More Gold Nuggets: News You Need to Know!

The Fed Meets

The policy-setting Federal Reserve Open Market Committee meets this week on Tuesday and Wednesday, July 30 and 31. The announcement of any policy decisions will be made on Wednesday at 2 pm Eastern time.

At the top of the agenda is a cut in interest rates. We think that if the Fed fails to cut rates, Wall Street will throw another one of its infamous temper tantrums and stocks will fall. On the other hand, we think the possibility is growing that even if the Fed cuts rates, stocks will take a beating.

Why?

Find the answer in the warning we posted two weeks ago, “Buy the Rumor, Sell the News.”

Our Number One Recommendation!

Take advantage of the new trend in the Gold-Silver Ratio. See our recent post, here, and speak with your RME Gold professional. He can give you examples of just how this powerful profit strategy can work for you.

Look Out Below!

Emerging market debt has climbed to $69.1 trillion. From Financial Times:

“Debt in the developing world has risen to an all-time high, adding to strains on a global economy flagging under the weight of rising trade protectionism and shifting supply chains.Emerging economies had the highest-ever level of debt at the end of the first quarter, both in dollar terms and as a share of their gross domestic product…

“The combined debts of 30 large emerging economies rose to 216.4 per cent of their GDP in March, from 212.4 per cent a year earlier.”

Exit Rule for the Stock Market Bubbles

From hedge funder John Hussman:

“One of the most important warnings offered by firefighters is simple: get out early.

“Similarly, our ‘Exit Rule for Bubbles’ is straightforward: You only get out if you panic before everyone else does. You have to decide whether to look like an idiot before the crash, or look like an idiot after it….

“Presently, we observe [stock] market conditions that have been associated almost exclusively, and in most cases precisely, with the most extreme bull market peaks across history.”

Why Can’t We All Just Print Money?

“A 20-year-old woman was recently arrested in Germany for walking into a car dealership and trying to by a €15,000 car with fake banknotes printed on a cheap inkjet printer using regular printing paper….

“At first, everything went smoothly. She inspected the car, took it for a test drive, but when the time came to pay the €15,000 price, dealership staff were stunned to receive a waddle of €50 and €100 bills that looked more like Monopoly money than actual currency. One employee told German media that he literally asked the woman if she wanted to play Monopoly or buy a car, but after seeing that she was serious, he called the police.”

- OddityCentral.com, 7/19/19

Because It Costs More and More to Buy Less and Less!

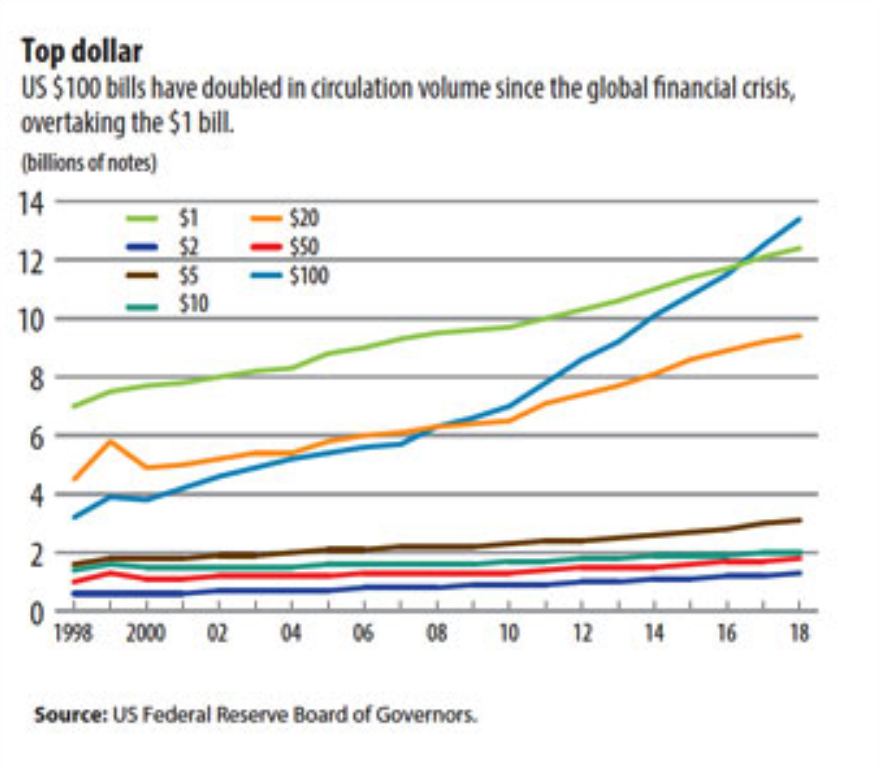

The $100 dollar bill has overtaken the $1 dollar bill for the first time in history as the most widely used paper money.

Citing the Federal Reserve, the IMF reports there are more $100 bills circulating now than ever before. The $1 bill is now number 2, while the $20 dollar bill comes in third.

The number of $100 bill in circulation has almost doubled volume since the global financial crisis. (see chart).

No wonder we prefer gold! It’s the world’s superior money for wealth preservation, profit, and even privacy