The Value of the Dollar: Then and Now

It’s not a secret that the dollar doesn’t buy what it once did. You’ve undoubtedly heard stories about how a few nickels were enough to buy a loaf of bread, but have you ever wondered what caused this significant decline? Inflation, which is a rise in the prices of goods and services that in turn lowers the value of a currency like the U.S. dollar, is a major factor here. But, why does inflation occur? And what other factors cause a decrease in the value of the dollar?

What Influences the Value of the U.S. Dollar?

Cost-Push Inflation

Moderate economic growth is almost always accompanied by moderate inflation. The Phillips curve, named after the economist A. William Phillips, describes the relationship between wage growth and price increase.

As an economy grows, more jobs are available than there are workers to fill them. This scarcity of labor allows workers to demand more compensation for their time, and as a result, wages rise. With a rise in wages comes a rise in demand for goods, and an increase in the cost of production. Put simply, if a labor force has more money, it will purchase more goods and services and thus drive demand up. As a reaction to increased demand and increased cost of production, producers of goods and services raise prices, resulting in the dollar buying less today than it did yesterday. Economists refer to this as cost-push inflation.

Interest Rates

Interest rates controlled by the Federal Reserve lead to fluctuation in the value of the dollar. When the Fed lowers interest rates, banks lend less cautiously since the penalty incurred by this lowered rate on money acquired is negligible. When interest rates rise, banks lend with higher degrees of scrutiny due to increased penalties and risk. Therefore, when interest rates fall so does the value of the dollar and vice-versa.

Why does the Federal Reserve manipulate interest rates? Ideally, the Fed monitors the health of the U.S. economy and makes decisions based on what is best for the country at any given time. If the Fed believes the economy is in need of a boost, it can lower interest rates to stimulate growth and stave off recessions. Conversely, if it sees the economy moving too quickly and creating unsustainable growth, known as a “bubble,” it can raise interest rates to impede irresponsible lending and thus prevent a collapse.

Overall, the strength of an economy ultimately dictates the value of its currency. With a strong economy behind it, a currency maintains or grows in value on the global scale.

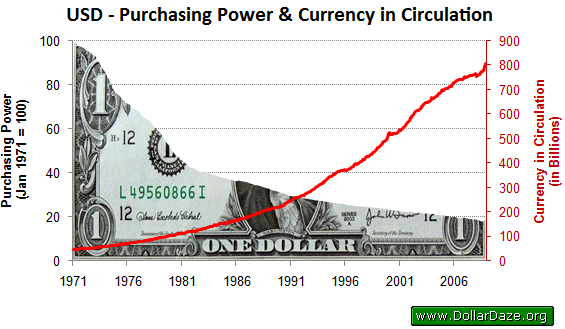

The U.S. Dollar’s Value Over Time

According to The Bureau of Labor Statistics, $1.00 in 1913 is worth the equivalent of $26.32 today. That’s a 2,632% increase in just over a century.

Source: World Resource Simulation Center

If you’re like most American workers, you’re paid in dollars, and if your wage doesn’t keep pace with inflation (around 2.5% yearly), you’ll end up working just as hard for less and less.

When compared to other major currencies, like the Pound or the Euro, the U.S. dollar is less valuable, but this isn’t always the case. Currency-based economies are inherently unstable. For instance, during the Greek debt crisis which came to a head in 2014, the opposite was true and the U.S. dollar was worth almost 1.33 Euros. Now, in 2020, the U.S. dollar is worth approximately .92 Euros. These types of fluctuations are inevitable, and with that knowledge, savvy investors often shy away from the high-risks of currency trading.

If the dollar is consistently losing its value over time, what alternatives exist? Commodities like precious metals have experienced consistent and steady growth for the past half century. In recent years gold has become increasingly attractive to investors looking for less speculation, less risk, and ultimately more peace of mind.

The Global Market for Gold is Stable

Unfortunately, in economies driven by currency, inflation is an inevitability. Fluctuations in value of a currency like the dollar can threaten hard-earned wealth, both in times of prosperity and hardship. Insulate yourself from speculation by investing in precious metals like gold. If you have questions about the process or you’re ready to buy, speak to an RME Gold representative. Call 602-955-6500 to discuss your options today.