Watching the Government Debt Fundamentals

If you watch the news about government spending and debt closely, you’ll understand why you need to own gold.

This is the end of one government accounting year and the beginning of another. So in Fiscal Year 2019 the federal government added well over a trillion dollars to the national debt.

And nobody who knows anything about anything thinks next year’s debt will be any less. Quite the contrary, if the widely expected recession materializes, tax revenue will fall thanks to slowing business conditions, while the government’s social welfare spending will skyrocket. And we’ll be looking at little old trillion-dollar deficits in the rearview mirror.

Same thing when interest rates normalize. The interest on the federal debt will explode, exacerbating a situation that already is beyond control!

Ten years ago, the total on-the-books federal debt was less than $12 trillion dollars. Now its $22.6 trillion, so we’ve been adding a trillion dollars a year to the debt for a decade now.

In fact, you may remember when the Tea Party came together to yell, “Stop!” to the exploding debt. Anybody hear much about the Tea Party these days? Do you hear anything much about the debt in the presidential debates? Or do you hear promises about the next big government giveaways?

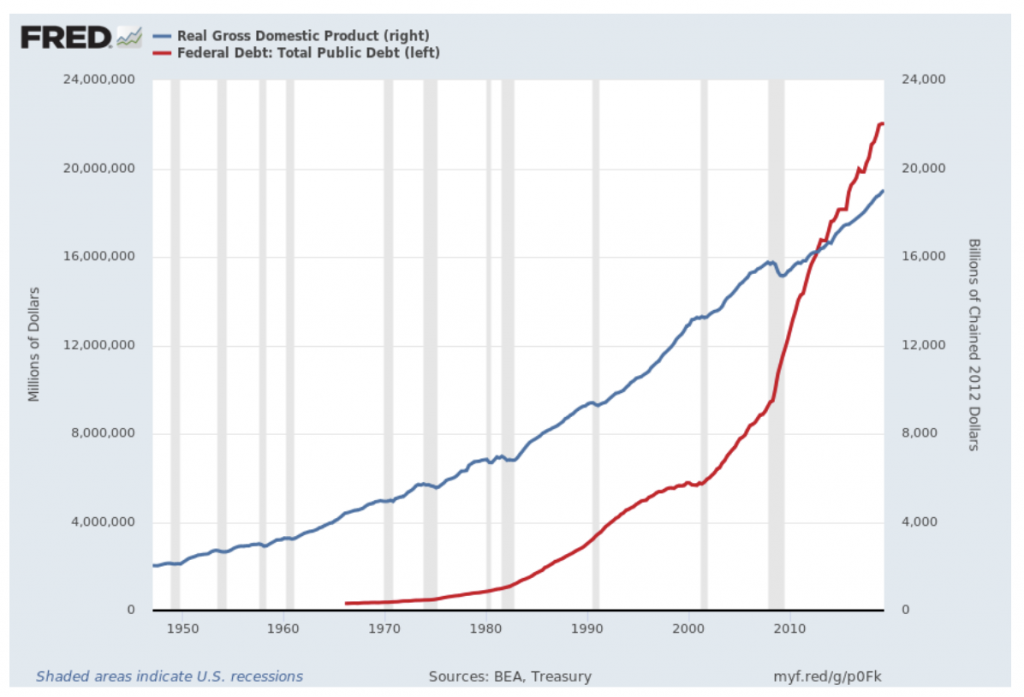

The following chart is one we have shown several times. It is easy to understand and it tells the whole story. The nation’s productivity – called GDP – is represented by the blue line. The red line represents the visible, explicit portion of the national debt.

As you can see the dollar value of government debt has passed the total dollar value of the nation’s productivity. And it is climbing at a steep rate. This is a very dangerous situation. The government is spurting red ink from every vein and artery.

$22.6 trillion is an incomprehensible amount of money, more than the government will ever be able to pay. The government must borrow every year just to pay the creditors that it borrowed from last year. And just like someone taking cash advances from Visa to pay their MasterCard bill – it can’t go on forever.

The government can only hope to print its way out of this mess. If you listen carefully you will hear the drums beginning to beat already for new money printing. It’s just what you would expect in the end-game. Printing more paper money will devalue the dollar. And make more people realize that they need gold and silver.

Because you can’t know exactly when the government’s spending and debt game of chicken will end, you must take steps now to protect yourself with gold and silver.

Before it is too late.

We have made the case repeatedly and the evidence confirms that we are in a long-term gold bull market. Because markets never move in a straight line, we advise our friends and clients to use any price corrections or pullbacks to add to their portfolios.