If it’s Paper, It’s Not Gold!

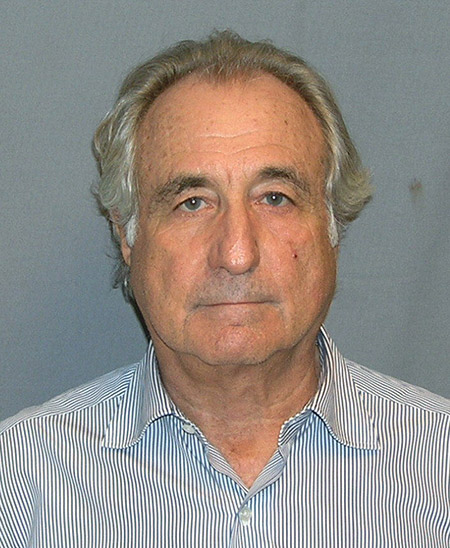

We wonder how much longer Bernie Madoff’s stunning stock swindle could have continued but for the financial environment suddenly shifting.

It all fell apart for Madoff with the Wall Street shakeout that included the failure of Bear Stearns and Lehmann Brothers in the fall of 2008. Investors everywhere were in trouble and began selling their holdings. By November, Madoff was swamped with billions of dollars of redemptions for clients that he couldn’t meet.

Soon he was in jail. Madoff may be eligible for release if he lives to be 201 years old.

Not likely.

We tell this story because while financial funny business may go on all the time, it is in time of upheavals and reorientations that it gets exposed. Times like this. As Warren Buffett put it, “When the tide goes out, you see who’s been swimming naked.’

We don’t have the time and expertise to be forensic accountants. We aren’t in a position to investigate everything happening on Wall Street. But with the tide has gone out in some of the markets, and monetary and fiscal policy as unhinged as they have ever been in our lifetimes, we think this is a good time to remind our friends and clients that if it’s paper, it’s not real gold.

One of real gold’s primary virtues is that it is not somebody else’s liability. Real gold that you own is not dependent on someone else’s promises, performance, or solvency.

Not so with paper gold or other vehicles that purport to represent or to be based on the ownership of gold at some indeterminate place, time, and form. This applies to futures, options, ETF’s, shares, forward contracts, and IOUs of all kinds.

If you want the protection that gold offers, you want real gold. Not paper. Paper is not gold.

We bring this up now because there are questions about gold that is represented to be accounted for in some of the world’s financial centers.

An account on the financial news website ZeroHedge is asking questions about the source and perhaps even the title to gold held by the world’s largest gold Exchange Traded Fund. The report asks whether “the same gold bars are claimed by two distinct parties, the central bank which lent the gold and still accounts for it on its balance sheet, and an exchange-traded gold-backed ETF which thinks that it has title to those same gold bars.”

We don’t know all the facts, or where this story will lead, but here is a link to it, Amid Gold Market Turmoil, HSBC Taps Bank Of England For GLD Bars, if you’d like to know more.

We alerted you in March that some dealers were not able to make immediate delivery of gold and silver to their customers. Because of the extreme demand for precious metals in these uncertain times, the prices for real gold and silver decoupled from the price of precious metals substitutes and paper benchmark prices. The world gold and silver prices, index prices and the prices of ETFs that you read about in the newspaper were disconnected from the real price for physical gold and silver you can take home and put in your safe.

Look, foreign governments are suspicious enough that they have been repatriating their gold from other national banks for some time now. Americans have not been able to get a simple audit of the Federal Reserve or of our gold. By the way, an audit is not just an inventory. It goes beyond counting bars with the Fed or at Fort Knox. An audit seeks to know if the titles have been compromised, it the gold has been pledged, promised, loaned, hypothecated, or re-hypothecated. That seems to be where the real risk may be.

But there has been no audit.

This is no way to run a business. Or a government.

Now, the tide has gone out on our financial system. Big changes are headed our way.

You need gold and silver in these uncertain times to protect your wealth, yourself, and your family.

And by that, we mean real gold and silver. That’s what we deliver here at Republic Monetary Exchange.

We deal with real gold and silver. That you own. That you take with you.

Not paper.