“Trumpflation” and What it Means for Gold

“TRUMPFLATION” AND WHAT IT WILL MEAN FOR GOLD IN THE TRUMP ERA

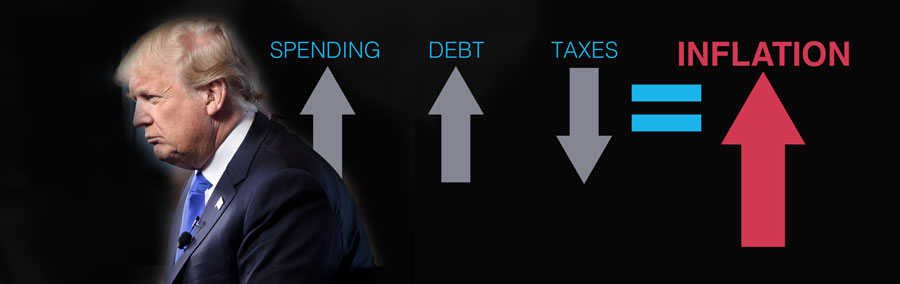

What does a Trump presidency mean for inflation, the markets, and your financial future? From what history tells and the President Elect has promised in his policy outlines, it will be debt, inflation, market collapse, and a potential trade war. While Mr. Trump promises to build new roads and bridges that are “second to none”, he also promises to lower your taxes. Welcome to Trumpflation… where three things are poised to rise: the national debt, interest rates, and gold.

In the immediate aftermath of Donald Trump’s upset win, gold prices skyrocketed due to volatility. Shortly after they pulled back. Long-term, however, they will be buoyed by several different economic trends that are stirring the markets.

A TRUMP PRESIDENCY MEANS INFLATION AND DEBT

You think the Obama administration contributed to our national debt problem? You would be right. But wait until you see what levels the national debt will soar to under a Trump presidency. The self-proclaimed “King of Debt” is going to increase spending, and he has not been shy about saying so. He has pledged increased spending particularly in defense and infrastructure.

Donald Trump has also promised tax cuts. In theory these tax cuts will stimulate business and create more jobs. However this does not happen instantly and takes time for these effects to be felt. In the short term it means reduction in tax revenue. Greater spending with less revenue could mean adding up to 50% to the national debt in Trump’s first term alone. This equates to massive inflation.

The Federal Reserve has been eyeing raising interest rates all year. Each meeting they argue that the case is “strengthening” and that a hike before the year is over must happen. When rates do finally go up, this will drive inflation and push inflation rates higher than we have seen since the 1970s.

Gold is a hedge against rising inflation. Inflation means dollar devaluation. As the dollar goes down, gold will go up. Gold always preserves purchasing power, unlike the dollar, which is subject to inflationary and deflationary trends.

THE STOCK MARKET IS PERFORMING AT ALL-TIME HIGHS… BUT FOR HOW LONG?

The stock market has been hitting highs on a nearly daily basis the past couple weeks. How long will it continue after higher interest rates and “Trumpflation” hit?

The stock market is approaching a bubble burst. It is in an inflationary trend and higher interest rates could be the trigger for it bursting. Some analysts are warning that the stock market is already overpriced, and its current rally could come back to bite investors. Furthermore, the direction that the bond market is moving does not bode well for Wall Street.

Gold price has been suppressed the past couple weeks as the stock market hit record high after record high. When the bubble bursts, however, investors will flood back to safe haven metals.

WHY YOU SHOULD BE WATCHING THE BOND MARKET

The yield on the 10-year government bond has experienced a sharp increase since November 8th shooting up 40 basis points. The yield is going up because prices are falling. In the week after the election, 10-year bond prices plunged 1.4%. They are being sold off rapidly in anticipation of Trump’s spending stimulus. Holders of U.S. treasuries are anticipating dollar devaluation and selling off their bonds now.

The yield on the 10-year government bond has experienced a sharp increase since November 8th shooting up 40 basis points. The yield is going up because prices are falling. In the week after the election, 10-year bond prices plunged 1.4%. They are being sold off rapidly in anticipation of Trump’s spending stimulus. Holders of U.S. treasuries are anticipating dollar devaluation and selling off their bonds now.

As the yield percentage increases, so do interest payments on the obligation of the bonds. Many U.S. mortgage rates are tied to 10-year bond yields, meaning higher borrowing costs for companies. 30-year fixed mortgage rates plummeted 9% in the election’s wake.

In the short term, the dollar is enjoying a 14-year high. In the long run, this will all increase the national debt subjecting the dollar to further devaluation. Rounds of quantitative easing will follow. All of this will bode well for the gold investor, and, more importantly, strengthens the argument for gold as a natural hedge against the markets. The last time the dollar was this strong, gold was $300 per ounce. Gold is now trading over $1,200 an ounce. Gold is an alternative to the dollar, particularly during inflation and devaluation.

TRADE POLICY AND DOLLAR DEVALUATION

Increased government spending on defense and infrastructure is intended to stimulate the economy through job creation. With national debt levels as high as they are, it is “artificial”, government-created dollars that are going to be spent.

Some analysts warn there will be stagflation instead though. The economic growth that this spending will drive could be halted by some of Trump’s proposed trade barriers. These could keep the proposed tax and regulation cuts from reaching the intended stimulating effect. This will mean rising prices, but little growth to go along with them. The global economy is already experiencing sluggish growth, and protectionist trade policy will slow it further.