The Paper Dollar Birthday

8/15/2019

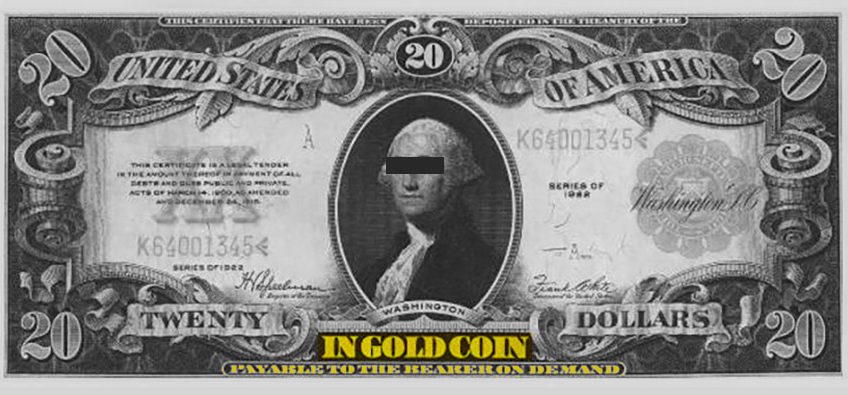

The US has had paper dollars for a long time, but through most of our history, even the paper dollars were tied to gold. Until this date, August 15, back in 1971. It was then, 48 years ago today, that President Nixon severed the last remaining link of the U.S. dollar to gold.

Today, almost half a century later, we are experiencing the long-term consequences of that decision. Those consequences include a trade and currency war, a race among nations to destroy the purchasing power of their currencies, unrestrained money printing, inadequate personal savings, interest rate manipulations, weak economic growth, a stalled out middle-class, growing deficits, and skyrocketing debt.

Under the post-World War II monetary regime, the rest of the world had been persuaded to hold dollars as reserves and conduct international commerce in dollars. But U.S. politicians of both parties had a grand time for years spending money and buying votes on left and right to delight their special constituencies. There was the Great Society and the Vietnam War, too. Because they had the Federal Reserve to print money for them, it had been a wild spree.

But like any ne’er do well, the U.S. was writing bad checks. The state was issuing more dollars than it could possibly redeem for gold at the promised exchange rate of $35 per ounce.

The rest of the world saw the U.S. money printing under the dollar/gold exchange standard and noted the falling purchasing power of the dollars they held.

They began to race for the exits. They wanted to cash their paper dollars in for gold while they could.

Like a run on the bank, the demand to exchange dollars for gold was beyond containment.

Nixon decided to find a bogeyman to blame for the government’s wastrel ways. He chose “international money speculators.”

The crisis of the U.S. writing hot checks was their fault, he said.

In making his case against them, Nixon uttered more monetary babble. “The strength of a nation’s currency is based on the strength of that nation’s economy,” he said. But that was simply untrue: America’s economy has been growing while the value of the dollar was sinking.

And so, on that hot August night in 1971, Nixon closed the gold window and abandoned any pretense of dollar redeemability in gold.

That was 48 years ago today.

Now we find ourselves on the doorstep of a long-brewing currency crisis. With the dollar redeemable in nothing, what would act as a restraint on the issuance of more and more dollars, an endless torrent of money printing?

If the rest of the world noticed that they were having difficulty cashing in their dollars for gold decades ago, consider how they must feel today knowing that there is nothing to cash them in for.

We are speeding toward the long inevitable crisis of resolution. At every hand, the central banks and governments of foreign nations, are taking steps to insulate themselves from the developing dollar crisis.

Many of the central banks are using dollars to add to their gold reserves. They may not mind fleecing their citizens with their own debased currencies, but they didn’t want to be victimized by ours 48 years ago. And they still don’t want to be victimized by it today.

And neither should you.