Watch Out Below!

Gold to Gain from Falling Dollar

The US dollar could fall by as much as 35 percent next year. Thanks to the ending of its status as the world reserve currency.

That’s according to Stephen Roach. He says the dollar is vulnerable to a sharp correction. A crash is looming, he says.

Roach is an economist at Yale University now. Before that he was with Morgan Stanley, and with the Federal Reserve.

We wrote about Roach a couple of time last summer (see HERE and HERE) when he said that “US living standards are going to be squeezed like never before.”

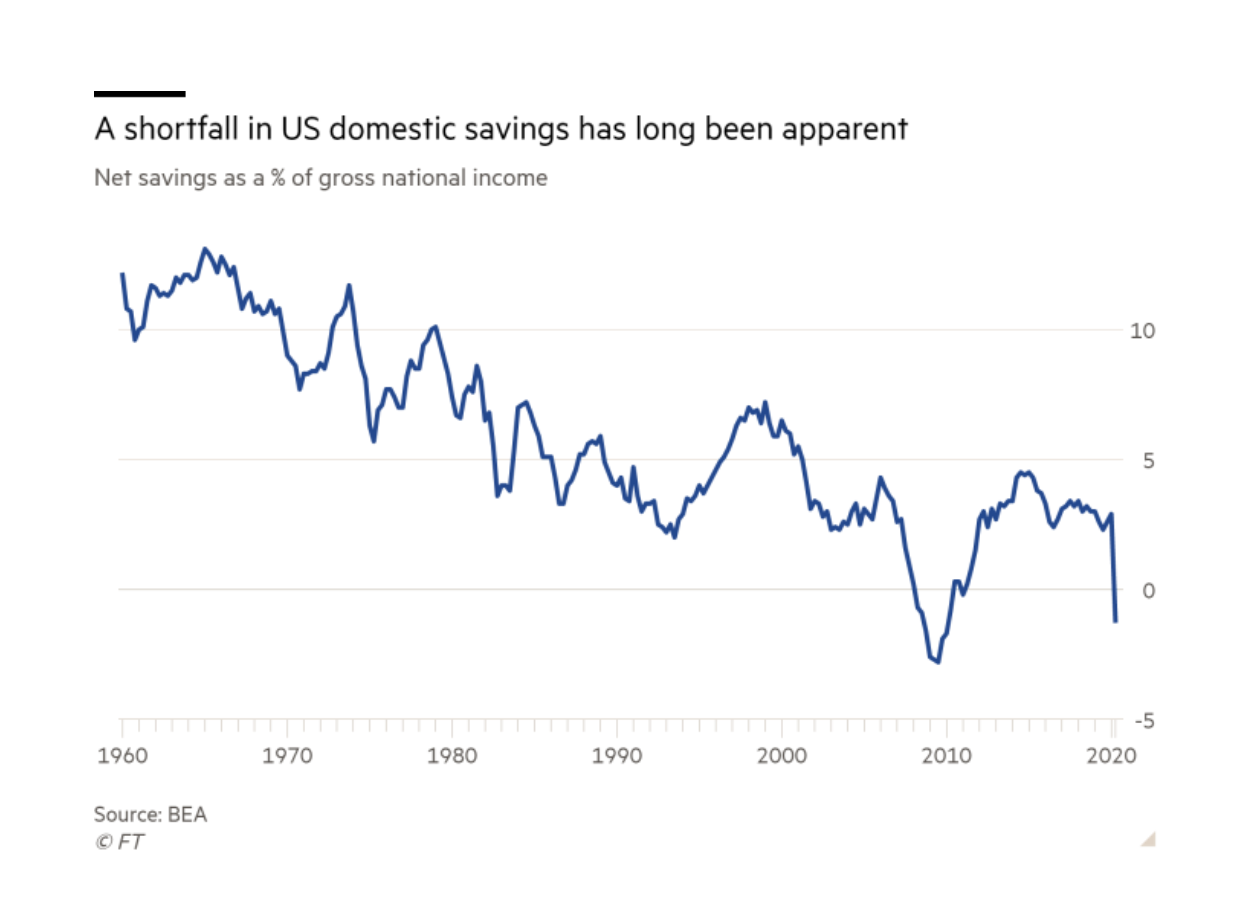

In a new article in the Financial Times, Roach writes that a shortfall in American domestic savings is going to exact a high toll. Between 1960 and 2005, domestic savings average about 7 percent. From 2011 to 2019, before the Covid-19 shutdown, it had fallen to 2.9 percent. Now domestic savings has plunged into negative territory, just like it did in the mortgage and housing meltdown.

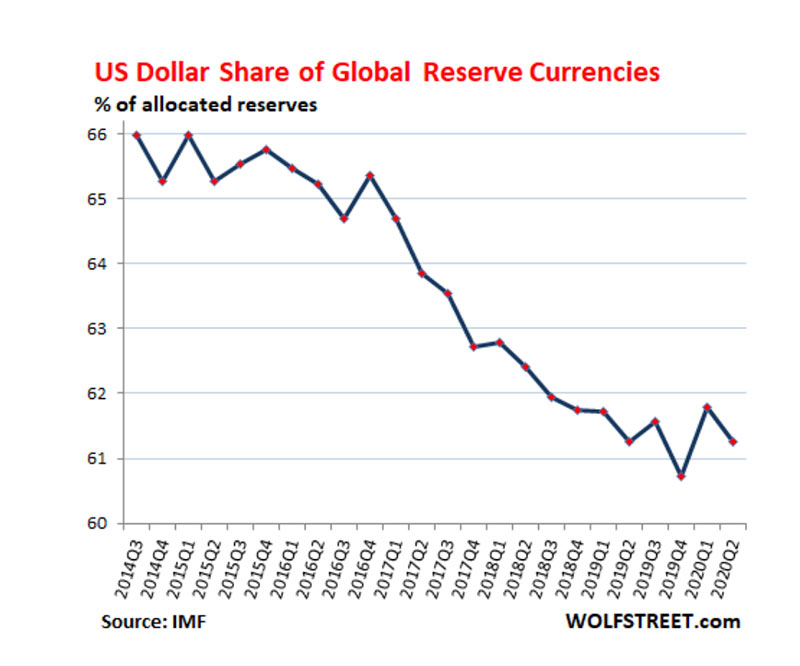

The dollar’s share of global currency reserves was 85 percent before the inflationary 1970s. Now it is 61 percent. And Roach says it will move lower suddenly.

Roach:

“With America’s position as the world’s dominant reserve currency slowly eroding since 2000, foreign lenders are likely to demand concessions on the terms for such massive external financing. This normally takes two forms — an interest rate and/or a currency adjustment. The Federal Reserve has recently shifted to a strategy that takes into account an average of inflation rather than a specific target, and promised to keep policy rates near zero for several more years. That means the interest rate channel has effectively been closed. As a result, more of the current account adjustment will now be forced through a weaker dollar.”

Stated differently, foreigners are not going to keep funding the US as if there is no alternative. There are alternatives. Shining brightly among them is gold.

Roach says that America has “squandered its exorbitant privilege.” That term, “exorbitant privilege,” refers to the dollar remaining the world reserve currency. He’s right. That’s why foreign central banks are replacing dollar reserves with gold.

For our part, we will just warn that a sharp drop in the value of the dollar can happen in the wink of an eye.

That is why we urge our readers to establish their position in gold and silver for profit and protection without delay.