Inflation Raises Its Ugly Head

Did the authorities really think they could throw $3 trillion more into the US monetary mix without causing price increases?

No, they didn’t think that. Mostly they didn’t think at all. They just did it. And because they are preparing to do even more of the same, you can expect 2021 to be the year that consumer price inflation raised its ugly head.

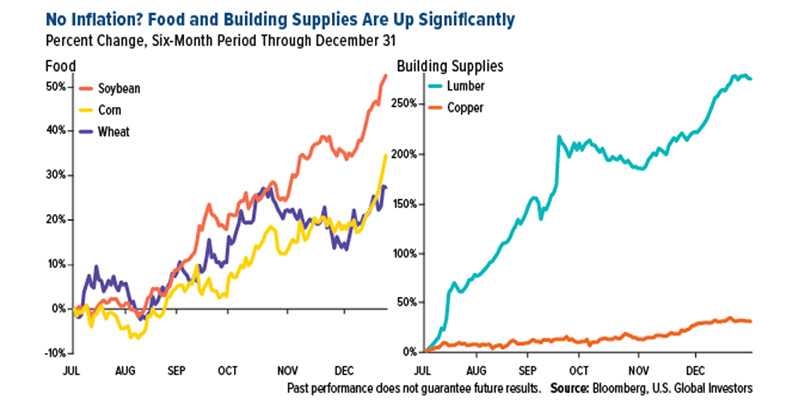

Here is just some of the evidence:

Prices are climbing fast at the level of raw commodities. Corn, soybeans, and wheat are at the highest prices in years:

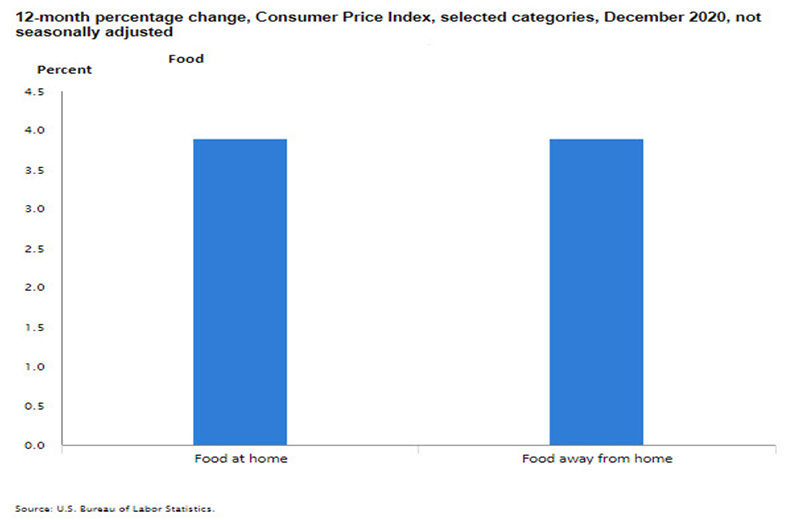

And now prices are beginning to climb at the retail food level:

Food prices climbed 3.9 percent in 2020. That is twice as fast that the Fed’s nonsensical inflation target. But take heart: higher food prices will only hurt people who eat.

If you don’t eat, you won’t notice a thing.

But it is not just food. Cotton prices are at highs that have not been seen in several years. Major appliances were up about 17 percent last year; used cars and trucks up 10 percent; the cost of elder care rose 7.5 percent.

The Federal Reserve’s latest “Beige Book,” a regularly scheduled report on economic conditions in the Fed’s 12 regions of the country. was released Wednesday (1/13). Upon review, economist Robert Wenzel says “there is a strong current of increasing prices” across the country.

Sure, airfare, hotel rates, and the cost of business attire are all lower. But only because the lockdown has decimated the customers for each.

But be aware that more stimulus spending is coming, which will further raise prices.

Meanwhile, Fed officials far and wide and starting to talk about raising their inflation targets. They are bound to lose control along the way. A number of observers are pointing out the Fed “may not be able to control how fast the dollar inflates, so we could jump from inflation to hyperinflation overnight.” That is correct; a thin line divides the two. The Fed is always behind the curve. Long before the results of one round of money-printing have worked their way into consumer prices, the Fed will have already launched another round.

We recommend you review your portfolio today with a Republic Monetary Exchange precious metals professional. You will be glad you did.