Silver Opportunities in the Bull Market

In a precious metals bull market like this, it usually takes silver a while to wake up!

Silver is waking up now.

We like to alert you to great profit opportunities. Gold goes first. It leads the way. But when silver starts moving, it really rips!

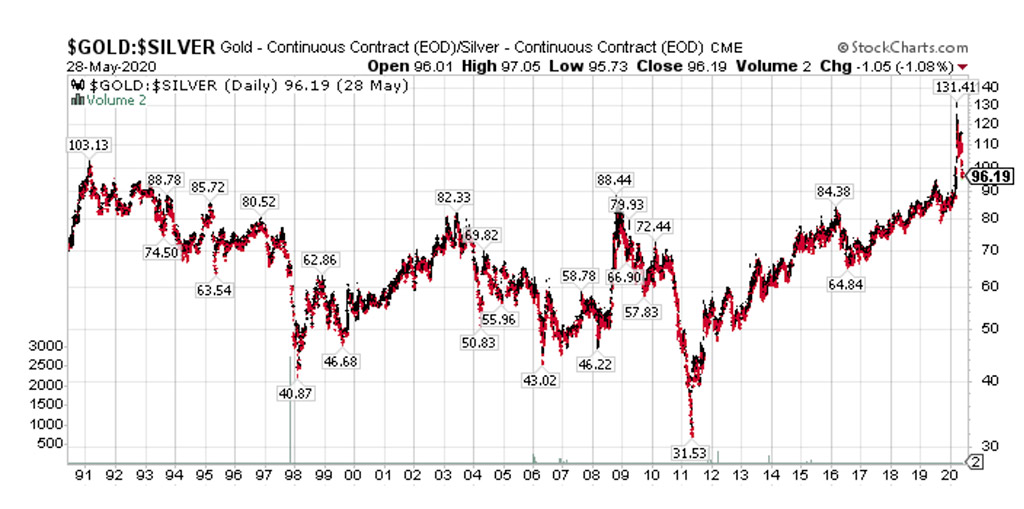

Silver has started moving! The gold/silver ratio, which reached 130 to one in March, has fallen to 97 to one.

The gold/silver ratio is simply the price of gold divided by the price of silver. It reflects how many ounces of silver it takes to equal an ounce of gold. When silver appreciates faster than gold, the ratio moves down. When gold appreciates faster the ratio moves up.

Using the gold/silver ratio as a trading strategy, one that keeps you fully invested in precious metals all the time is a powerful means of growing the total number of ounces of gold and silver you own.

An example for illustration purposes using the spot prices of the metals, ignoring transaction costs and premiums, can help make the strategy clear. In March one could hypothetically have traded one ounce of gold for 130 ounces of silver. The ratio of 130 to one was the highest gold to silver ratios in history.

Now the gold/silver ratio has turned down.

The ratio has fallen because the silver market has awakened and the price of silver has begun moving faster than gold itself! Now, an ounce of gold is equal to 97 ounces of silver; the ratio is 97 to one. This is still a historically high ratio that has only been equaled twice in history, once during World War II and once in 1990.

The following chart shows the ratio over the last 20 years. Since the two metals have different supply-demand fundamentals, their prices do not move in lockstep. The ratio is always in motion, creating the opportunity to emphasize in your portfolio the one poised for the greatest percentage gains.

The gold/silver ratio strategy indicates that right now the metal poised for the greatest percentage gain is silver. We are never surprised to see silver climb faster than gold. We are never surprised to see the gold/silver ratio begin to turn lower. It is a common feature of gold and silver bull markets.

At some point those who use this strategy, trading gold for silver now, will trade back into gold when the ratio moves lower, thereby substantially increasing their total gold holdings. Your Republic Monetary Exchange precious metals specialist can give you examples of this strategy at work. Depending on your unique objectives it can make sense to be in the precious metal poised for the fastest appreciation.

Speak with your Republic Monetary Exchange precious metal specialist to see if taking advantage of today’s gold/silver ratio, still at historic highs and beginning to turn lower, makes sense for you. He will explain how to grow the number of ounces of precious metals in your portfolio. Trading the gold/silver ratio is a simple strategy, one that many of our clients and I have used for years.

We think it represents a tremendous opportunity.