The Diving Dollar

Have you seen what has been going on with the US Dollar? It looks like it is diving off a cliff.

Here is a one-year chart of the US Dollar Index. You can see the appearance of the COVID-19 shutdown early in 2020 and the confusion in the currency markets. The dollar fell, bounced back up, and headed back down for the rest of the year.

The dollar fell almost seven percent altogether last year. One leading economist, Stephen Roach at Yale, says it will fall 35 percent by the end of this year.

We’ve been calling your attention to his warnings since June. See for example the commentary DOLLAR BREAKDOWN AHEAD! that we wrote on June 9.

You can see form the chart that most of the dollar’s 2020 losses took place after we published that and other warnings last summer.

None of this is especially complicated. The Fed has been printing a lot of US dollars. They are not backed by anything – certainly they are not backed by gold as they once were. Since they are not backed by anything real, since the Fed creates them out of thin air, they are worth less and less with each turn of the printing press.

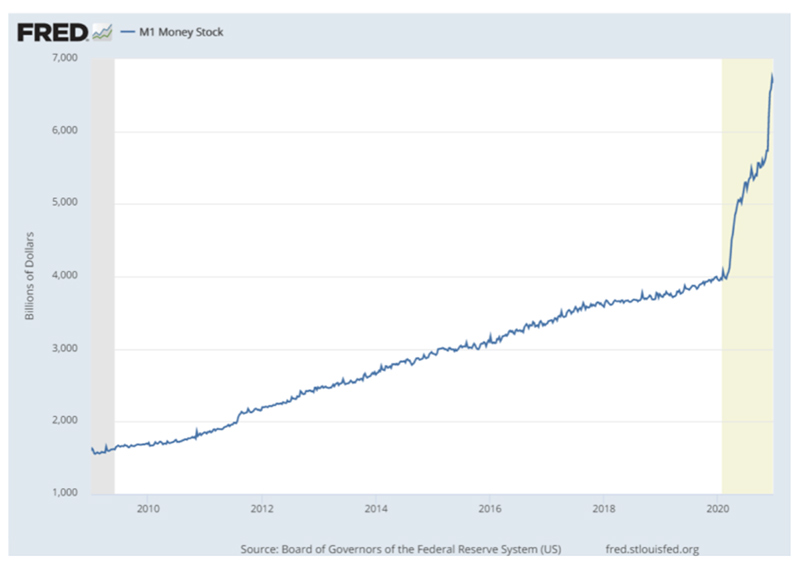

The venerable American Institute for Economic Research published the following chart last week, pointing out that “the Federal Reserve System has indirectly increased the money supply (the M1 version) by a whopping 75 percent over the past year.”

That’s a lot of money printing. No wonder the dollar looks like it is cliff diving!

AIER explains:

“The money was created for the primary purpose of buying up Treasury securities that were issued to finance the massive federal budget deficits of late (more than $3 trillion for fiscal year 2020; probably higher next year). The Fed soaked up about $2.3 trillion of the new debt, bringing its total portfolio of Treasuries to about $4.7 trillion. In addition, it added about three quarters of a trillion to its holdings of mortgage-backed securities, boosting those holdings to over $2 trillion. This was done to suppress longer-term interest rates that it does not directly control.

“Is your head spinning yet? Who can grasp a trillion of anything? It may help if we divide these numbers by 128 million, the total number of U.S. households:

| Item | Total | Per household |

| 2020 Federal deficit | $3 trillion | $23,437 |

| Federal debt, net of inter-agency holdings | $21 trillion | $164,000 |

| One-year M1 money supply increase | $2.8 trillion | $21,875 |

| Fed holdings of Treasury securities,one-year increase | $2.3 trillion | $17,968 |

| Fed holdings of mortgage-backed securities, one-year increase | $0.75 trillion | $5,859 |

According to AIER, the basic message from all this is, “We’re in trouble.”

It concludes, “Those who understand that the piper will be paid must protect themselves and their families first, then do what they can to understand and promote sound economics.”

We agree. You must protect yourself and your family first. The gold and silver professionals here at Republic Monetary Exchange can help. Why not contact us today?