Gold & Oil Hit Multi-Year Highs This Week

The Dollar Hit a 3-Year Low, Boosting Gold Over $1,360

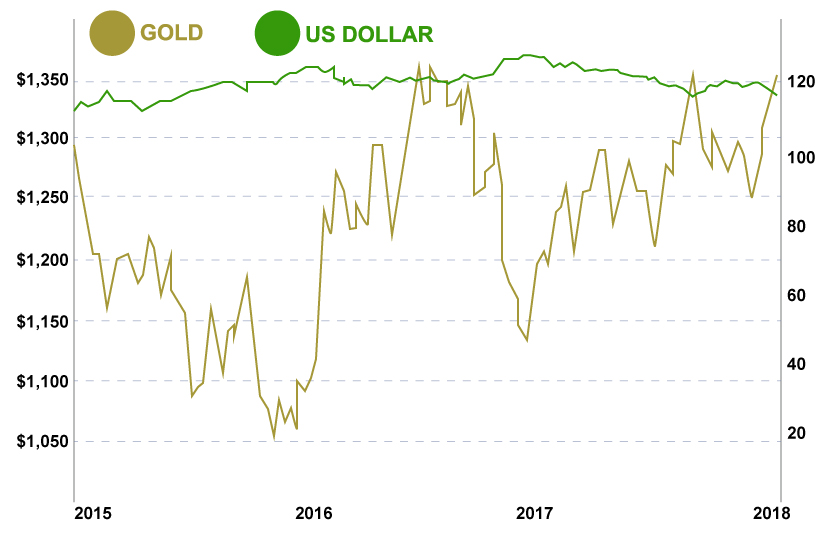

The recently falling dollar hit a 3-year low this week, and helped gold rally to its highest level in 17 months. The last time we saw gold prices reaching $1,360 was in August of 2016, and it looks like they will keep rising. Silver also rallied this week. It touched just under $18 on Thursday and settled to around $17.43.

The recent dollar weakness we have been seeing was further exacerbated this week by Treasury Secretary Steve Mnuchin’s comments at the Davos World Economic Forum – the annual summit of world and business leaders that takes place in the Swiss Alps. On Thursday Mnuchin said that the dollar needs to weaken, and that it will be good for trade if it does. Later that day however at Davos, President Trump stated – in a reversal of his position 13 months ago – that the dollar would get “stronger and stronger,” pushing the index up again. Following his address on Friday there was a further boost. Gold prices had some pull back, but seemed to remain supported.

Despite the boost though from Trump’s comments, the dollar remained stagnant. GDP data released Friday was less optimistic than expected. The euro was also up this week which weighed on the dollar index.

What this means for investors: A weaker dollar means higher metals prices. When the dollar is down, gold, the world’s oldest currency, is a better wealth preserver. The dollar is signalling a buy sign right now as its strength of the past few years retreats. But the dollar isn’t the only thing signalling further optimism for gold right now…

Oil Reaches Multi-Year High This Week Alongside Gold

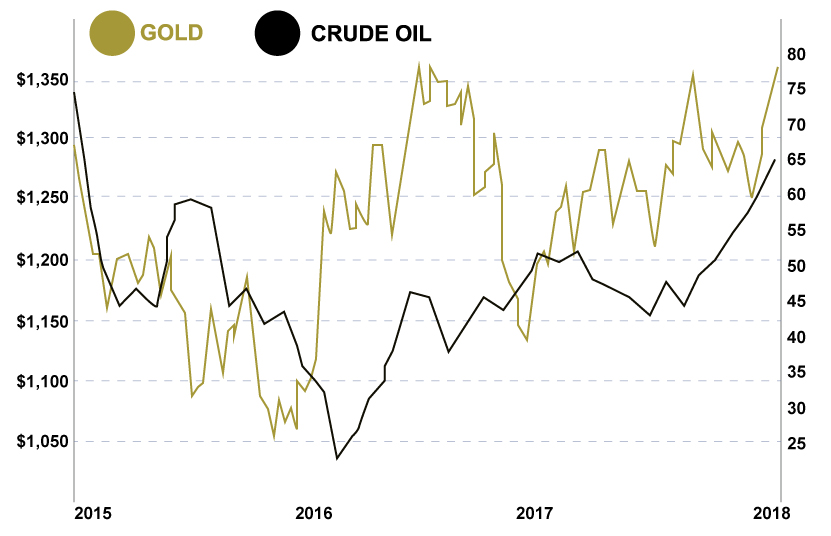

In an inverse movement, oil prices hit a 3-year high this week while the dollar hit a 3-year low. Oil price passed $71 per barrel for the first time since 2014 due in part to OPEC supply cuts and dwindling U.S. crude inventories.

What this means for investors: Rising oil prices are historically a bullish indicator for the entire raw commodity sector. Both gold and oil have an inflationary relationship and historically move up when the dollar is down. Movements in oil have a significant impact on gold, and until recently oil has not been moving much. It looks like that could be about to change. Geopolitics also drive both, and growing volatility in the Middle East and Korean peninsula will fuel safe haven buying. Furthermore, there is rapidly growing appetite for both in China, the world’s second largest economy.

Bonds and Interest Rates Signal Time to Buy Gold

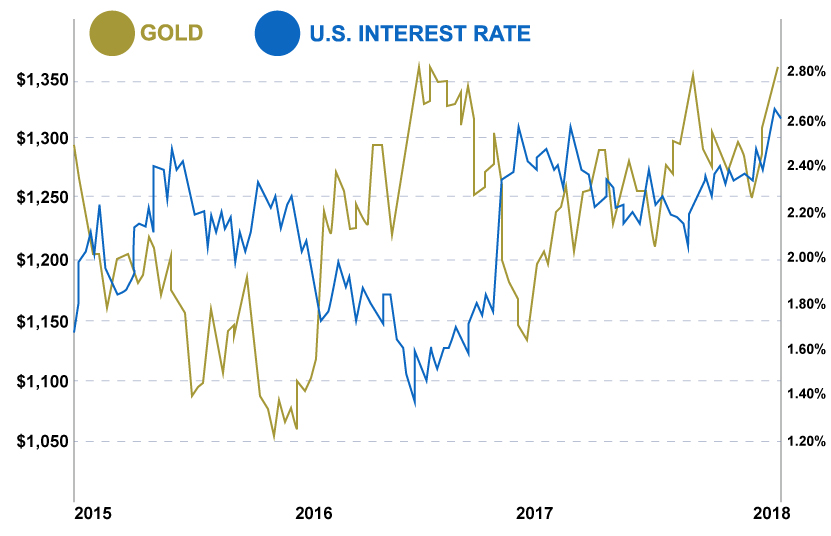

The bond market is also signalling that it’s time to buy metals. The slope of the yield curve can give indications on short term interest rates, inflation, and economic activity. A flattening yield curve can be a harbinger of recession. Interest rates and yields keep going up as bond prices go down. If the bond sell off continues, it could be disastrous for the markets and economy.

What this means for investors:Right now we are seeing rising bond yields, Fed tightening, a weak dollar, and a soaring stock market: just like in 1987 before the crash . Metals are security in such an environment, and rising inflation will lift prices.

Is Silver Finally Confirming the Gold Rally?

In recent weeks as gold rallied, silver has been lagging a little behind. This has made a great buying opportunity for the cheaper, more volatile metal. But it looks like it could be catching up. Silver, along with gold, rallied this week and posted a 4 month high and 3% gain. The weaker dollar and boost in oil prices this week also lifted silver. The gold to silver ratio has been unusually wide lately, and some analysts have been looking for signs about whether this bodes well or poorly for the gold rally, worrying it could mean gold is headed lower.

What this means for investors: Both metals look on track to continue their rally. Silver’s move this week allayed some fears that gold was running too fast too quickly. The current ratio along with the indications this week that silver will keep riding gold’s coattails is indicating buy silver now.

Read our latest original article to see what the gold investor should know about cryptocurrency

Bitcoin and cryptocurrency are undoubtedly a hot topic right now. How exactly the virtual, unregulated “currency” works though can be complicated to understand. Check out our original article that breaks down bitcoin mining, blockchain technology, and their future implications for gold, money, and society.

Stay Connected to the Markets. Subscribe Now to Get the Gold Market Discussion Delivered Every Sunday Directly to Your Inbox!

As always, I encourage you to speak with your broker at RME for more market updates. Expert brokers are available Monday-Friday from 9 AM- 5 PM or by special appointment after hours. Call today at 602-955-6500 or toll-free at 877-354-4040.