More on Global Debt

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

– Ernest Hemingway, The Sun Also Rises.

The world is awash in debt. Zombie corporations borrowing just enough to stay alive, but never earning enough to survive without borrowing more. Entire countries trying to print their way through the next fiscal year. The US itself issues bonds that cannot ever be redeemed without the issuance of new bonds to take their place.

At least 20 states have borrowed billions just to pay unemployment claims. Households and individuals so deeply in debt that a bump in interest rates will wipe them out. Consider that even before COVID-19, 60 percent of the people had less than $400 in savings.

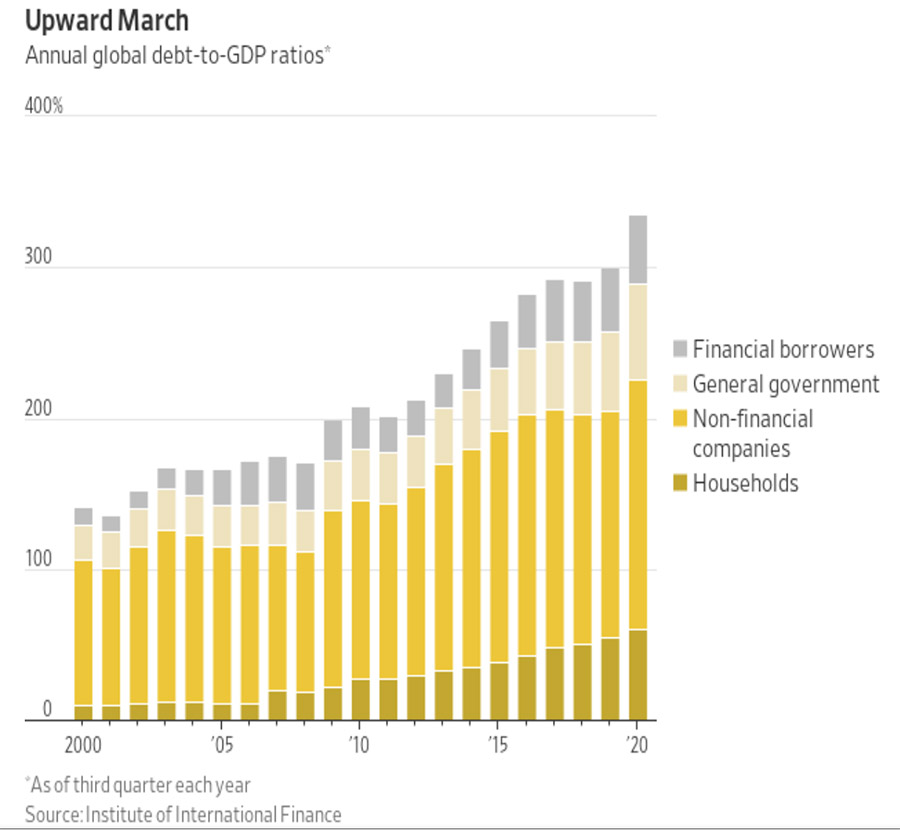

As we reported recently (World Debt Goes Stratospheric), global debt is expected to reach $277 trillion by the end of this year.

A few additional details from the Wall Street Journal:

- Companies and governments have issued a record $9.7 trillion of bonds and other debt this year.

- American companies with investment-grade credit ratings have issued more than $1.4 trillion of debt this year, up 54% over the same period in 2019.

- Among riskier borrowers, U.S. junk-bond issuance has soared 70% to $337 billion.

- Emerging government debt has risen nearly 10 percentage points to 61% of GDP this year, its largest one-year increase since the late 1980s.

What is a wise investor to do in this environment of unstable debt? There is really only one refuge from cascading waves of default:

Precious metals.

Gold and silver are the only monetary assets that are not someone else’s liability. They are not dependent on someone else’s solvency, promises to perform, or honesty. Their value does not depend on the endorsement, propriety, or honesty of any state or institution. They have no counterparty risk, no risk of rule changes, nonpayment, default, or bankruptcy by individuals, companies, financial exchanges, institutions, and banks – quite apart from being insulated from the risks of the Fed’s fiat dollar as well.

We are in a debt bubble that will end badly. Use this opportunity to speak with a Republic Monetary Exchange professional about steps to protect yourself and your family from the biggest debt bubble of all time.