More Rate Cuts

The Federal Reserve’s Open Market Committee meets again at the end of the month. This is the arm of the Fed that votes on, and sets, interest rate policies.

In a healthy economy

But the Fed pretends that it can do better. And so, with each interest rate intervention it distorts people’s perception of reality. For example, in the Fed’s housing bubble artificially low interest rates convinced homebuilders that there was much more real demand and ability to meet mortgage payments that there actually was. The Fed sent false signals to the economy. When the bubble burst, 500 banks went under; nearly 10 million Americans lost their homes.

Probably the most irritating thing is the way that the Fed dresses all this up as though there is something scientific about what they do. They are awash in high-priced economist and expensive consultants. They gather a never-ending flood of statistics.

Observing all this, James Grant says that instead of a gold standard, the US operates on “a Ph.D. standard.”

Still, for all the academic pretense, there is nothing scientific about what the Fed does. No board or body argues about the freezing or boiling point of water. 32 degrees and 212 degrees Fahrenheit respectively. That’s science. In electronics, Ohm’s law is science. In chemistry, the periodic table of elements. In astronomy, Kepler’s laws.

But the Fed just apes the language of the physical sciences and makes up money supply and interest rate policy to serve favorite constituents, like Wall Street, money center banks, or powerful politicians.

The Open Market Committee meets on Tuesday and Wednesday, October 29 – 30. It voted to lower the Fed funds target interest rate to 1.75-2 percent during its September meeting, and many suspect it will cut rates again this month.

The analysts at Bretton Woods Research are level-headed and, believe there is a bias for lower rates:

“Odds of a rate cut later this month are presently greater than 65 percent. Although there is just a 22 percent probability that the Fed will bring the policy rate down to 1.5% by December — completely rolling back Powell`s rate hikes from 2018 — we suspect the likelihood of further easing is greater than what futures markets currently suggest.”

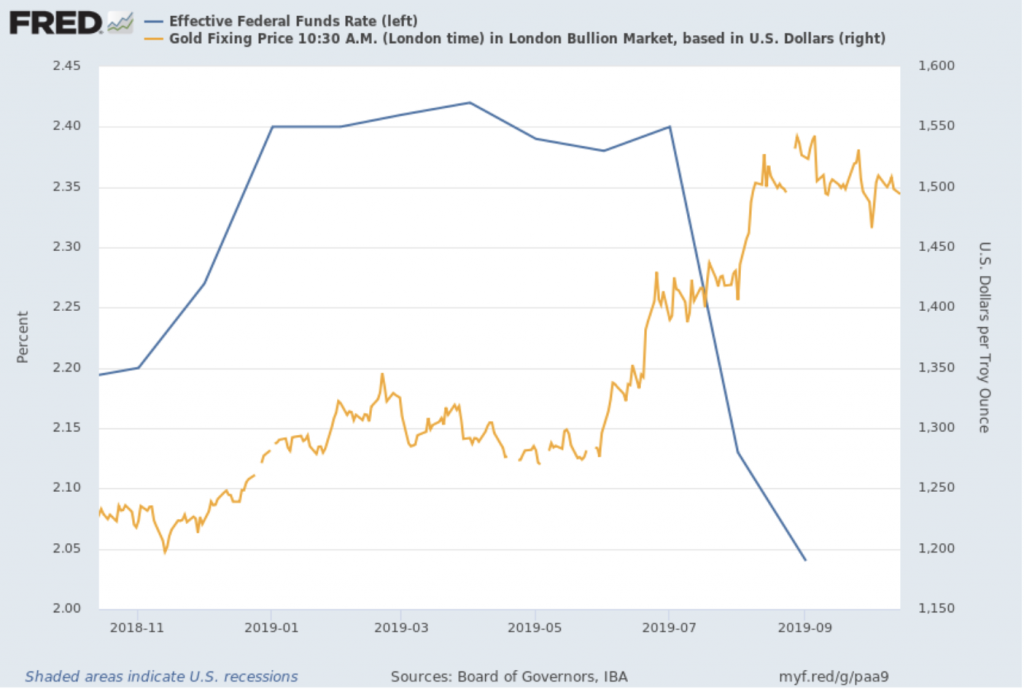

The following chart represent the Fed fund rate and the gold price over the last year. The Fed made plain that it was intent on a tightening policy until the stock market had a terrible temper tantrum in the second half of 2018. With stocks falling hard, the Fed reversed its policy course and began cutting rates (blue line).

As you can see in the following chart, gold surged as the Fed cut rates:

We expect more of the same. Especially since the Fed has now quietly embarked on a new fourth round of Quantitative Easing. More on that in days to come but suffice it to say that the Fed has quite simply gone off the edge. It will collapse entire sectors of the economy in steaming, smoldering piles of wreckage. Just like it did with the housing bubble.

Let us help you through the bubble-blowing of the Fed’s Ph.D. standard. Speak with an RME Gold associate today about owning real gold and silver. Simply call our office, (602) 955-6500, and you will be connected to one of our knowledgeable gold and silver professionals.