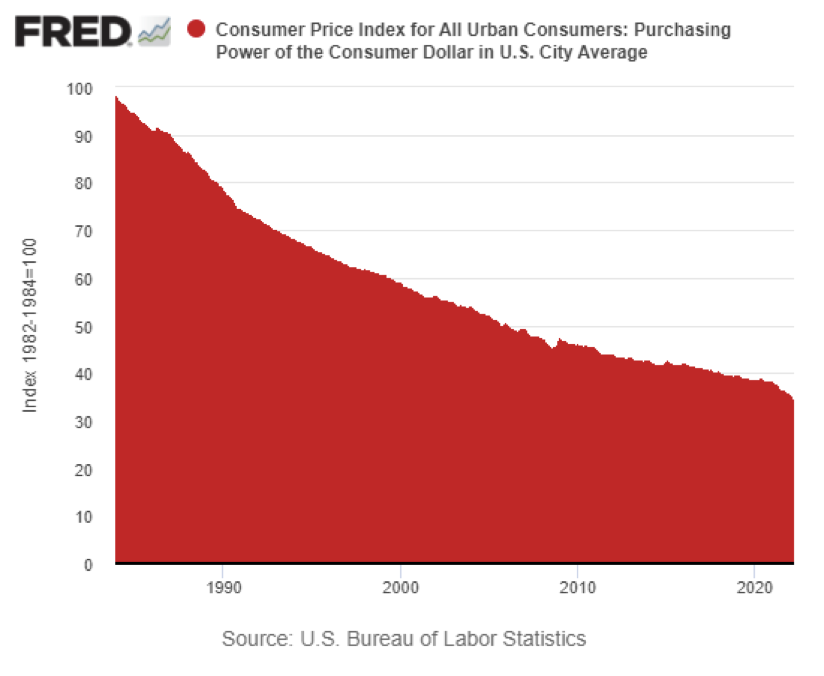

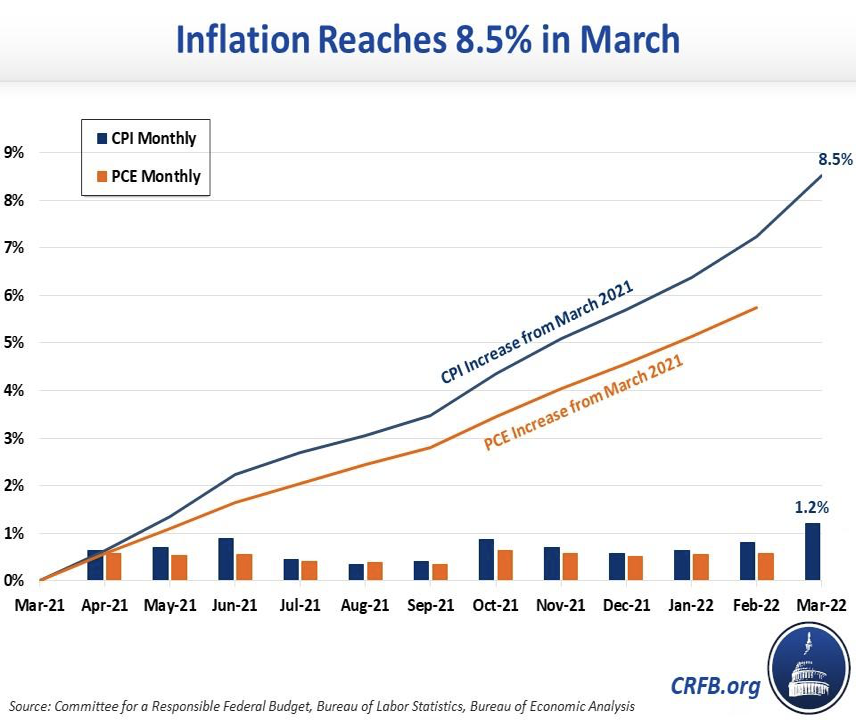

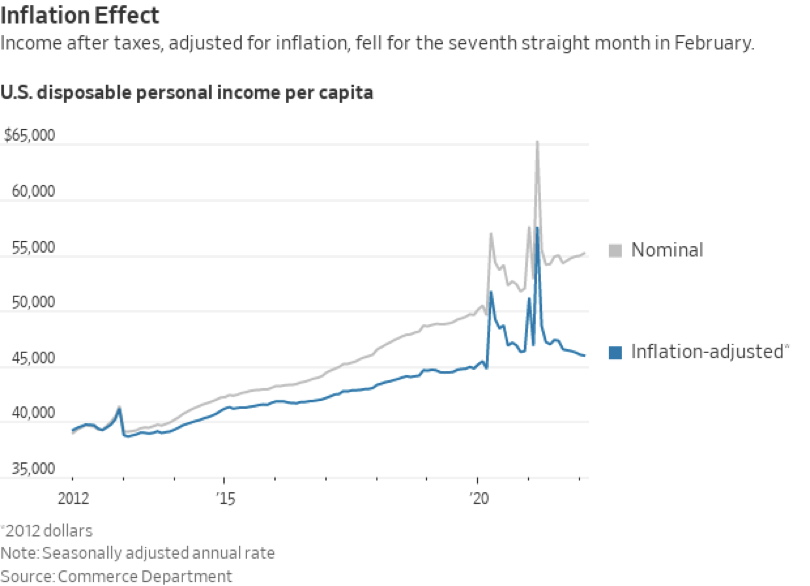

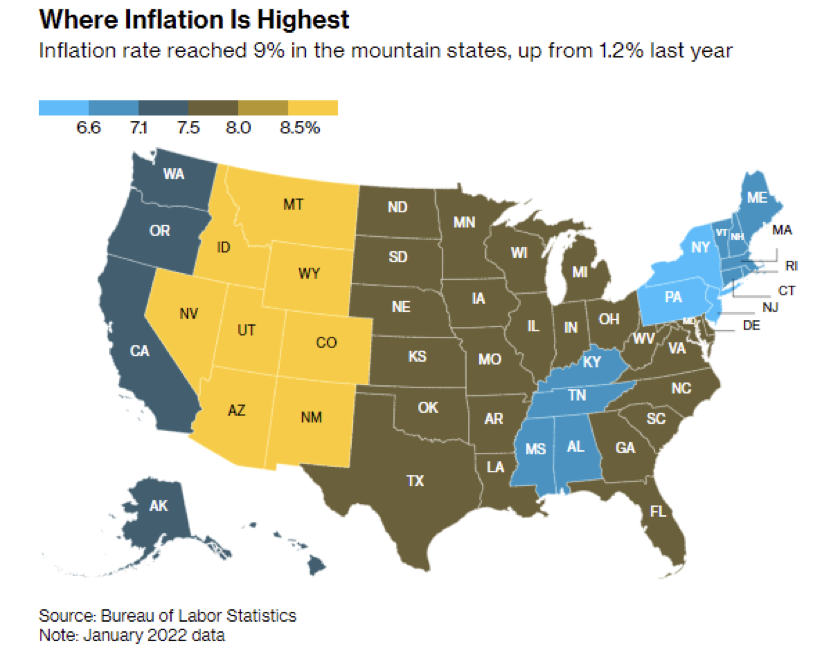

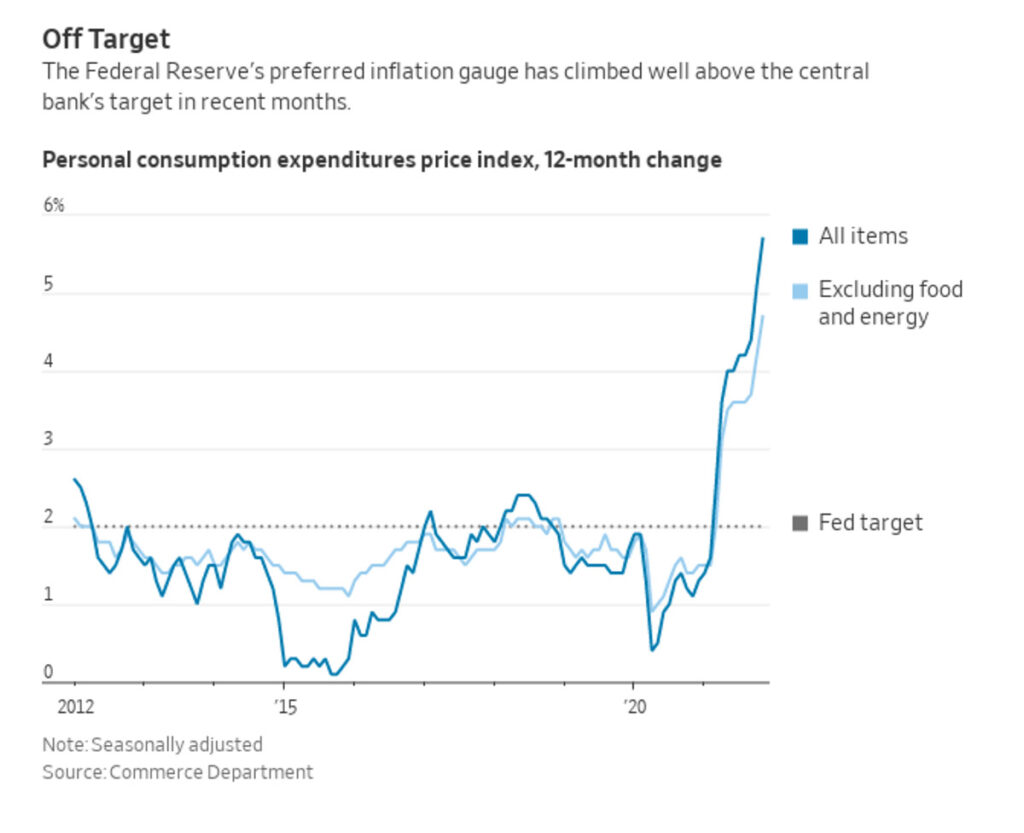

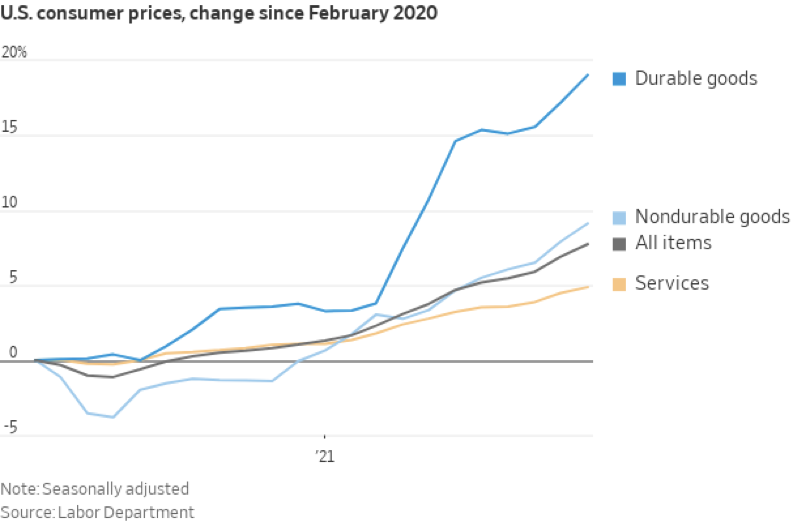

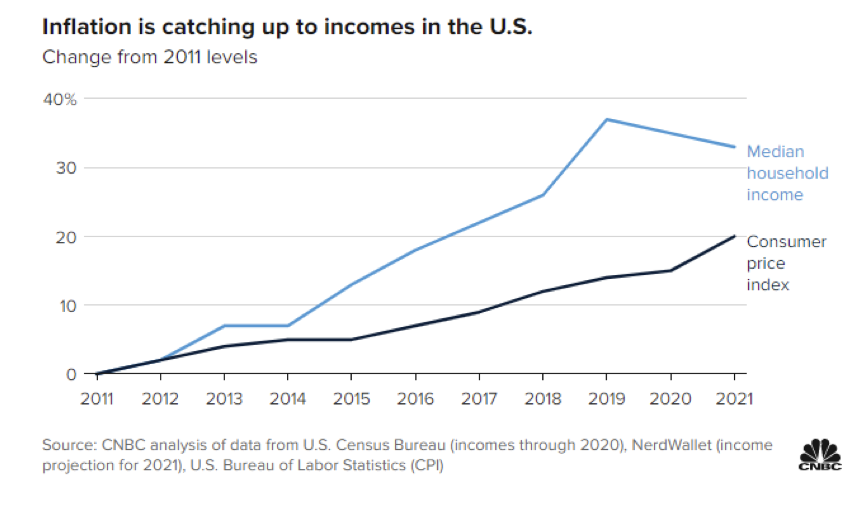

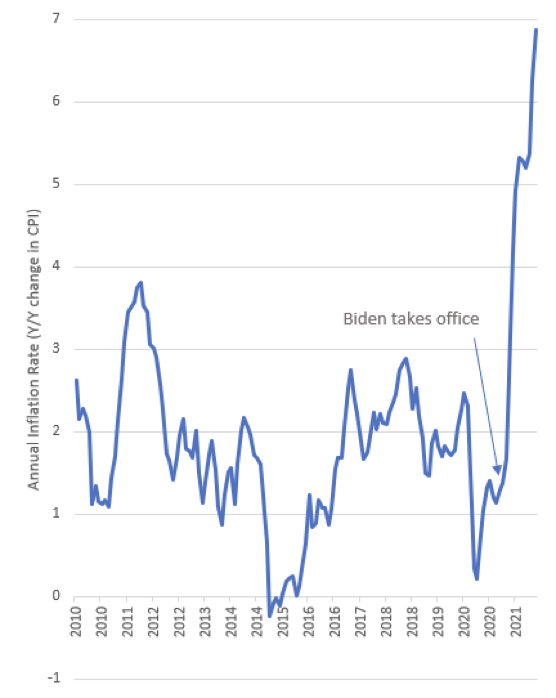

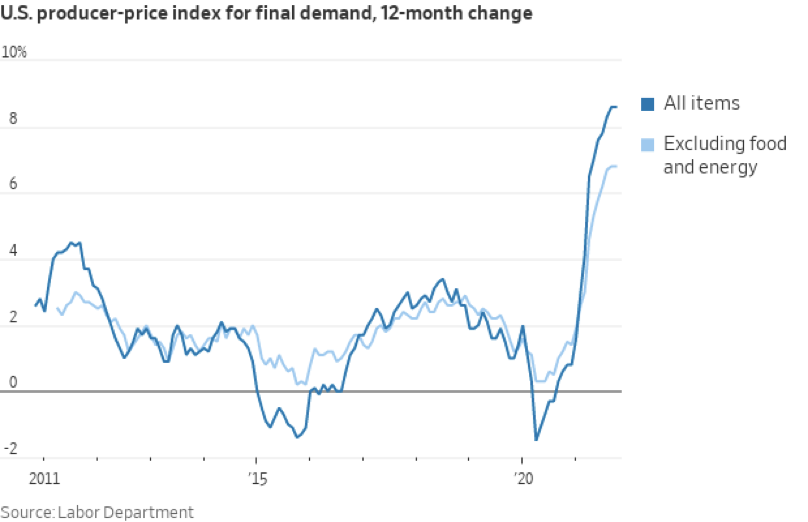

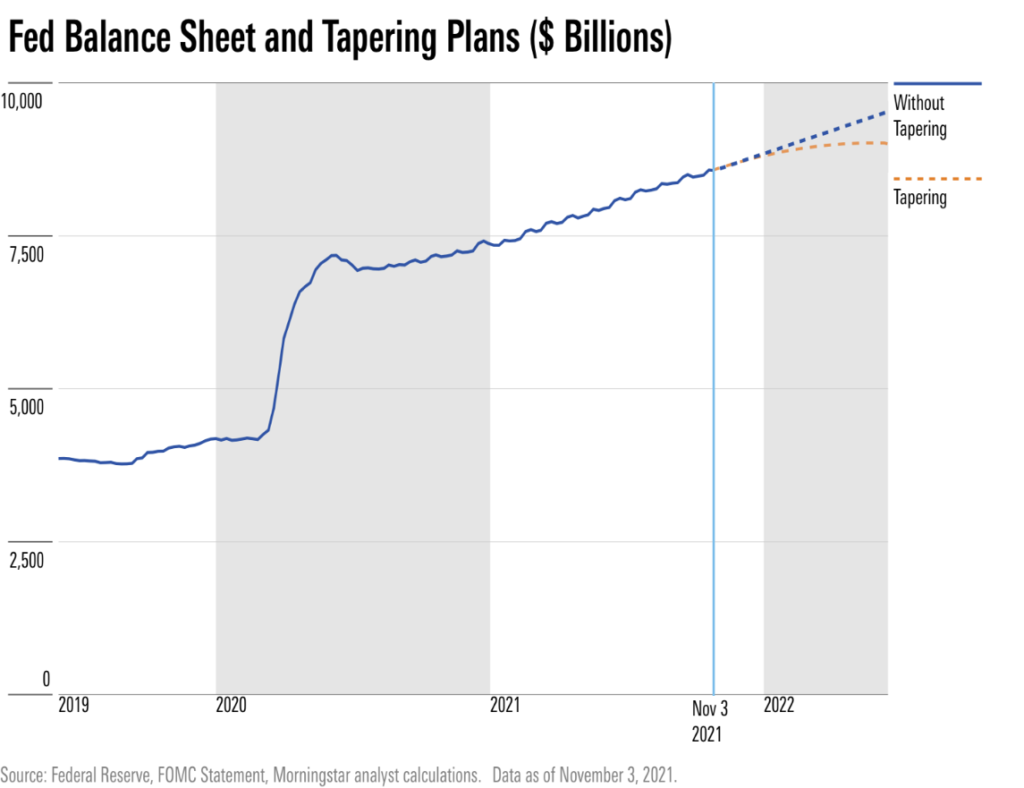

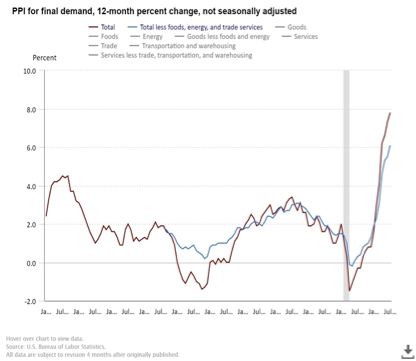

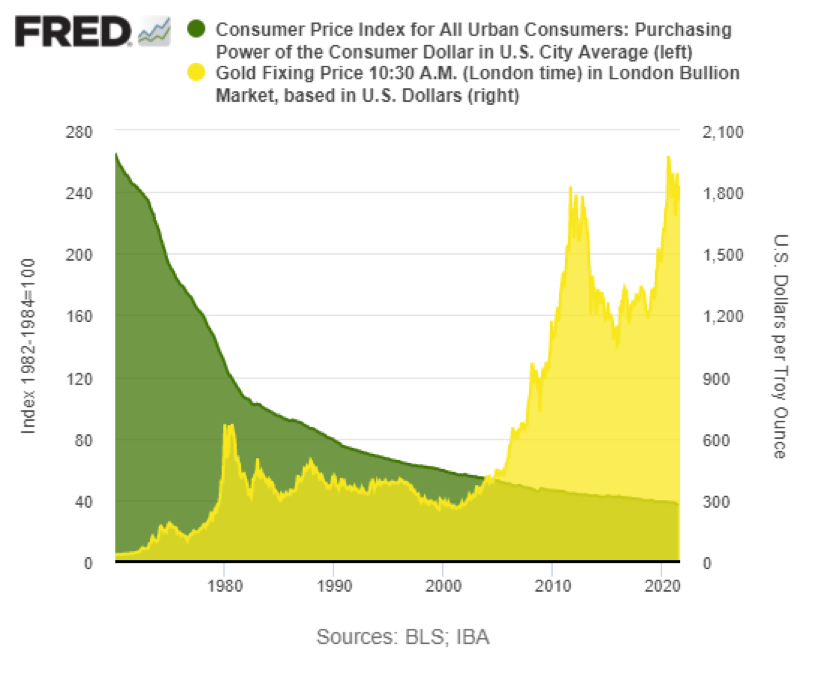

Let’s take a look at the real-world experience people are having with inflation.

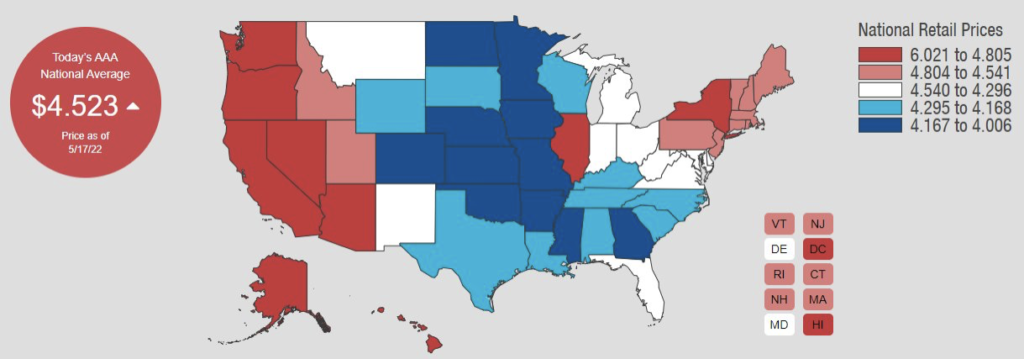

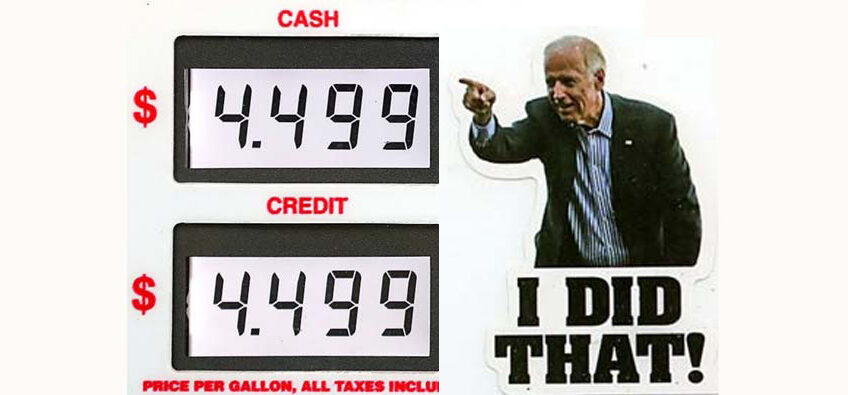

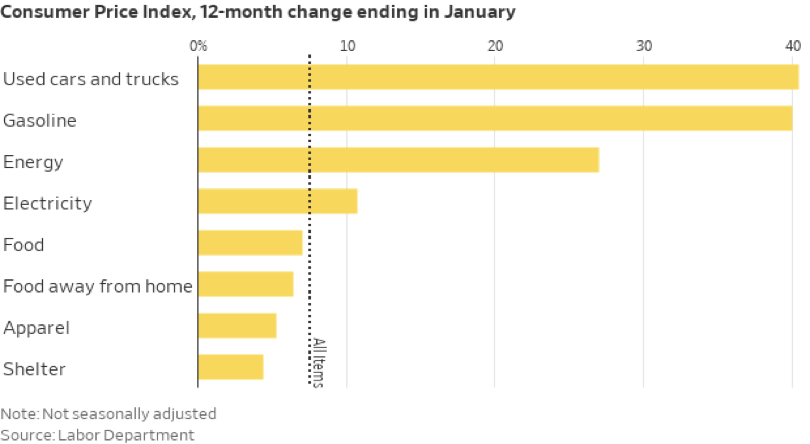

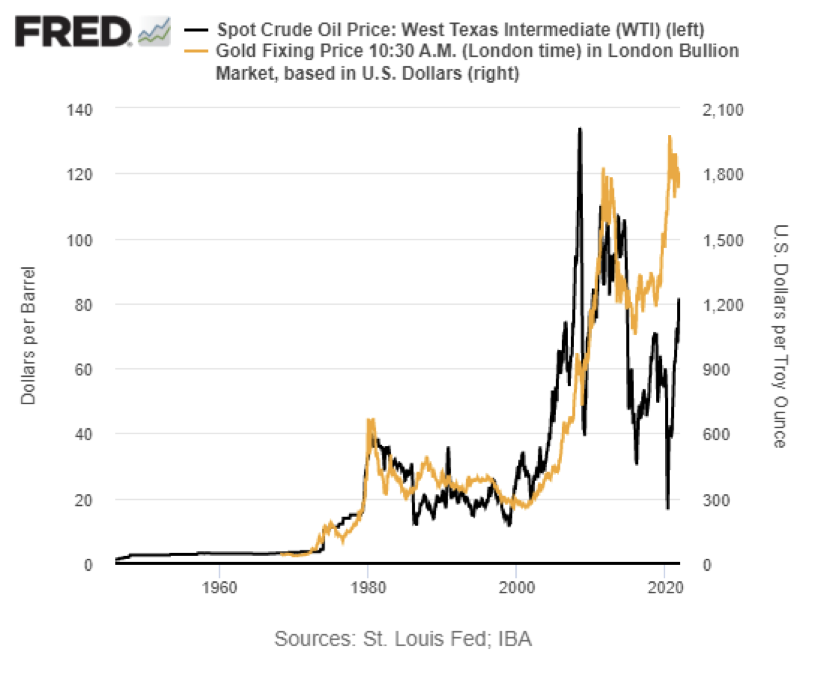

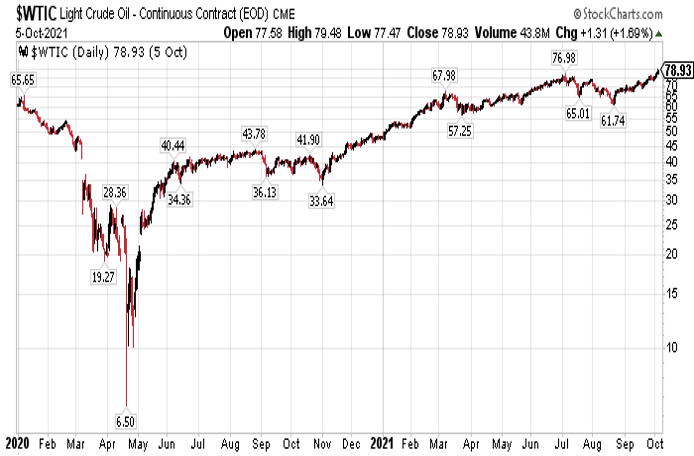

CBS News has found a handful of California gas stations charging $7.25 a gallon, more that the federal minimum hourly wage.

The Wall Street Journal reports that US households are now paying an annual rate of $4,800 for gasoline compared to $2,800 a year ago.

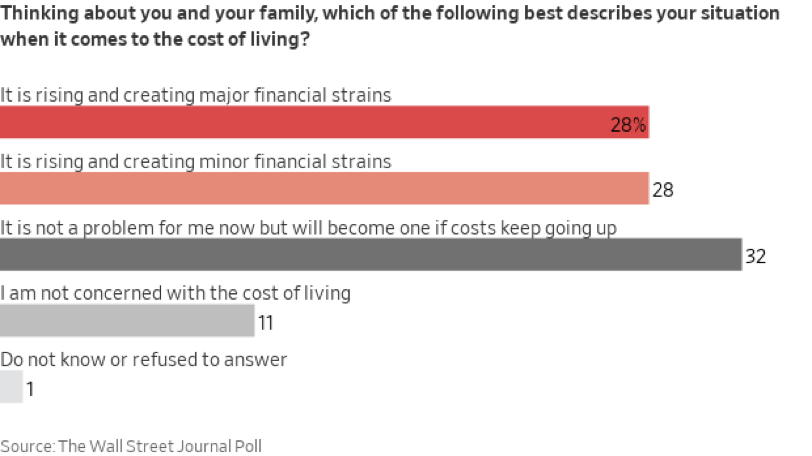

Something in the budget of an American household must give to accommodate $2,000 more a year for gas. A survey by OnePoll finds that skyrocketing gas prices and inflation have more than half of the people, 56 percent, “extremely” or “noticeably” more stressed.

Never mind that. The President says that high gas prices are part of our “incredible transition” away from fossil fuels:

“[When] it comes to the gas prices, we’re going through an incredible transition that is taking place that, God willing, when it’s over, we’ll be stronger, and the world will be stronger and less reliant on fossil fuels when this is over.”

Now does that sound like an everyday American who pumps his own gas and is left stunned at the sticker shock?

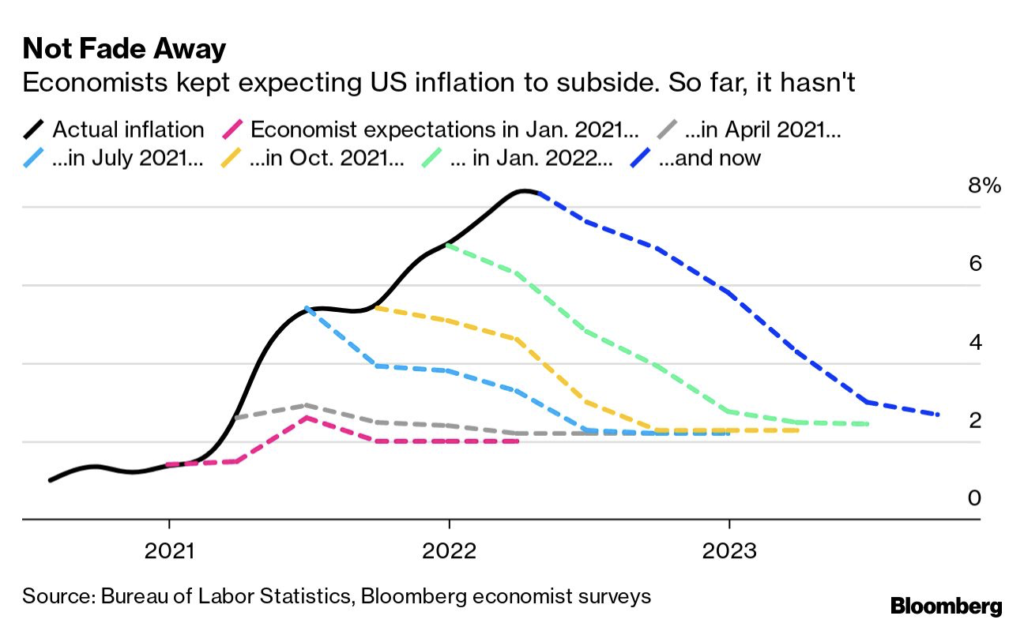

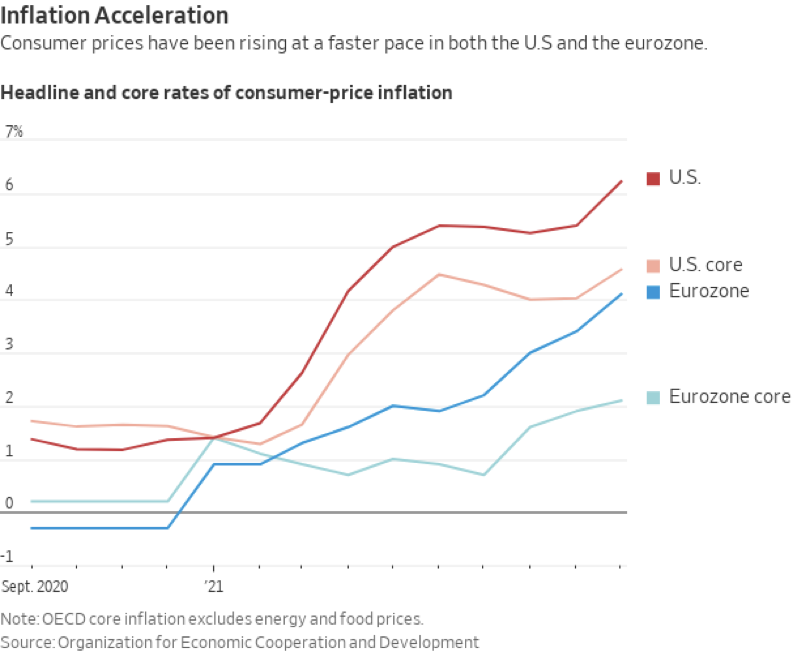

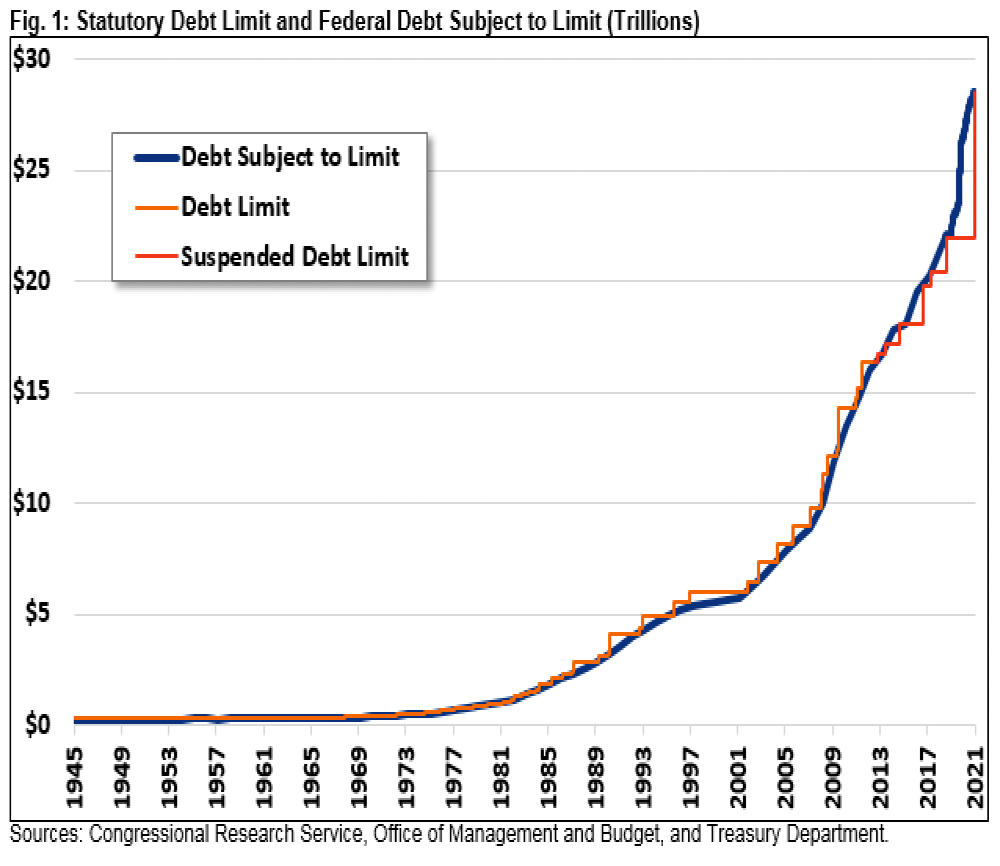

It was only a couple of months ago that House Speaker Nancy Pelosi said that government spending was not contributing to inflation and was “reducing the national debt.” It was apparently from that peculiar economic vantage point that this week she offered up that, “In terms of inflation, so much is being done by this president, we have to make sure that public sentiment understands that.”

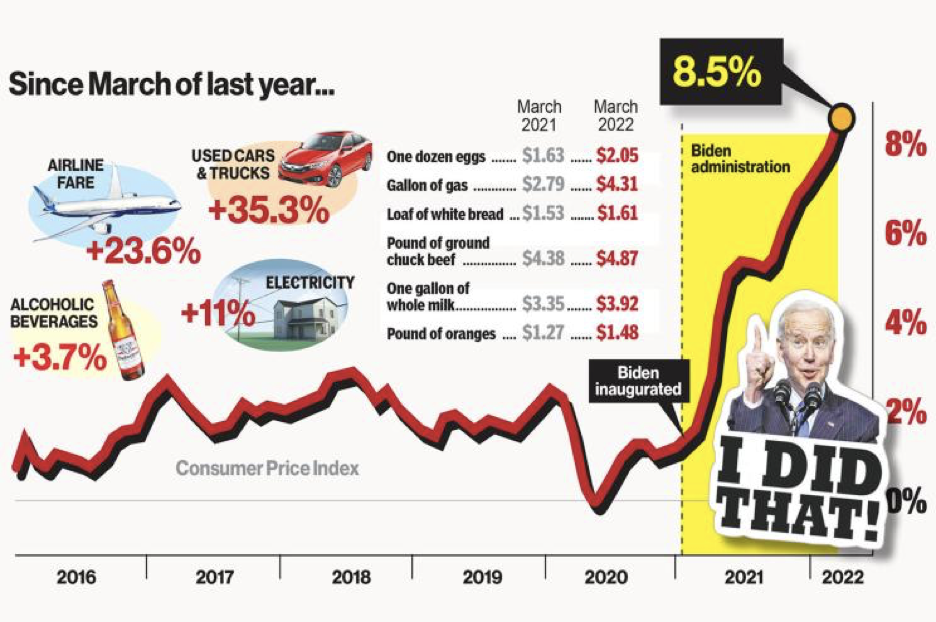

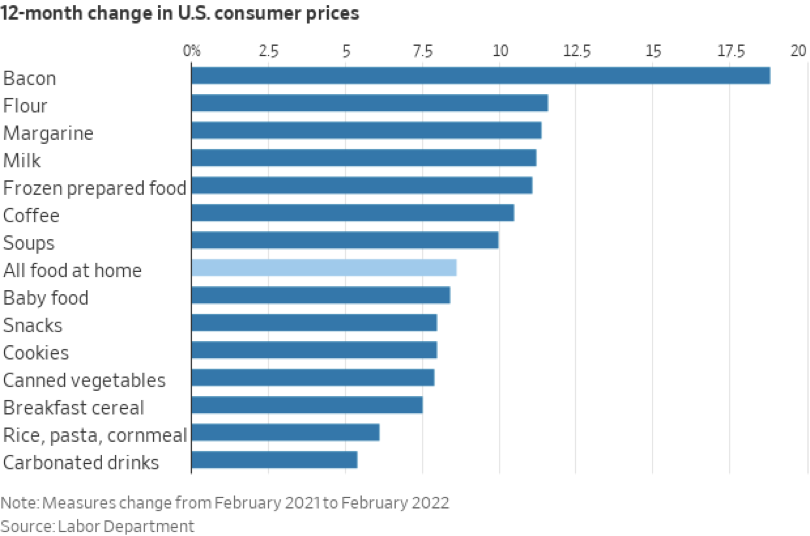

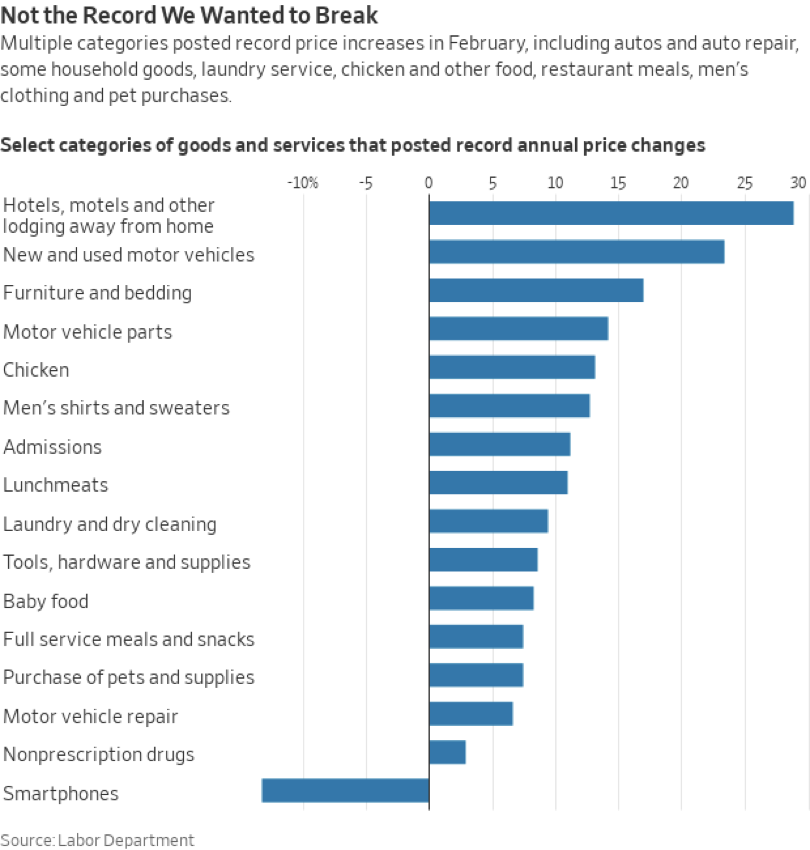

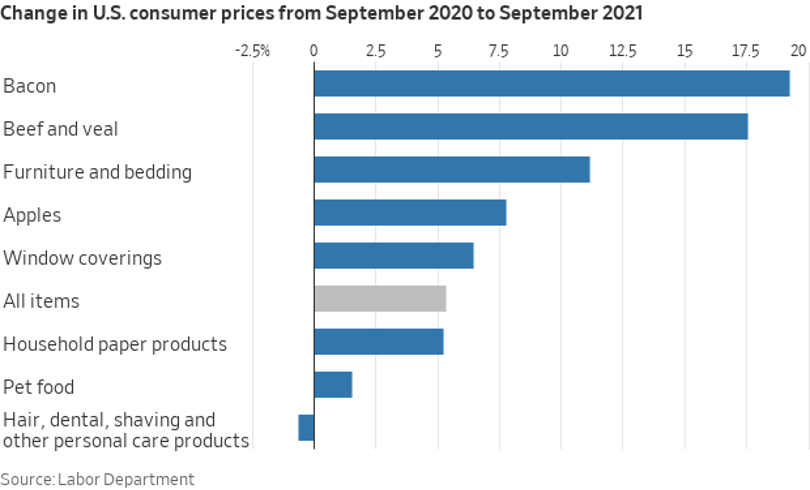

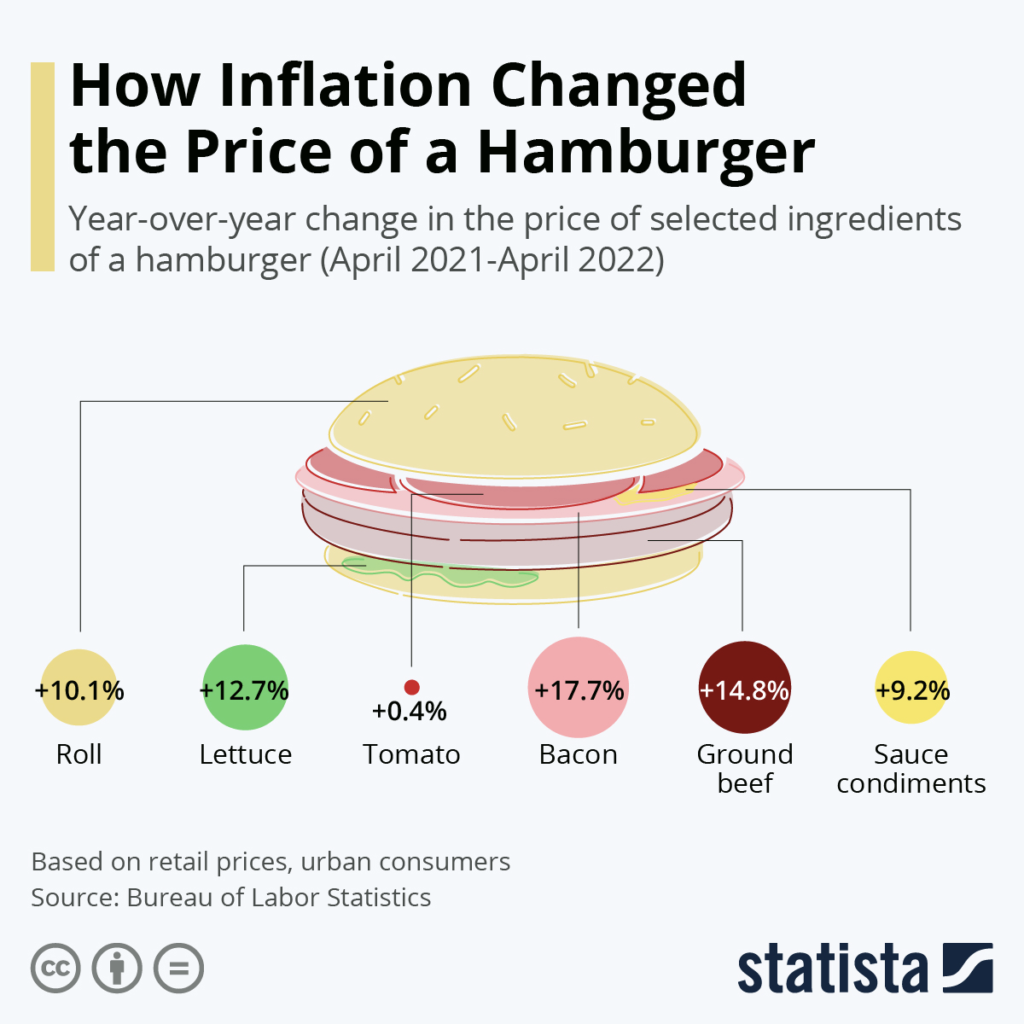

Speaking of the everyday American, what has inflation done to the price of a hamburger? Take a look!

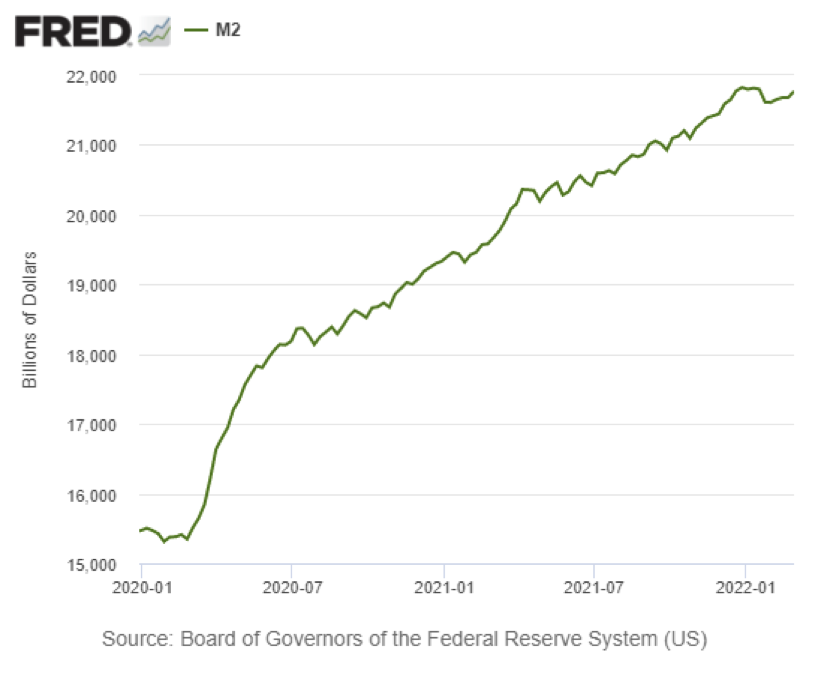

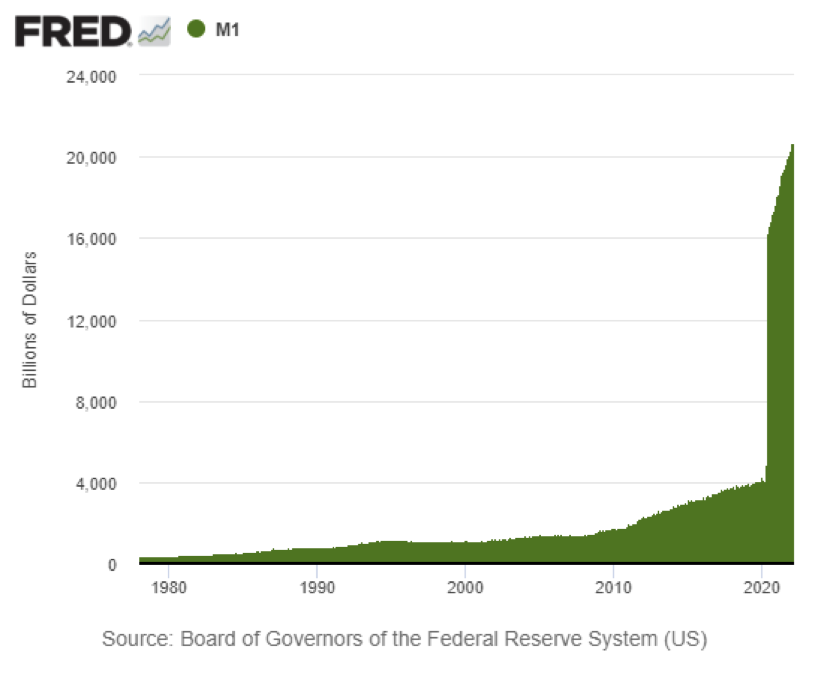

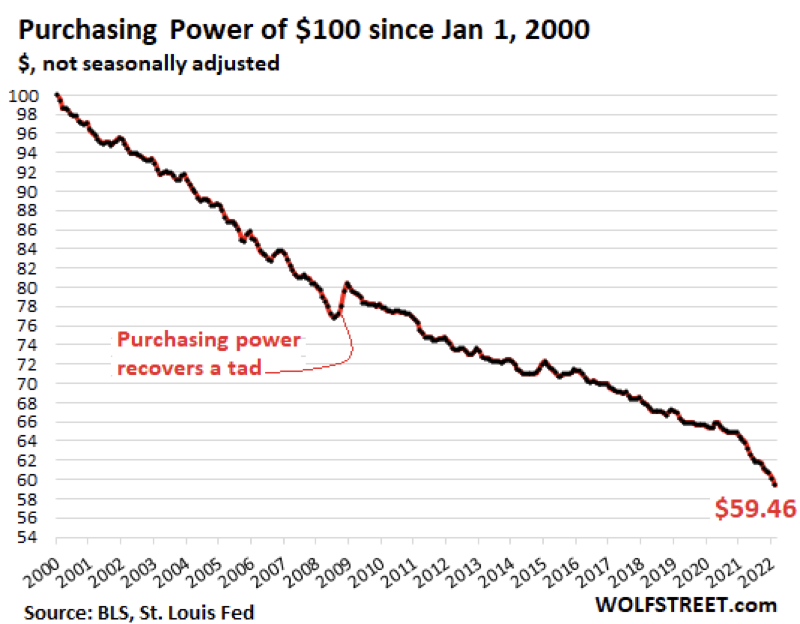

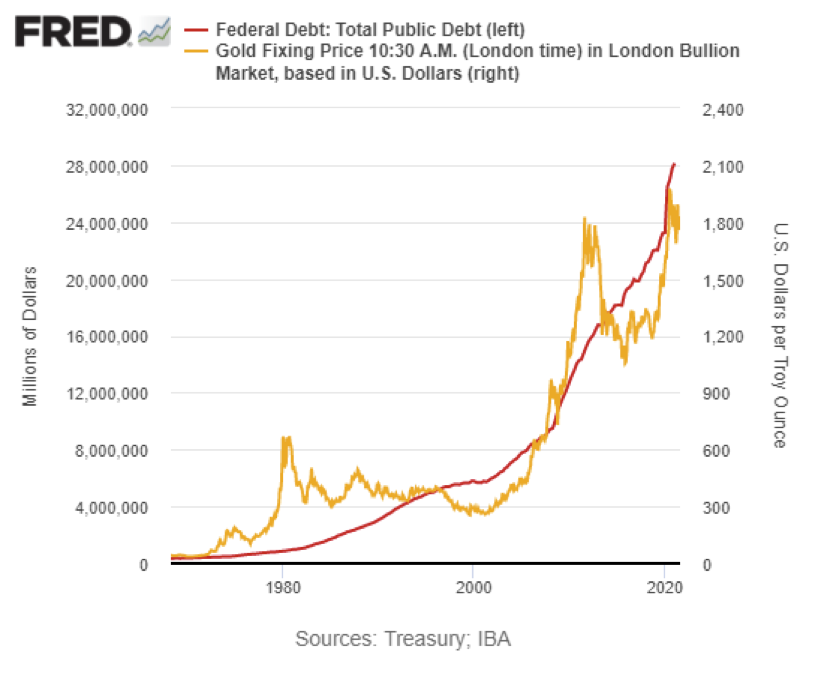

Along the same line, we caught a Yahoo Finance story that reports for the first time in decades the frozen food category is outgrowing the fresh food category. It says that so far this year, frozen food outgrew fresh by 230 percent. And so, the American standard of living continues to deteriorate at the hands of central bank inflationists.

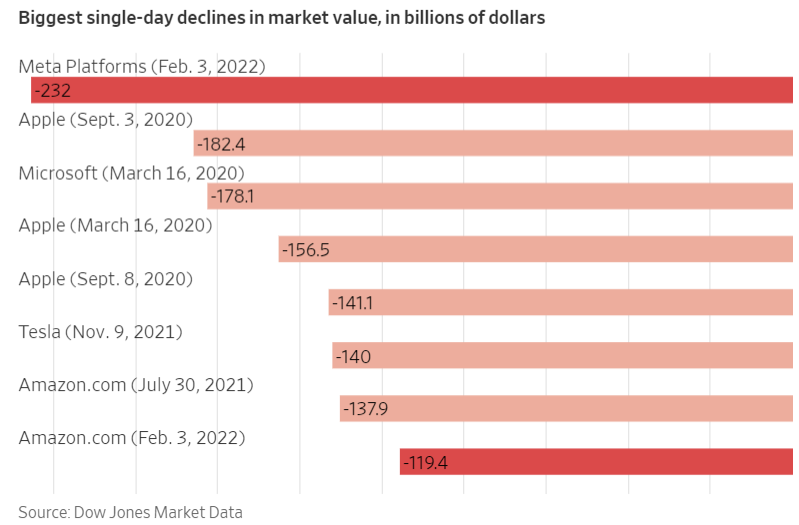

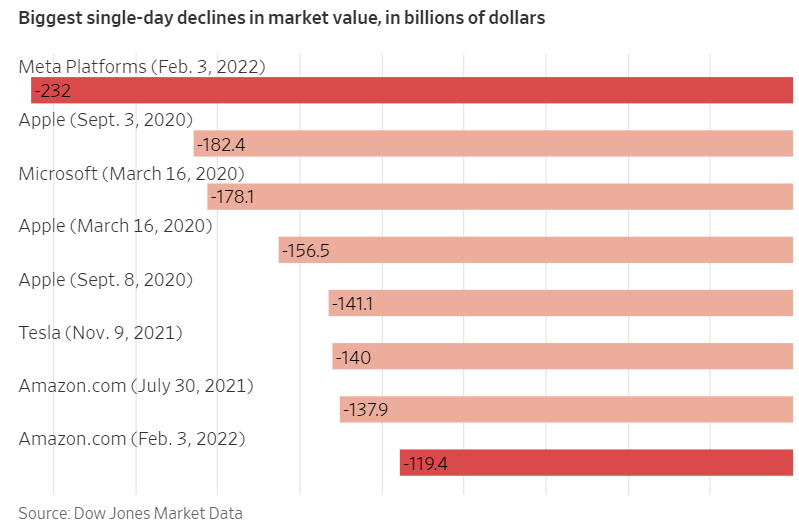

Changing consumer spending patterns can also be seen in huge excess inventories that caught major retailers by surprise, and by the subsequent sharp sell-off of retailer shares including Amazon, Wal-Mart, Costco, and Target.

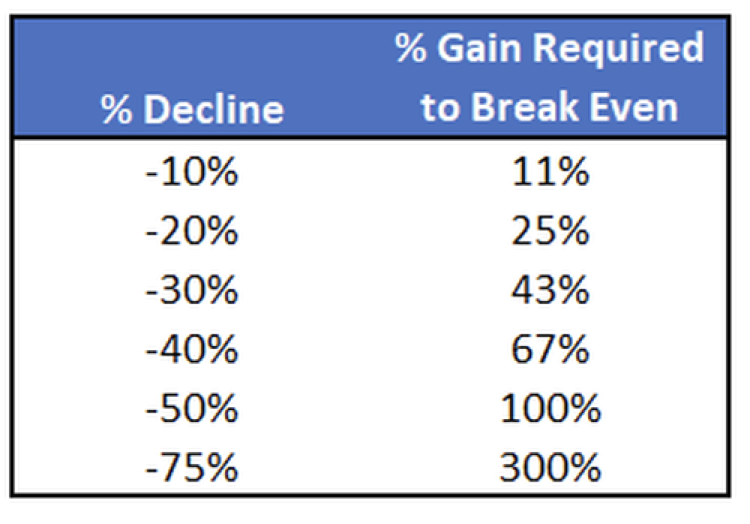

By the way, the OnePoll survey referred to earlier reports that on average those polled believe it will take them 38 years to pay off their credit card debt.

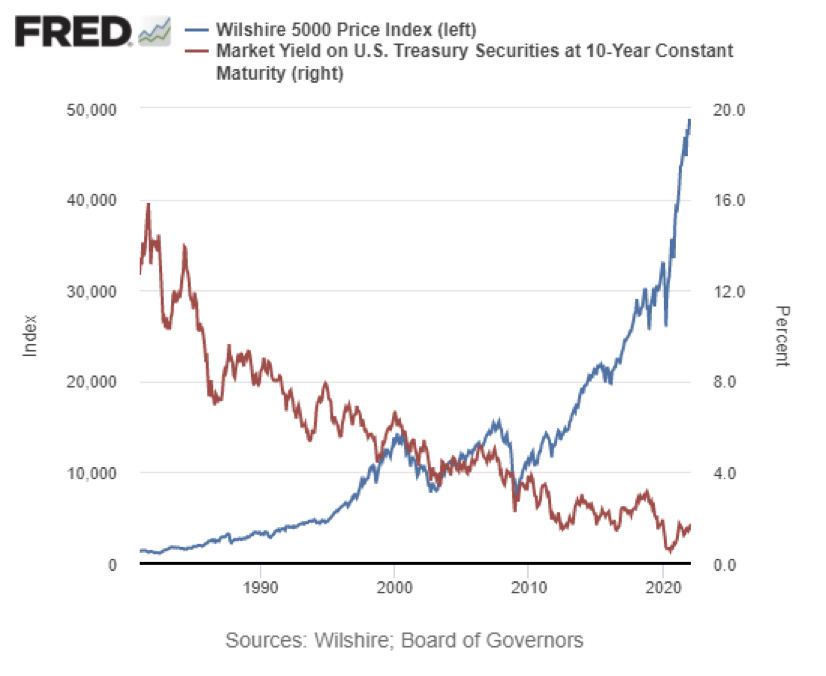

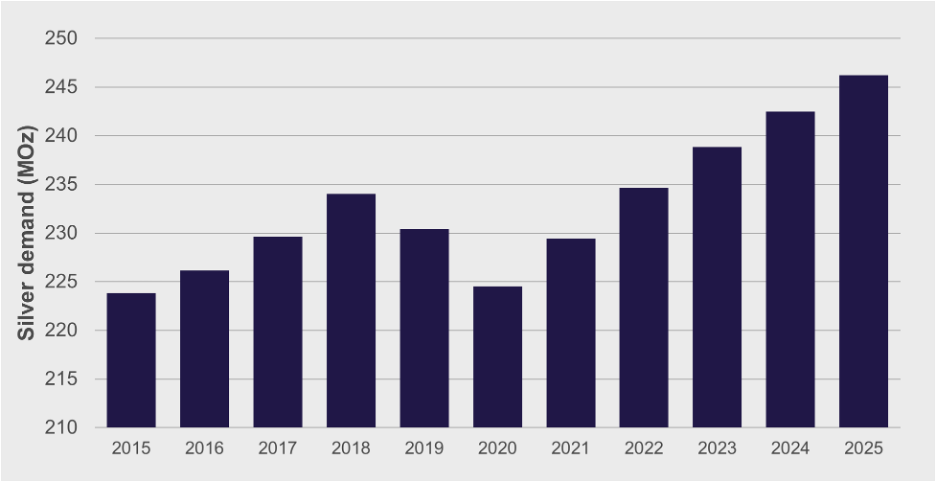

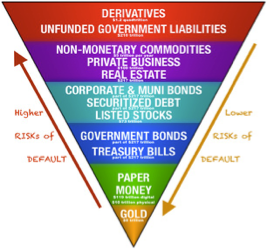

We can’t do anything about the price of gas and hamburgers, but we can help you preserve your wealth and even profit in this age of inflation. Contact us at Republic Monetary Exchange. We have knowledgeable gold and silver professionals standing by to help you.