It’s Still Money– and They Know It!

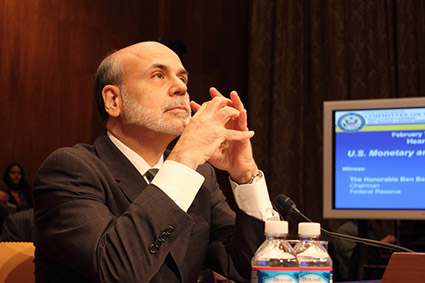

One day, not so many years ago, in the middle of testimony before the House Banking Committee, Federal Reserve Chairman Ben Bernanke was asked a question by committee member Congressman Ron Paul.

“If gold is not money,” asked Paul, “why does the Federal Reserve insist on owning it?”

It is an important question, one that gets right to heart of the contradictions in our monetary system. But Bernanke was quick on his feet. The Fed owns gold, he explained, because “it’s a tradition.”

Was the Chairman saying that the Fed feels obligated to abide by all kinds of monetary traditions, or simply monetary traditions having to do with gold? Or only the tradition that required the Fed to hold title to gold of the people of the United States?

Of course, Bernanke’s answer was simply balderdash.

The Fed insists on owning gold because it is the world’s premiere form of money, prized everywhere around the globe by both people and governments alike, and in both good times and bad.

Consider this. When the US government made it a felony for American citizens to own monetary gold under presidential executive order and the Gold Reserve Act of 1934, it wasn’t simply trying to demonetize gold, to force it out of the monetary system. It certainly wanted to eliminate gold as a competitor to its new paper money scheme, one that allowed it to print dollars without backing or limitation and to devalue that money when it suited the State.

It was serious enough about that objective.

But the government also wanted all the people’s gold for itself. So, the law threatened the people with fines of $10,000 and ten years imprisonment for its violation.

Rather severe threats for something that has no more significance than some old-time tradition, wouldn’t you say?

In reality, central bankers like Bernanke pretend that gold isn’t money, but in the real world, even among central banks, it remains money nonetheless.

When countries invade one another, the don’t rush to grab digital bookkeeping entries in which phony money is created out of nothing. Nor do the grab Christmas trees or maypoles or other symbols of traditions.

They rush to grab the gold.

Just recently Venezuela attempted to repatriate 14 metric tons of gold held by the British central bank, the Bank of England. It is gold that the South American socialist state has been using for “swap” operations. In other words, when it has borrowed from foreign institutions and central banks, they have insisted that Venezuela’s gold serve as the collateral for those loans. Because they are all really still on the gold standard.

Venezuela is finding getting its gold back to be very difficult indeed, thanks to US sanctions. That is because in their international operations nations and central banks are still on the gold standard.

The monetary authorities’ and central bankers’ manipulation of credit conditions and interest rates, their ability to boom and bust economies at will, is utterly reliant on people being persuaded that gold is not money.

But they know better themselves.

We hope you know better, too.