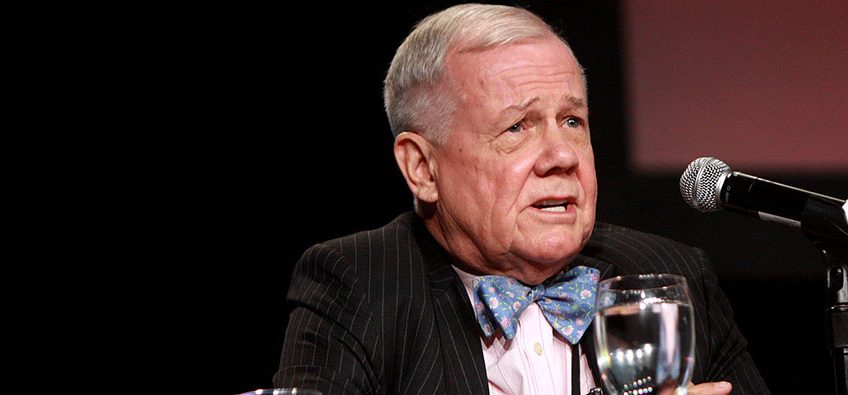

Investment Legend Jim Rogers

Once or twice a year we check in to see what Jim Rogers says about things. Rogers thinks the worst bear stock market of our lifetimes is headed out way.

We sample Jim’s opinion for several reasons, not the least of which is that he has a stellar track record. During the brutal bear market of the 1970s, the Quantum Fund, which Rogers co-founded, beat the S&P by an incredible 4,150 percent, making it one of the best performing hedge funds ever.

Since there is no substitute for up-close and personal real-life experience, Jim Rogers has twice driven around the world, once by motorcycle, crossing primitive frontiers and backwater boundaries in search of investment opportunities.

So, what does Jim say about the US stock market? The “worst bear market in my lifetime is coming,” he says. “It has been over 10 years since we had a serious bear market in the United States. I would suspect by the end of this year or next year, it will start,” Rogers says. “These things always start small, where people are not looking and then they work to the major markets, and then you see them on the major news.”

Although he says he’s the “worst market timer in the world,” Jim keeps his eyes on the fundamentals. He puts his money where his mouth in and says that he doesn’t own any US stocks now.

Despite headlines to the contrary, all touting the stock market as the place for investors to be, that’s a pretty wise position. Especially from the perspective of those of us that understand gold.

Measured by gold, the Dow has lost half its value since the turn of the century. That’s according to newsletter writer Bill Bonner, who notes the US hasn’t gotten off to a very good start in the new millennium:

“Our guess is that America peaked out at the end of the last century. Since then, with Dubya’s $5 trillion war against Iraq… Obamacare… quantitative easing and a negative real fed funds rate for 10 years… transgenderism, the Kardashians, Lee Greenwood, trillion-dollar deficits, $22 trillion in federal debt, fake money, fake interest rates, and fake wars – it has been all downhill.”

“The Dow – the flower of American capitalism – has lost more than half its value (measured by gold).”

Speak to your RME professional today about a sensible plan to protect your wealth from the next crisis. Simply call our office, (602) 955-6500, and you will be connected to one of our knowledgeable gold and silver authorities.