The Fed ‘Fesses Up

The Fed is doing what it did in reaction to the Panic of 2008. The very measures that ran gold to stratospheric new highs in a few short years.

Only they’re doing much more of it.

But don’t just take it from us.

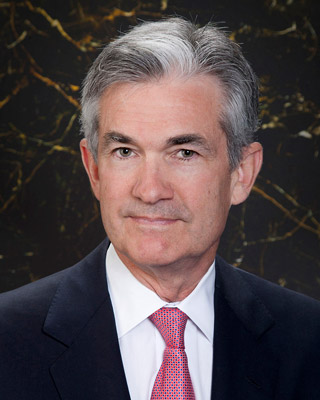

Now you have it directly from Lawrence Powell, the chairman of the Federal Reserve.

And the gold market is responding the way it did last time. By heading much higher.

Sunday night (5/17/20) on the CBS news show 60 Minutes, Powell confessed the whole money-printing scheme. Here’s the exchange with anchorman Scott Pelley.

Pelley: “In terms of size, Mr. Chairman, how does what the Fed is doing right now compare to the unprecedented action it took in 2008?”

Fed Chairman: “So the things we’re doing now are substantially larger. The asset purchases that we’re doing are a multiple of the programs that were done during the last crisis. . .”

During that money-printing spree, after the collapse of Bear Stearns and Lehmann Brothers and as the housing market melted down, gold ran up almost $1,200 hundred dollars an ounce, from about $700 to $1900. Silver rocketed from below $9 an ounce to almost $50.

Only this time, the Fed is creating even more money out of nothing than before and doing it much faster. (The Fed just prints it, said Powell, “We print it digitally.”)

As the interview continued, Chairman Powell assured Pelley that the Fed hasn’t done all it can do. Despite the fact that the Fed has created $3 trillion out of nothing since the first of October, Powell says it can still do much more.

Fed Chairman: Well, there’s a lot more we can do. We’ve done what we can as we go. But I will say that we’re not out of ammunition by a long shot. No, there’s really no limit to what we can do with these lending programs that we have. So there’s a lot more we can do to support the economy, and we’re committed to doing everything we can as long as we need to.

Pelley: What would the Fed’s next steps be, potentially?

Fed Chairman: Well, to begin, the one thing we can certainly do is we can enlarge our existing lending programs. We can start new lending programs if need be. We can do that. There are things we can do in monetary policy. There are a number of dimensions where we can move to make policy even more accommodative. Through forward guidance, we can change our asset purchase strategy. There are just a lot of things that we can do.

Pelley: What would the Fed’s next steps be, potentially?

Fed Chairman: Well, to begin, the one thing we can certainly do is we can enlarge our existing lending programs. We can start new lending programs if need be. We can do that. There are things we can do in monetary policy. There are a number of dimensions where we can move to make policy even more accommodative. Through forward guidance, we can change our asset purchase strategy. There are just a lot of things that we can do.

Two things:

First, buckle up. The Fed money-printing machine is going to shake this country to its foundations.

And two, contact your Republic Monetary Exchange gold and silver professional today.