Gold Notes and Nuggets for November 2020

Silver Demand Indicator

Sales of US Silver Eagles by the US mint have totaled 27.2 million ounces so far in 2020. That compares to the 2019 total of 14.8 million ounces

More Debt, Less Production

“Simply put, there is a fundamental inconsistency over the long run between an ever-rising share of US debt in world markets and an ever-falling share of US output in the global economy.” Kenneth Rogoff, Harvard.

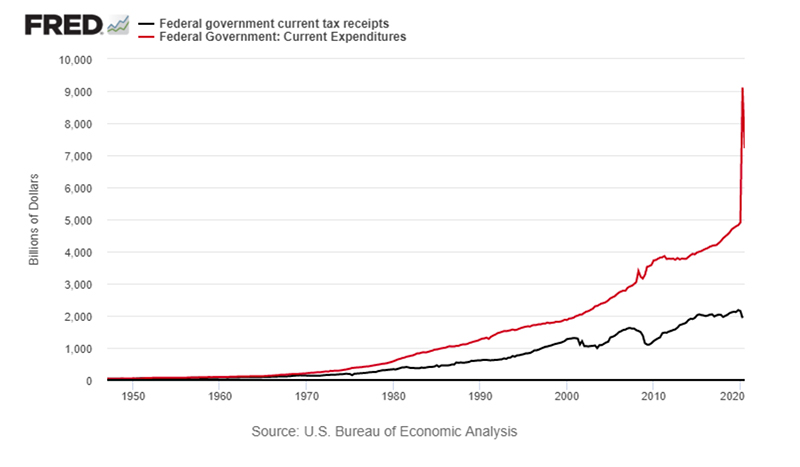

More Spending, Less Revenue

See for yourself!

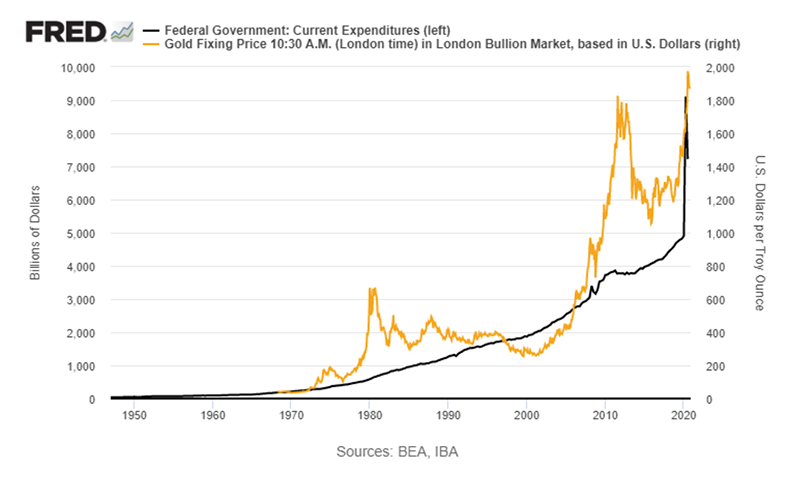

More Spending, Higher Gold

See for yourself!

More on the Full-Tilt Crypto-Boogie

That’s the unfortunate name we have given to the otherwise unnamed plan now on the Federal Reserve’s drawing boards to bring every commercial transaction in the US under the watchful eye of the national surveillance state with its own digital-crypto-central-bank-block-chain-wallet-Fed-coin-currency.

This is an ominous development and one of our leading reasons to own gold and silver and get off the Fed’s confiscation and monetary devaluation grid.

The latest is from across the Atlantic. If the Federal Reserve is Tweedledum, the European Central Bank is Tweedledumber. They are headed into the full-tilt boogie, too. Policy makers there intend to make a go/no-go decision on their block chain currency by the middle of 2021. ECB president Christine Lagarde said this week that, “If it’s going to contribute to a better monetary sovereignty, a better autonomy for the euro area, I think we should explore it.”

Monetary sovereignty? Perhaps. Personal sovereignty? Au revoir.

RME Reminder

You know the holidays always crowd everything else off the table this time of year, but while you can, before you get any busier, why not prepare for whatever instability 2021 brings… and do it now?

Contact Republic Monetary Exchange today and speak with one of our knowledgeable professionals, before the New Year arrives.