade wars, exploding deficits, and political turbulence. When the Fed performs in its usual inept manner, gold rises.

You don’t have to live on the razor’s edge. Speak with an RME Gold broker today for find out how to protect yourself in the New Year.