The Rush to Gold Will Be a Global Phenomenon

So far, the gold and silver bull market that began by our reckoning in August 2018 has been fairly typical.

Don’t misunderstand! We’re saying it has been typical for a powerful bull market! The move so far has been most impressive. Gold is up almost $700 an ounce since the bull started running. In fact, gold appreciated almost 25 percent last year. Silver did even better, racing up 48 percent in 2020, outperforming US stocks by three times.

It will continue to march much higher with every turn of the Fed’s printing press and every new federal budget.

But eventually, at some time in the not too far-off future, the price of gold (and silver) will go parabolic. The gold chart will resemble a hockey stick. It will hit an inflection point and turn straight up.

That will be the end-game for the dollar in its present incarnation. It will be game over for unbacked paper or digital government money issued without restraint by anyone, anywhere. What the authorities will do to attempt to prolong the game or replace it remains to be seen. But the prices of gold and silver – and other real things – will reflect the valuelessness of the paper money.

This calamity will be world-wide. There has never been an event like this on a global scale. When dollar inflation reached double-digits in the late 1970’s it was costly for other countries that held dollar reserves. The dollar was, as Nixon’s Treasury secretary John Connelly said to foreign finance ministers back in the day, “The dollar is our currency, but it’s your problem.”

But remember, that back then China and Russia were not even in the game. China was a closed economy, Russia was as well, although less so. The euro did not even exist back then. If the dollar was being debauched, there were other currencies that were not. Although the Swiss franc had gotten into bed with the dollar with the Bretton Woods agreement in 1945, it maintained a statuary tie to gold until 1999.

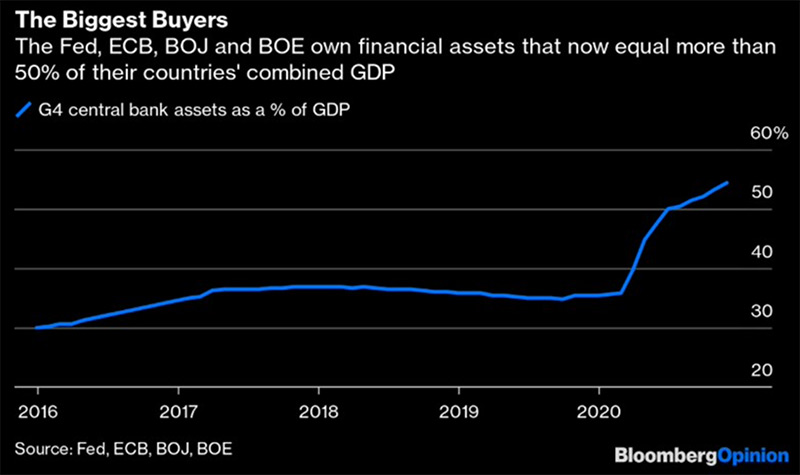

That is not the case today. All the major currency nations are printing money, just like the Fed. This chart from Bloomberg News illustrates how much money the US, Japan, Great Britain, and Europe are printing compared to their GDP. Over the last year, their assets – financial instruments they purcased with money they conjured out of nothing — have grown to more than half of their productivity.

When the dollar breaks down, when foreigners quit funding US government debt, no one will find refuge in euros, pounds, or yen. Or in yuan.

The rush to gold that ensues will be reflected in the hockey stick gold chart.

By then it will be too late for most people to do anything about it. The window of opportunity that is open today will have closed.

By the way, that day is approaching quickly. Sometime in the days to come we will write about the signs that inflation has now begun rearing its ugly head. And that the line between low and nuisance levels of inflation and crippling inflation is a very thin one indeed.

In the meantime, let a Republic Monetary Exchange gold and silver professional advise you about steps to take to protect yourself.