Gold: The Best Trade Going

(And a note about the Persian Gulf incidents)

From Bloomberg:

Paul Tudor Jones, the Tudor Investment Corporation founder, believes that gold is the best trade and is going to “scream” over the next year to two years.

Jones is a leading hedge fund manager of long-standing. His philanthropic activities are many. He first became prominent when he predicted the calamitous Black Monday stock market crash in October 1987.

In an interview on Bloomberg TV this week, Jones said:

“The best trade is going to be gold. If I have to pick my favorite for the next 12-24 months, it probably would be gold. I think gold goes beyond $1,400… it goes to $1,700 rather quickly. It has everything going for it in a world where rates are conceivably going to zero in the United States.

“Remember we’ve had 75 years of expanding globalization and trade, and we built the machine around the belief that’s the way the world’s going to be. Now, all of a sudden, it’s stopped, and we are reversing that.

“When you break something like that, the consequences won’t be seen at first, it might be seen one year, two years, three years later. That would make one think that it’s possible that we go into a recession. That would make one think that rates in the US go back toward the zero bound and in the course of that situation, gold is going to scream.”

SPECIAL NOTE:

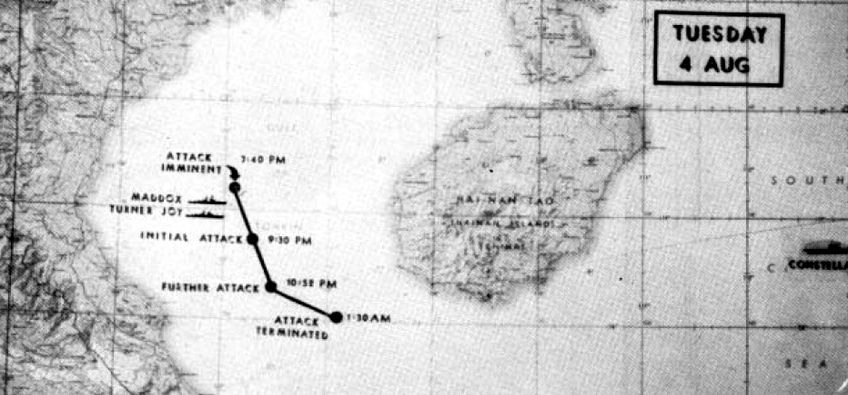

It is early to draw any firm conclusion about the latest incidents in the Persian Gulf attacks on two commercial vessels. We have lived through too many things like the Tonkin Gulf incident, forged yellowcake documents, and missing WMDs to jump to conclusions. There are too many parties with interests in the region and hopes to gain from an escalation of hostilities to attribute responsibility without definitive evidence. As we have learned, the possibility of a false flag attack is always high.

While Iran has the most to lose, it is worth bearing in mind Iranian President Hassan Rouhani promised last year to his nation that, “If one day they (the US) want to prevent the export of Iran’s oil, then no oil will be exported from the Persian Gulf.”

We note only that no matter who is to blame, and for whatever purposes, such incidents in the Persian Gulf threaten wider warfare and they are unreservedly bullish for gold and silver.

For important background, please review our April 22 post, Temperature Is Rising in the Persian Gulf, and the warning we posted on December 4 last year, Watch This One Carefully.