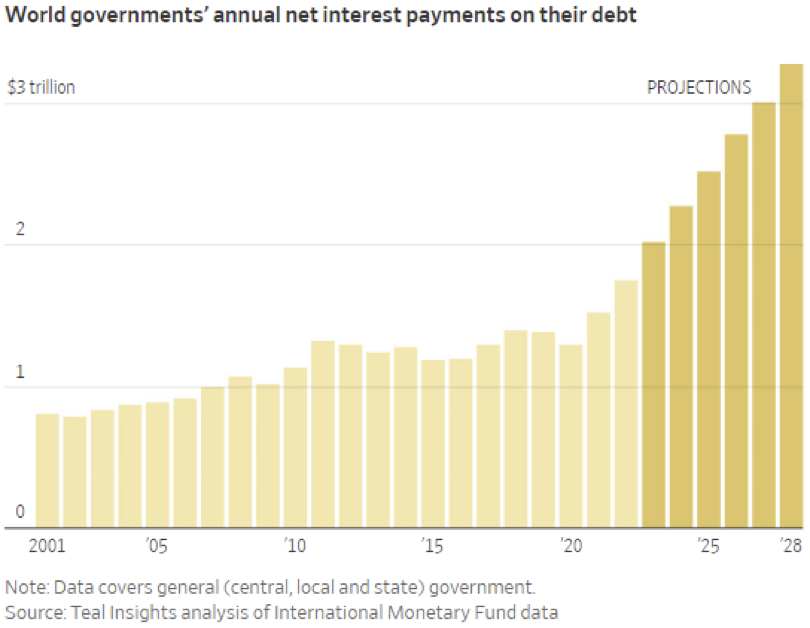

The World Bank is not even trying to hide it.

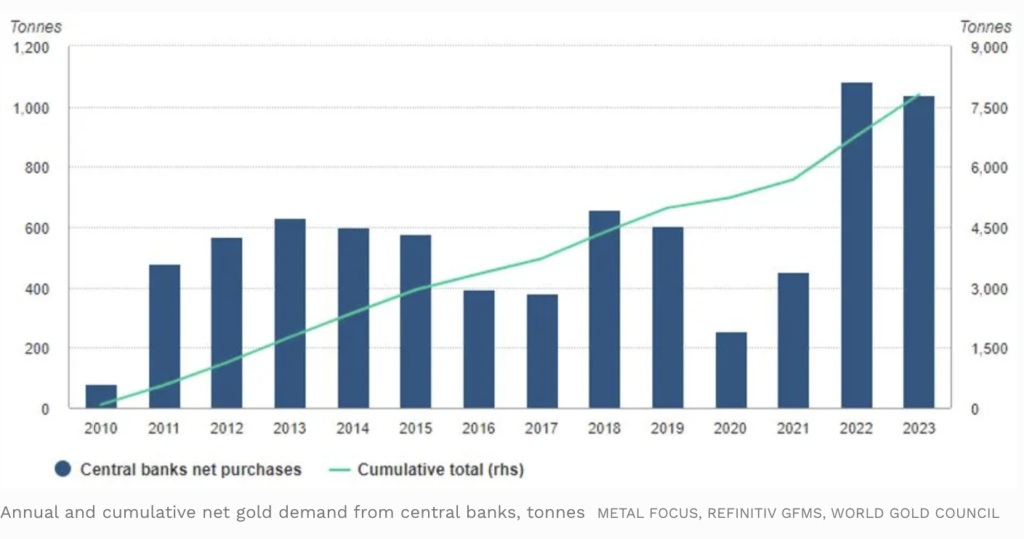

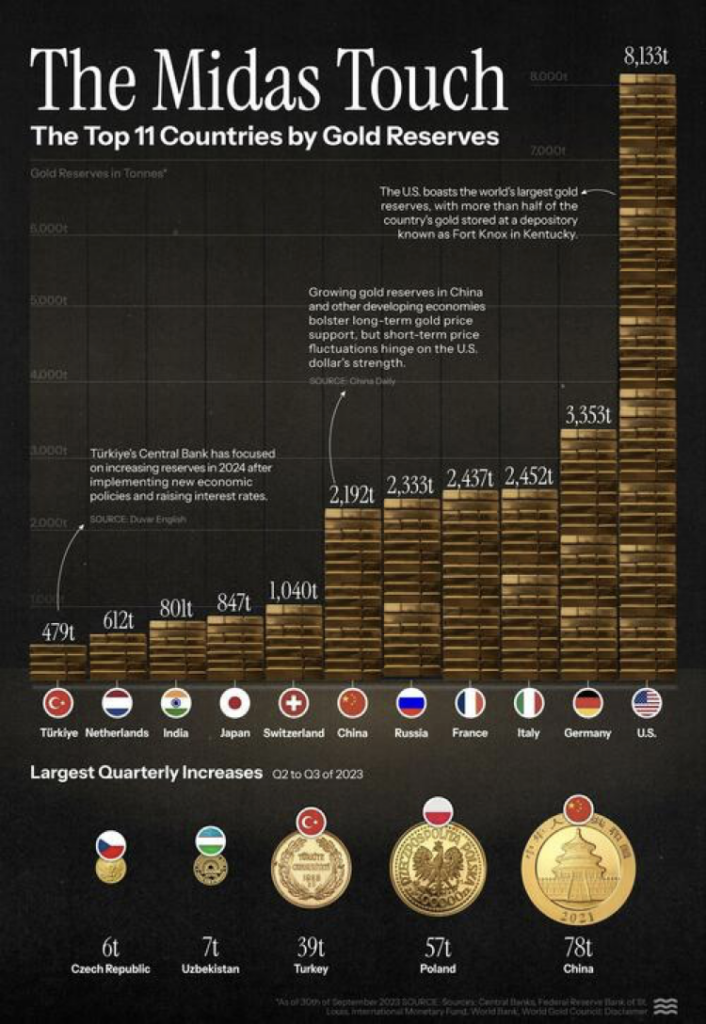

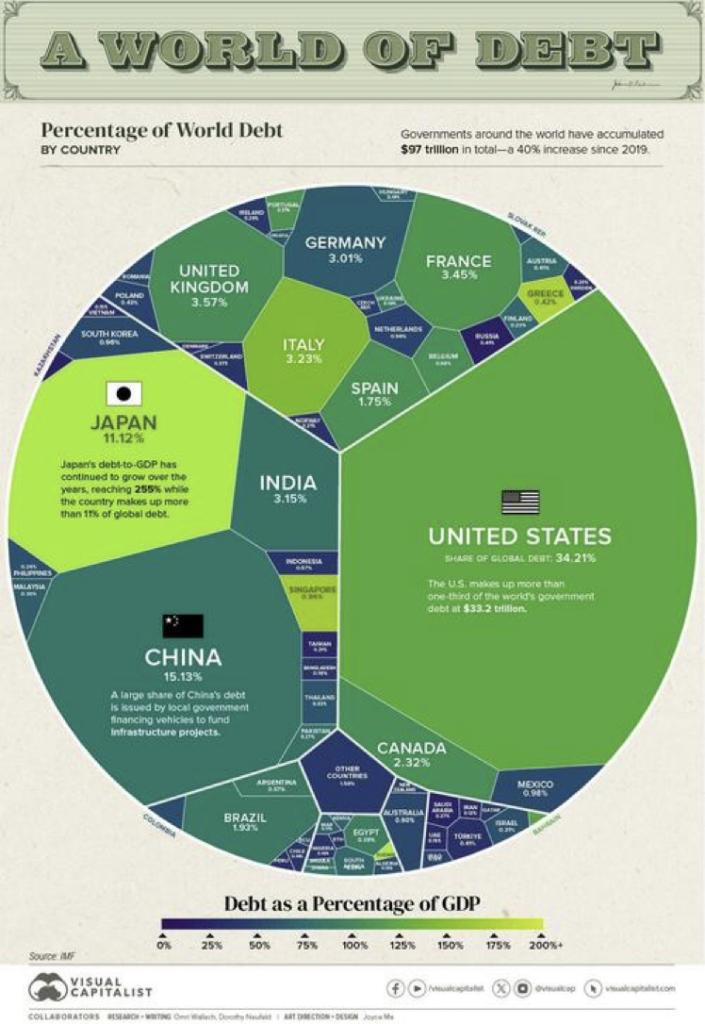

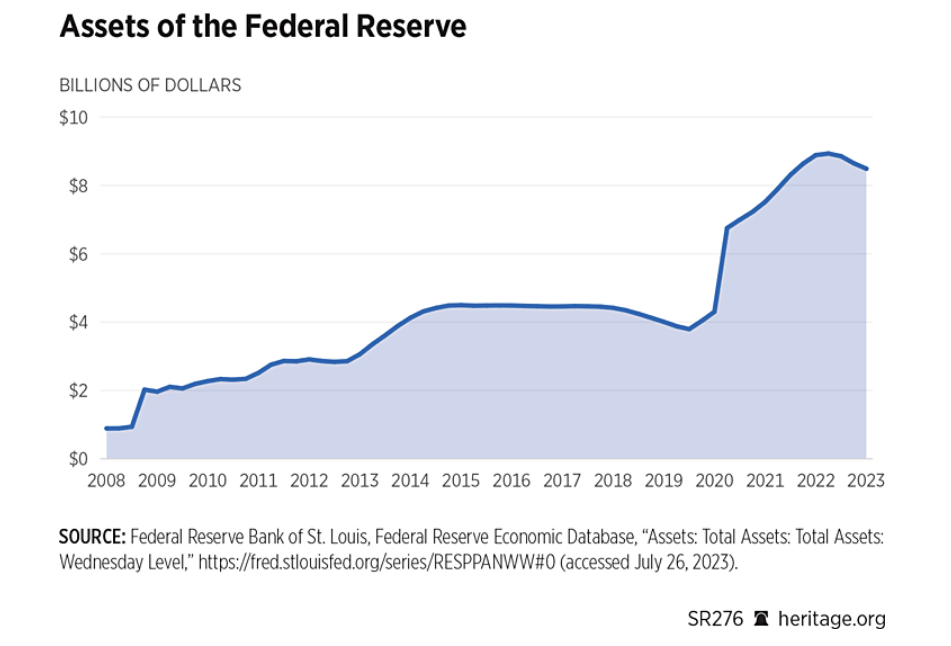

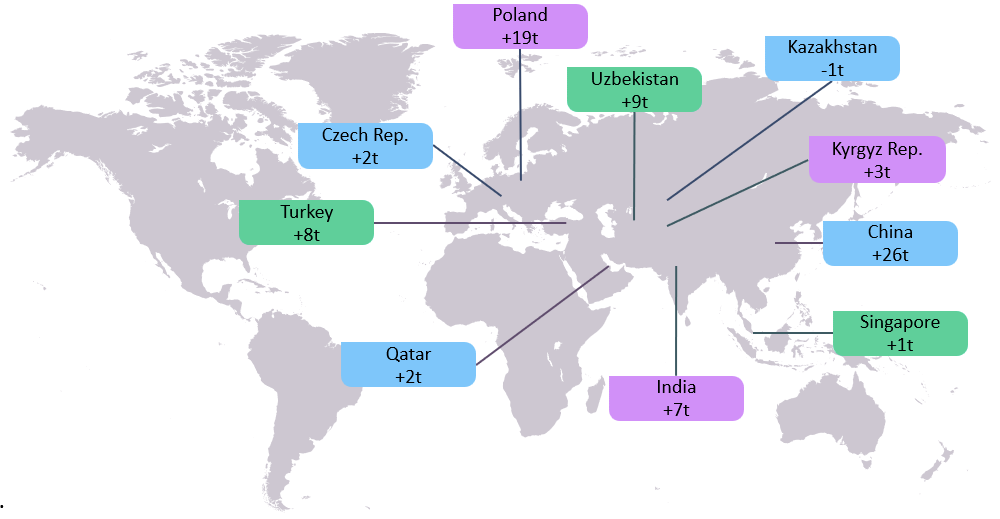

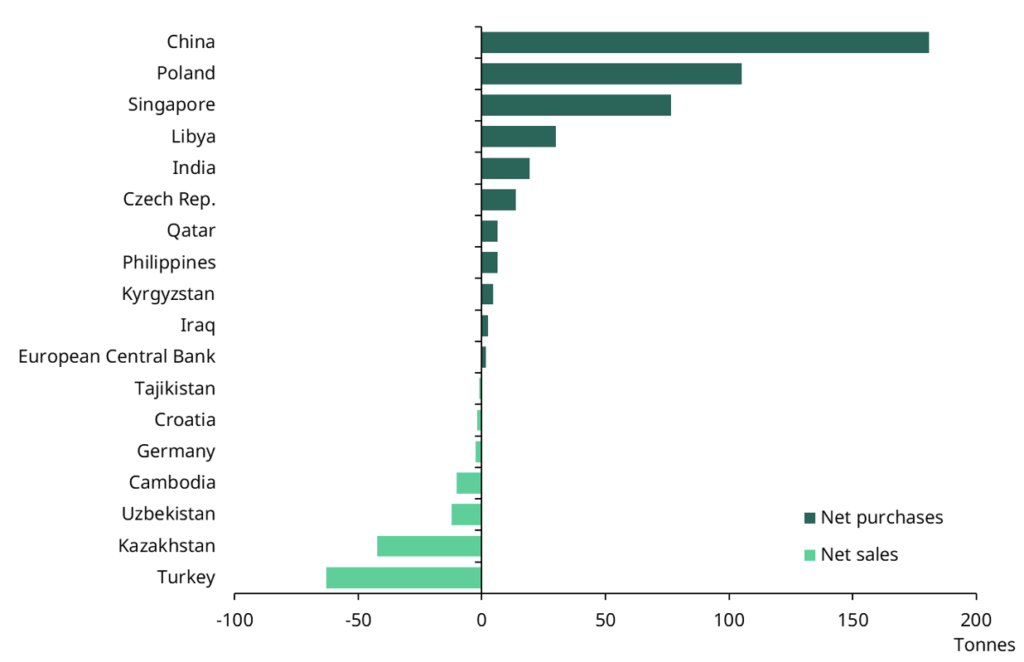

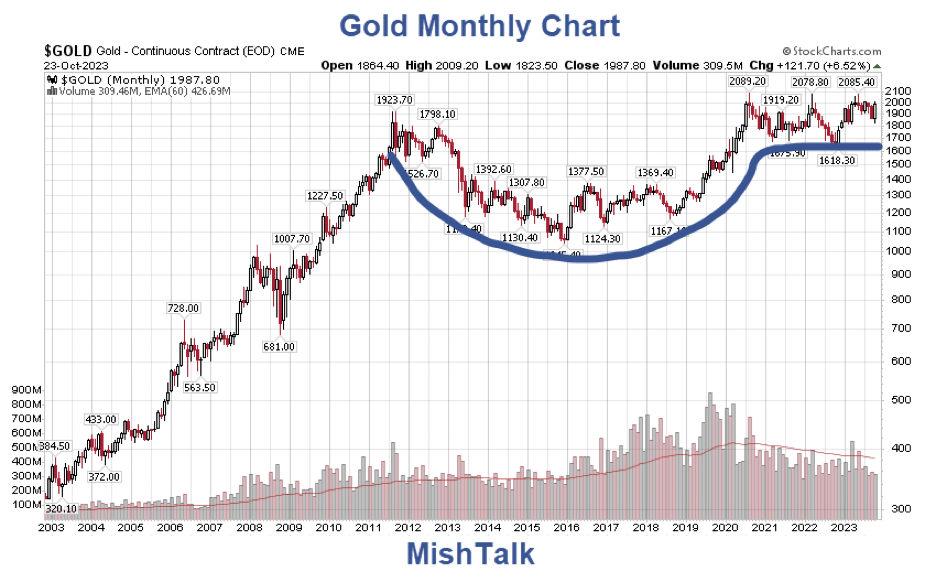

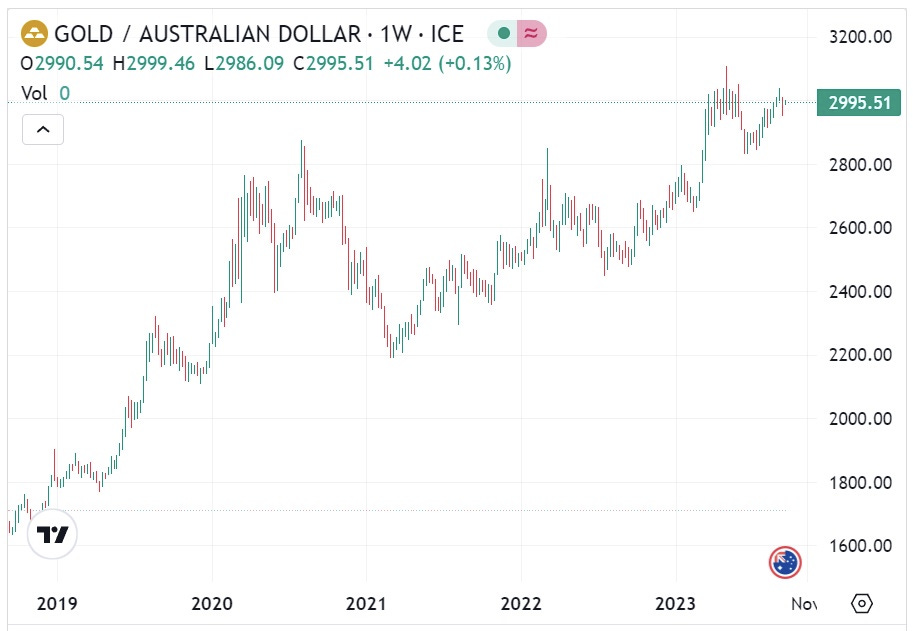

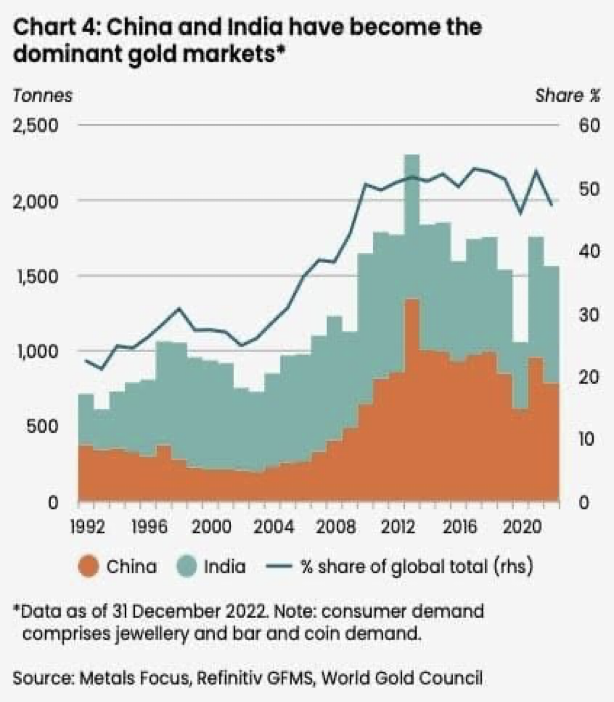

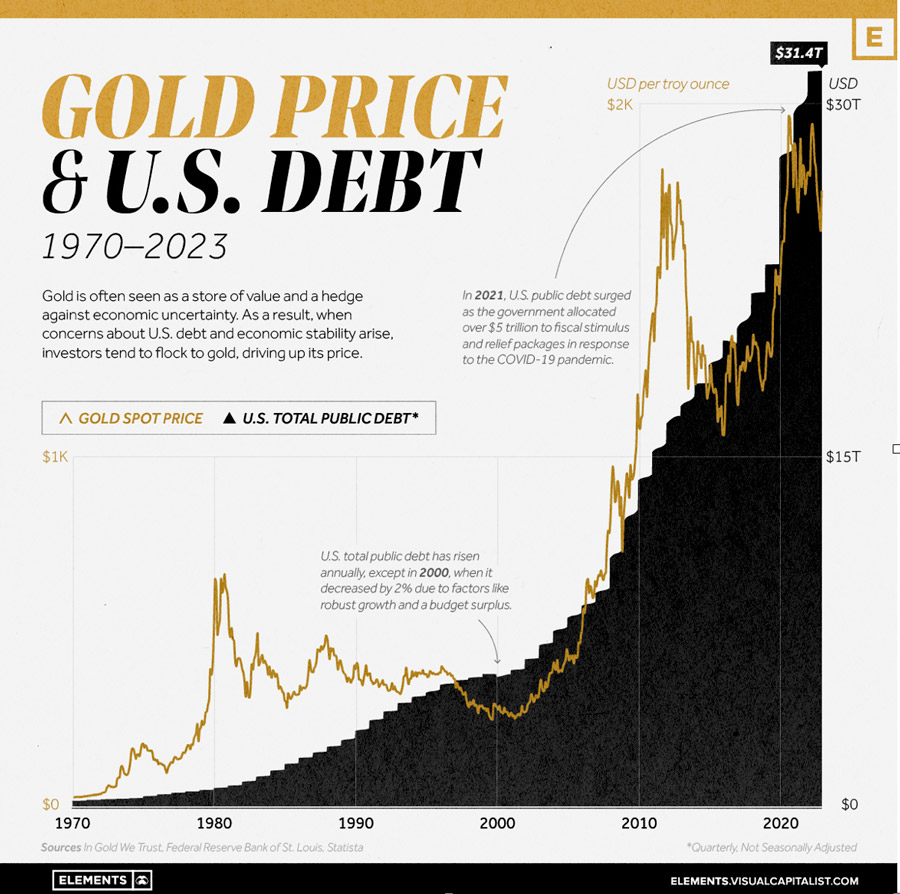

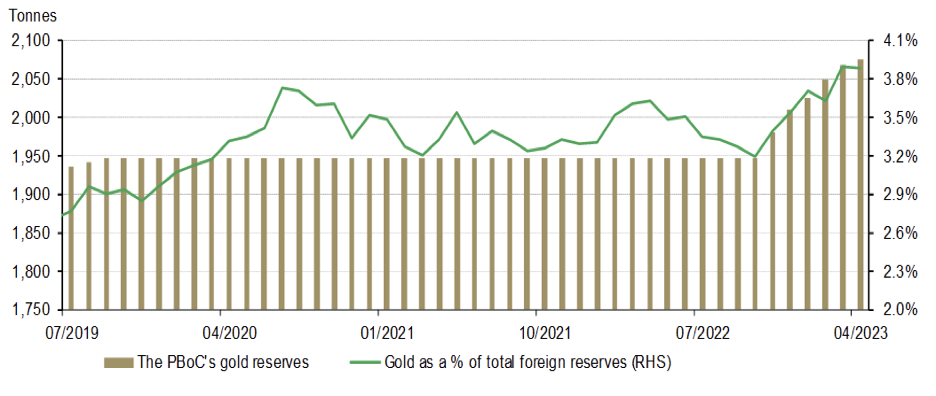

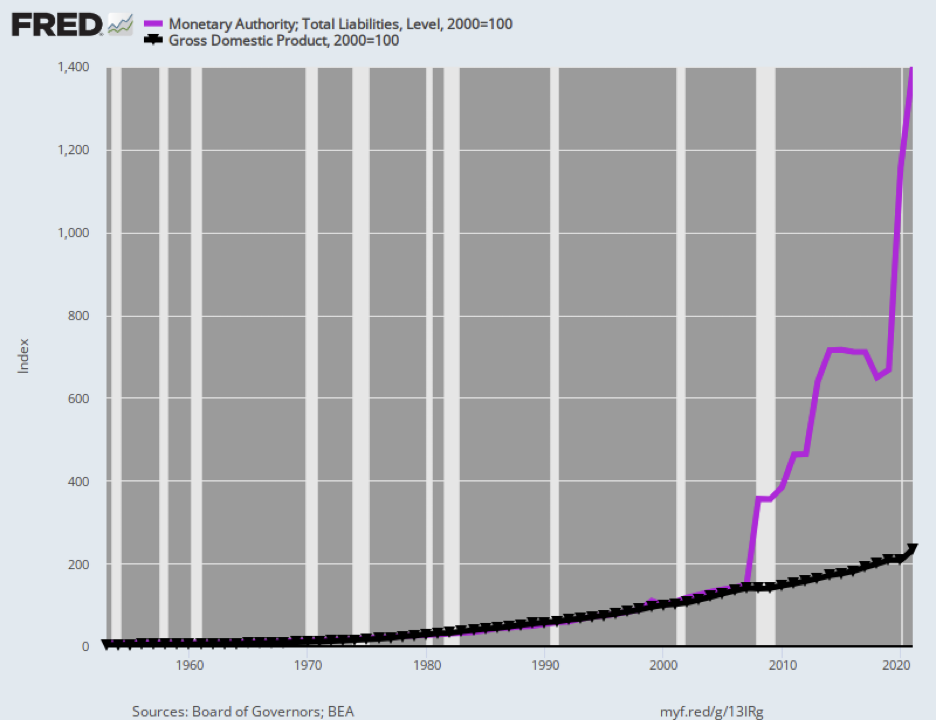

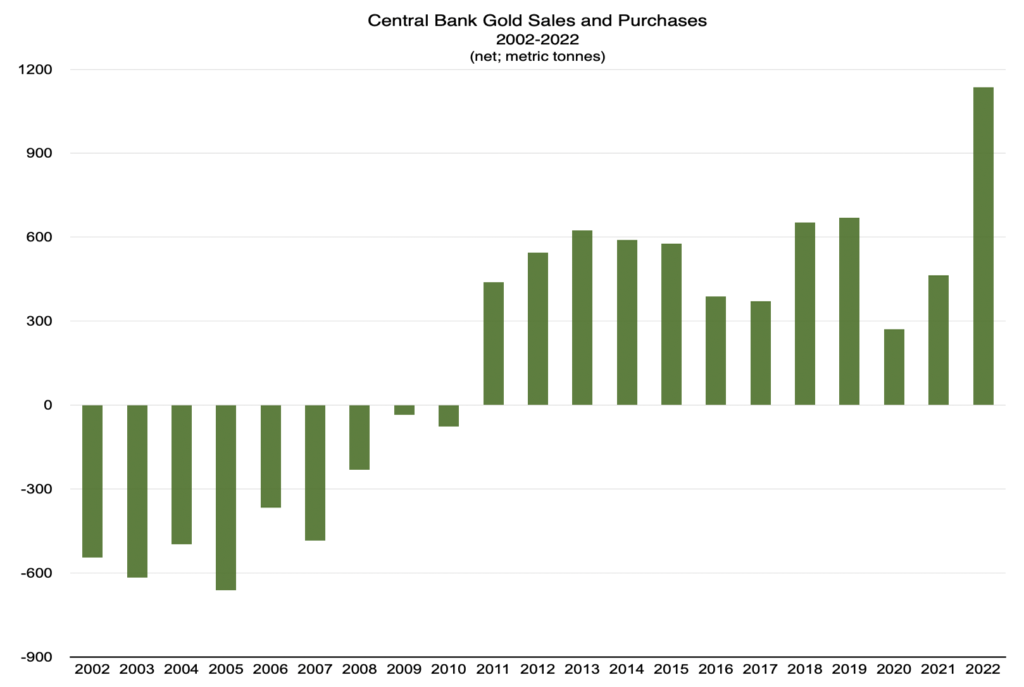

Why are global central banks beating a pathway to the gold market? Why are central banks an important force in driving the gold price to new all-time highs?

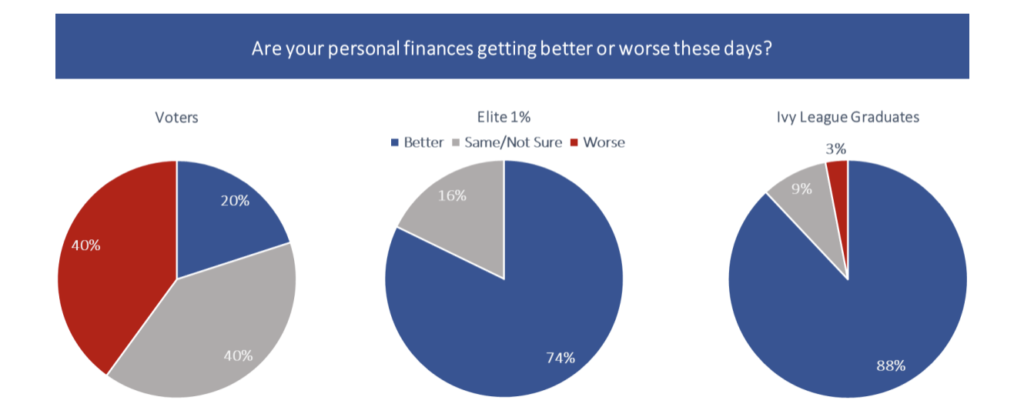

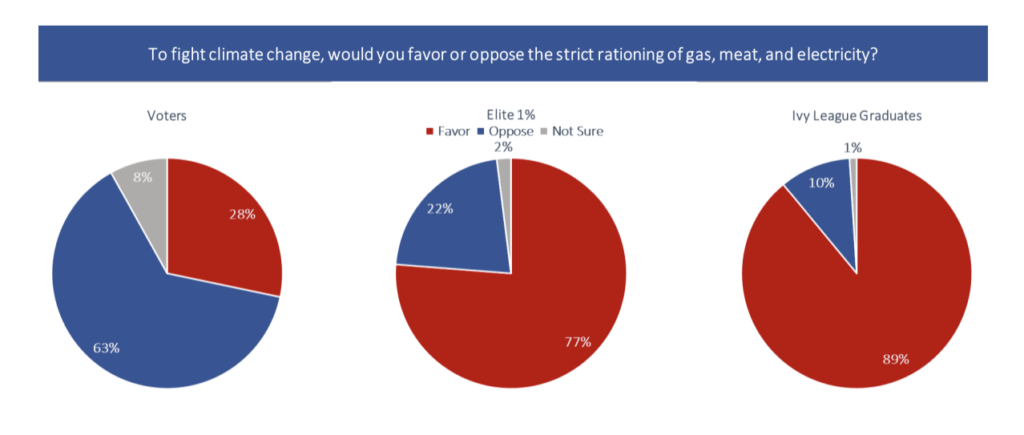

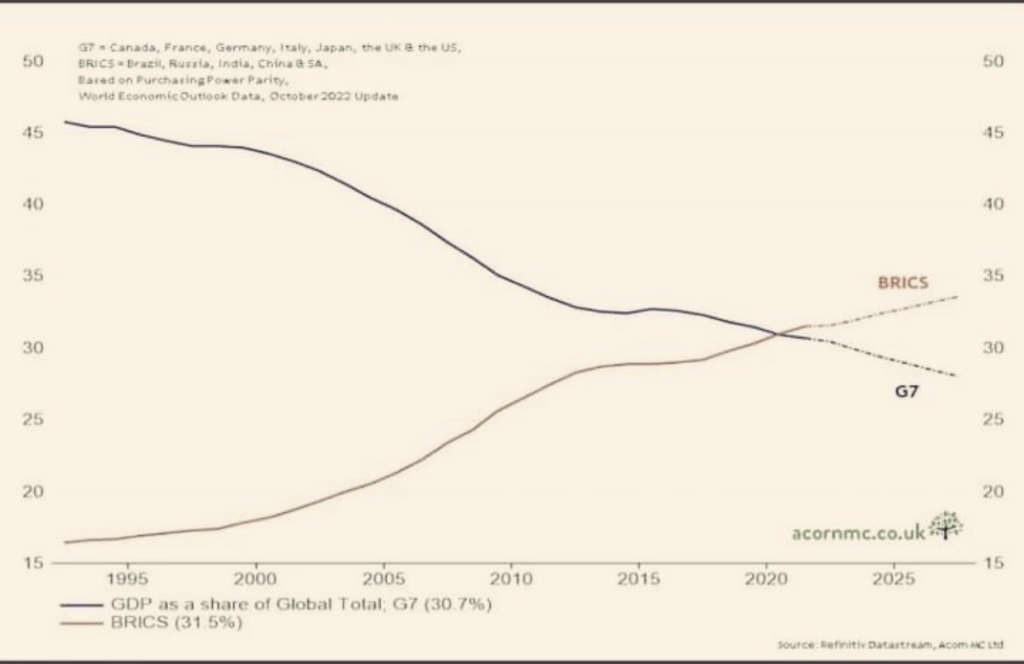

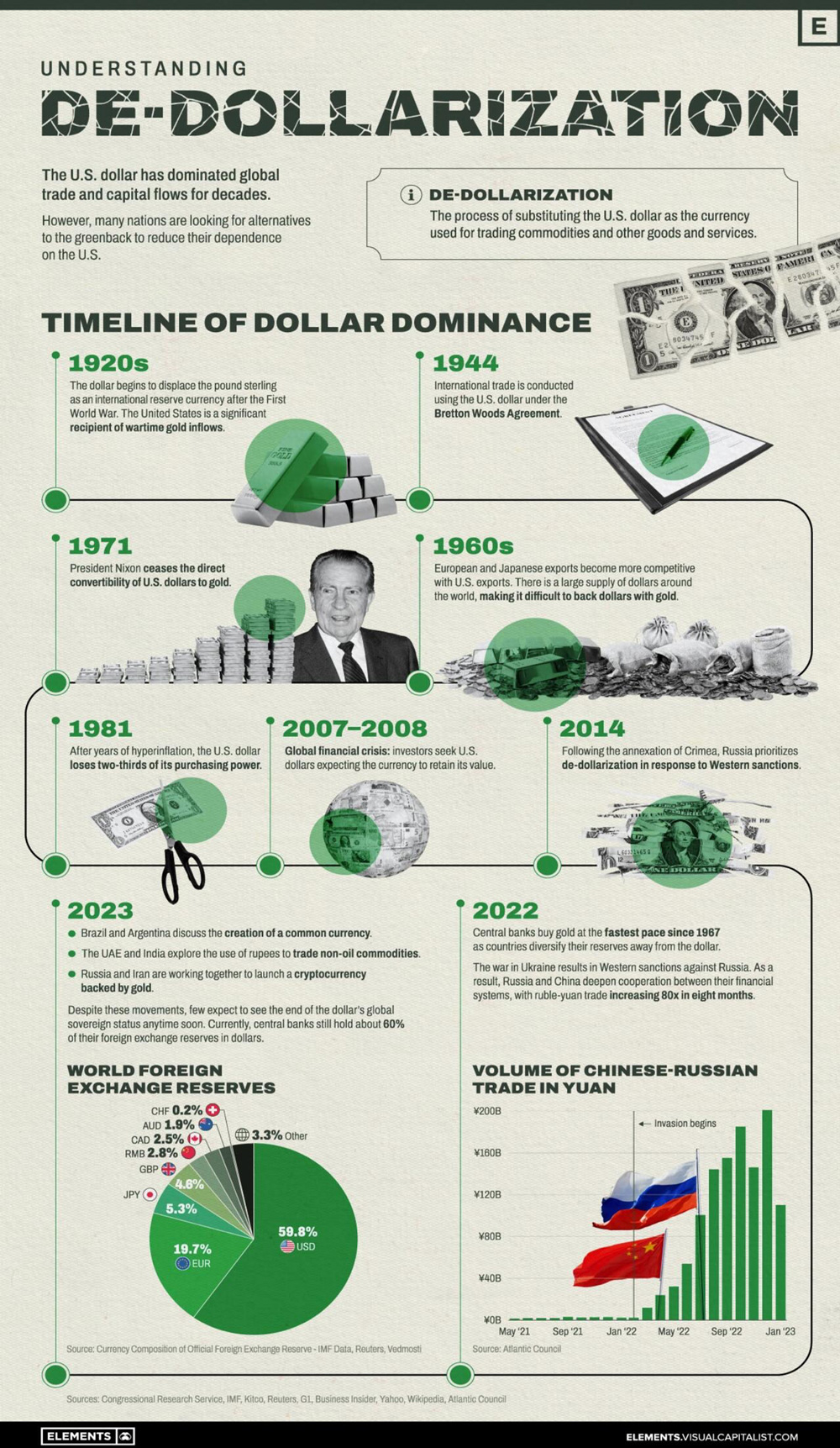

We have called central bank de-dollarization and gold-buying one of the most important megatrends of our time. Now a new World Bank publication spells out why this is happening, and it does so in a candid way that makes a powerful case for individuals to protect their wealth with gold.

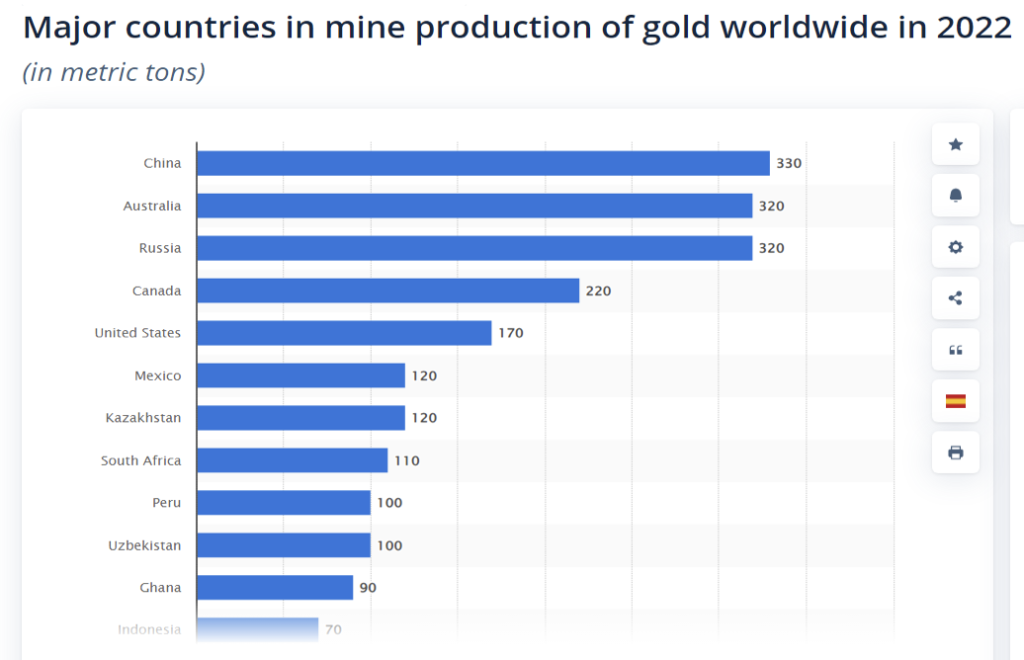

The Gold Investing Handbook for Asset Managers was authored by Kamol Alimukhamedov, Deputy Managing Director of the Central Bank of Uzbekistan. From the introduction:

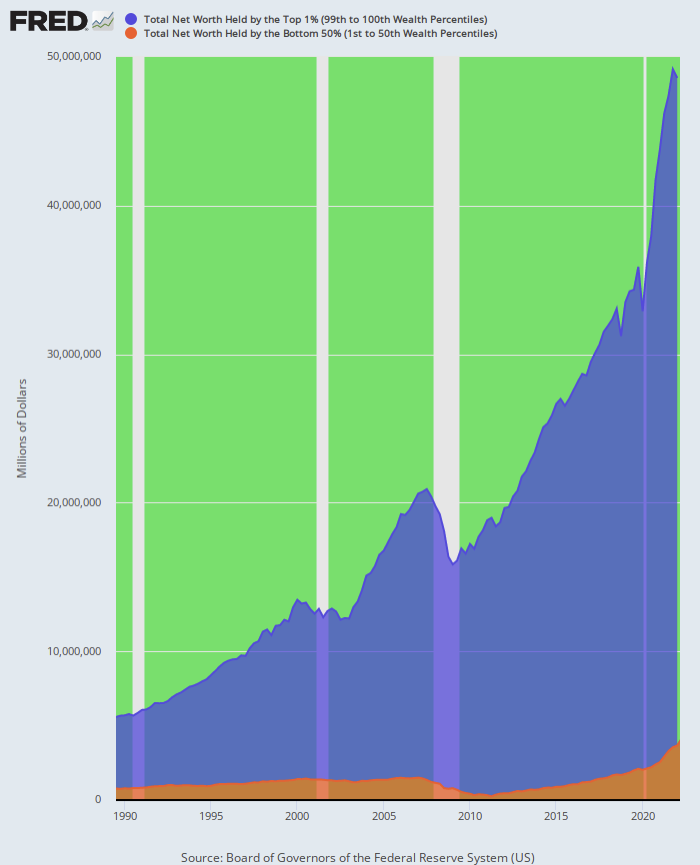

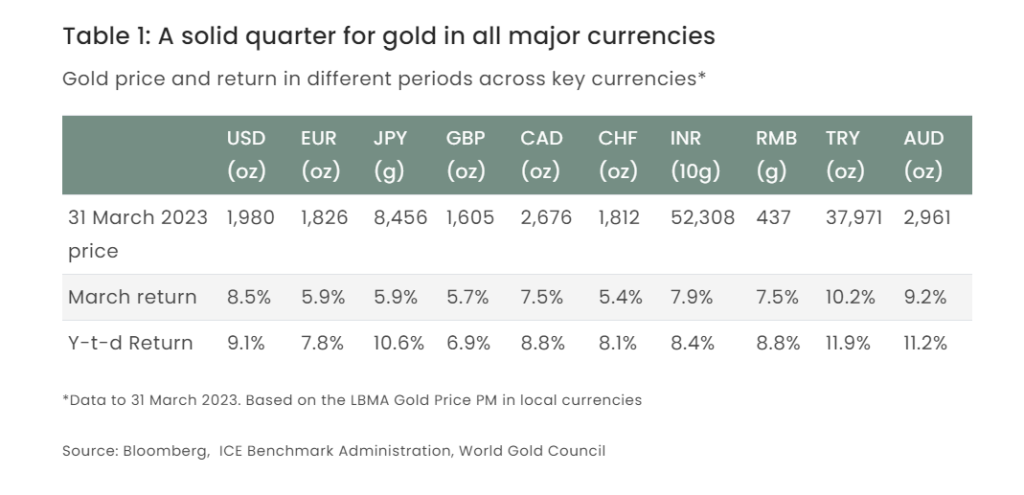

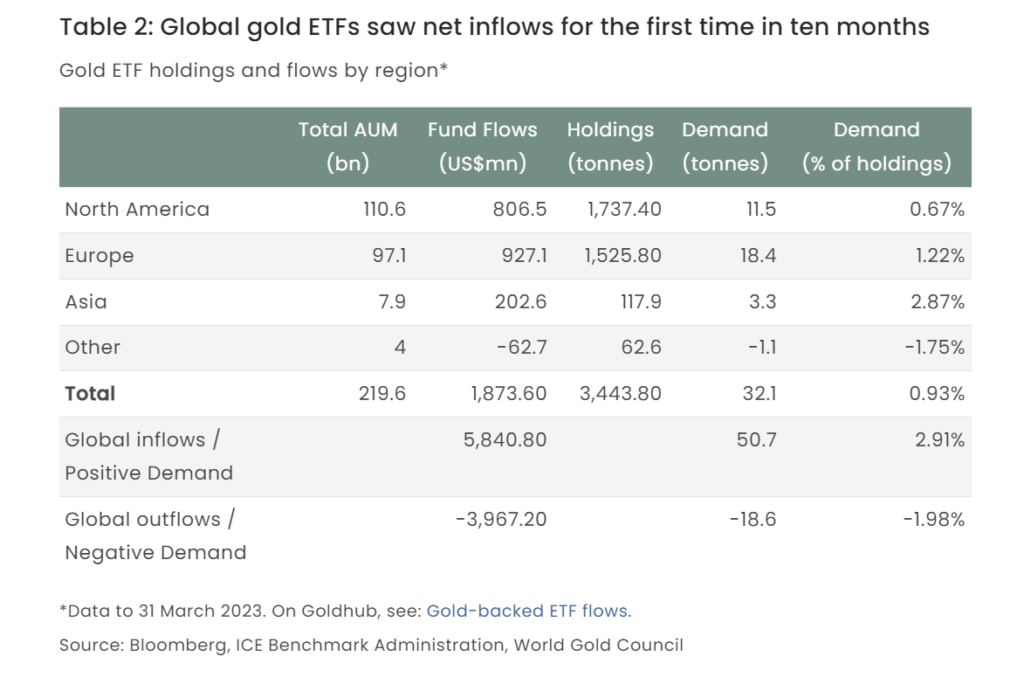

In recent years, gold has regained its importance as a financial asset, with many investors using it as a hedge against inflation and market volatility. In addition, central banks and other financial institutions continue to hold significant amounts of gold as part of their reserve assets.

The role of gold as a reserve asset for central banks has been a significant driver of demand for the precious metal. Gold is also considered a safe haven asset during times of economic uncertainty and geopolitical turmoil, making it a popular among investors looking to hedge against market volatility.

Here are a couple of bullet points from the new World Bank handbooks…

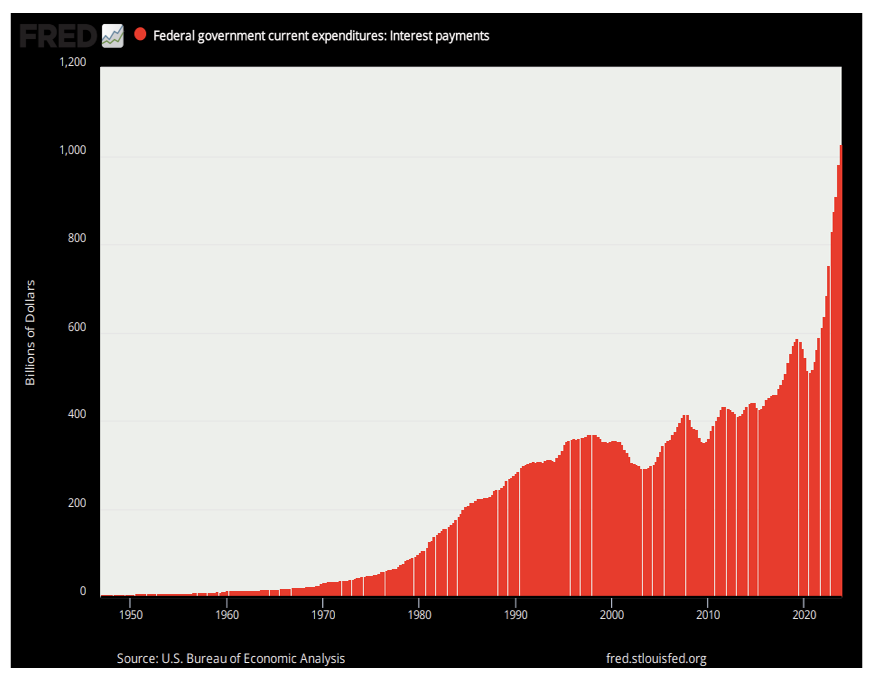

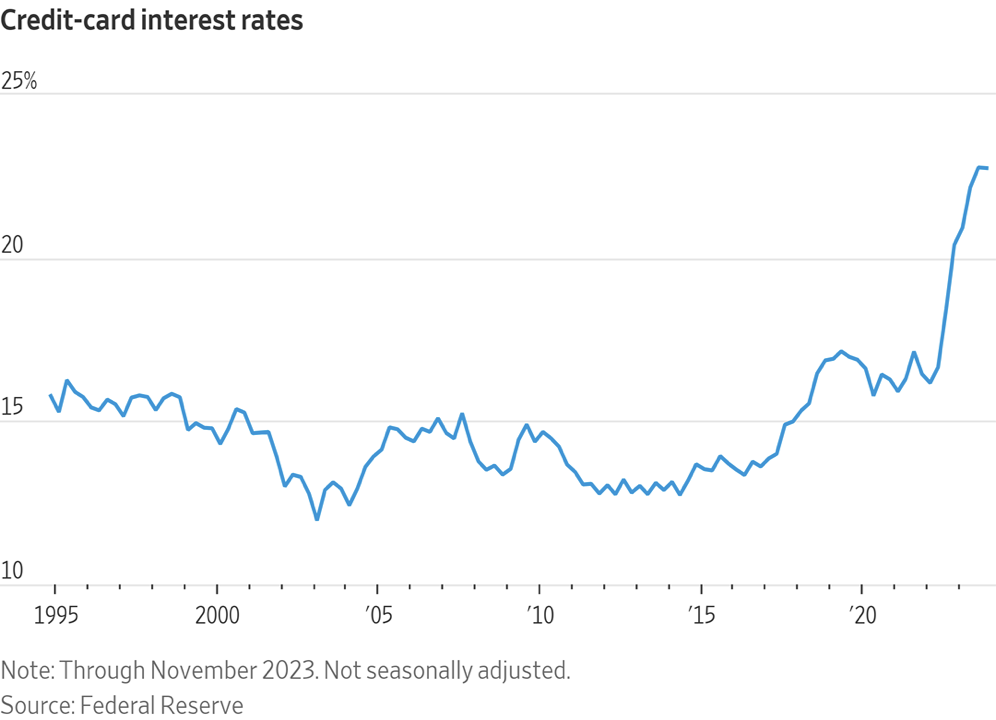

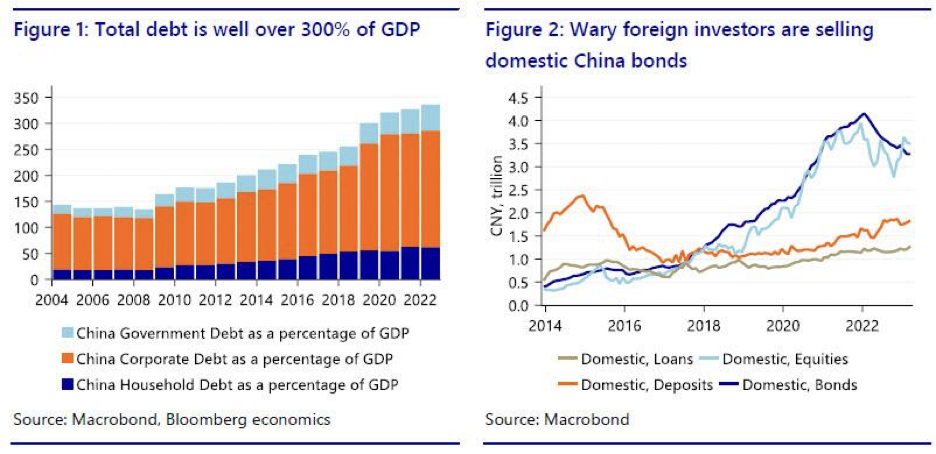

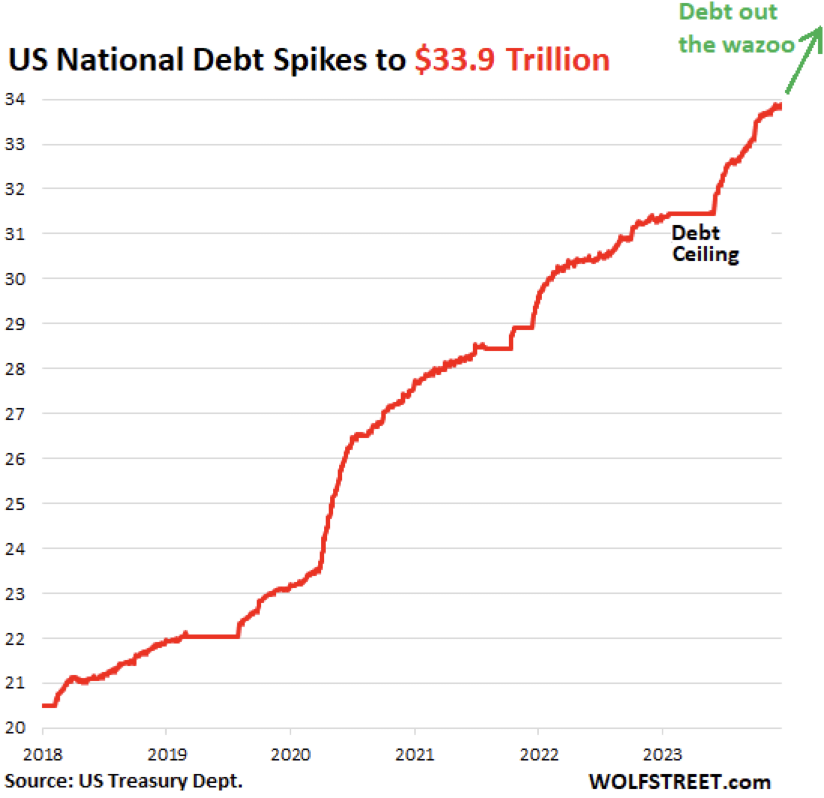

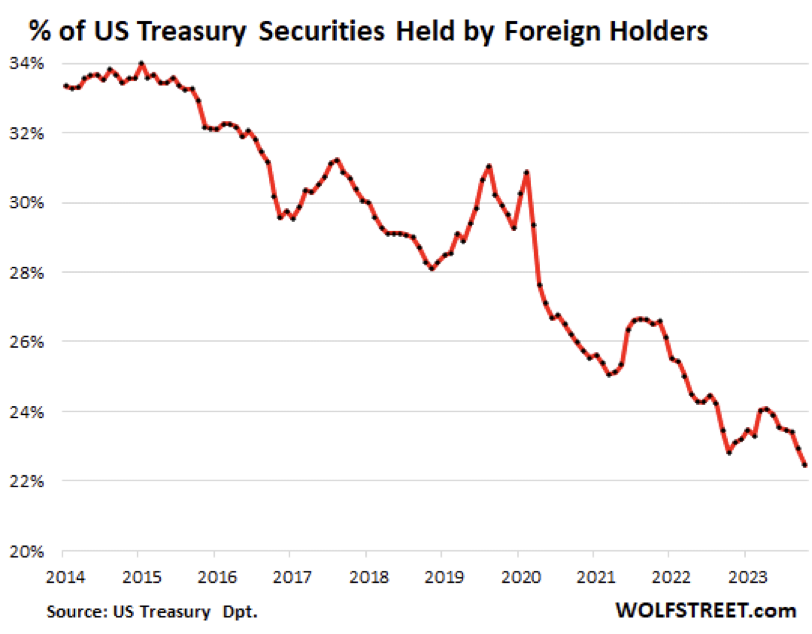

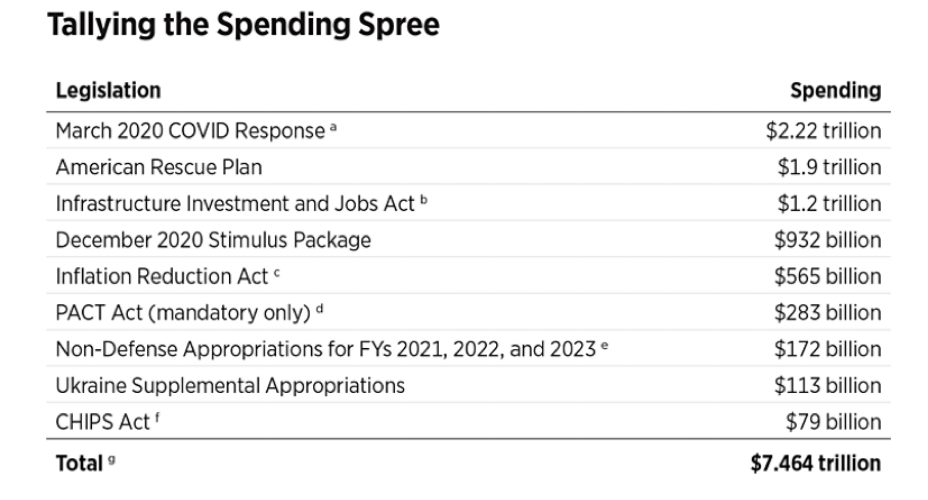

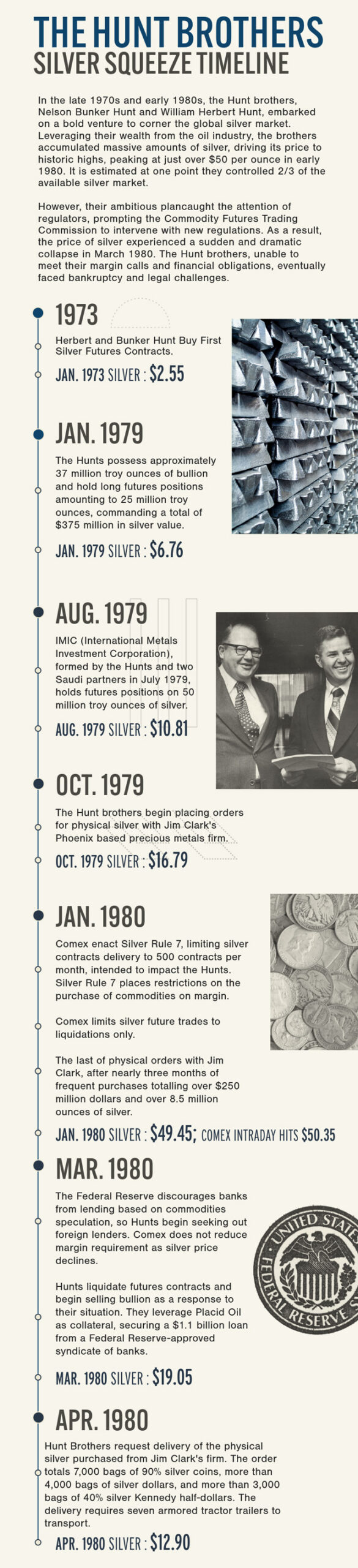

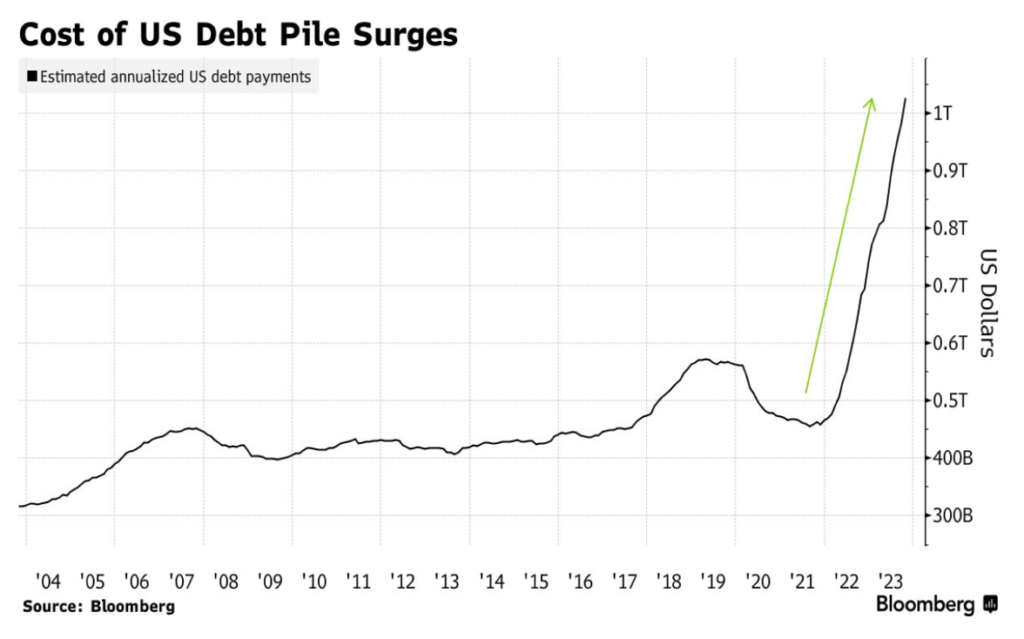

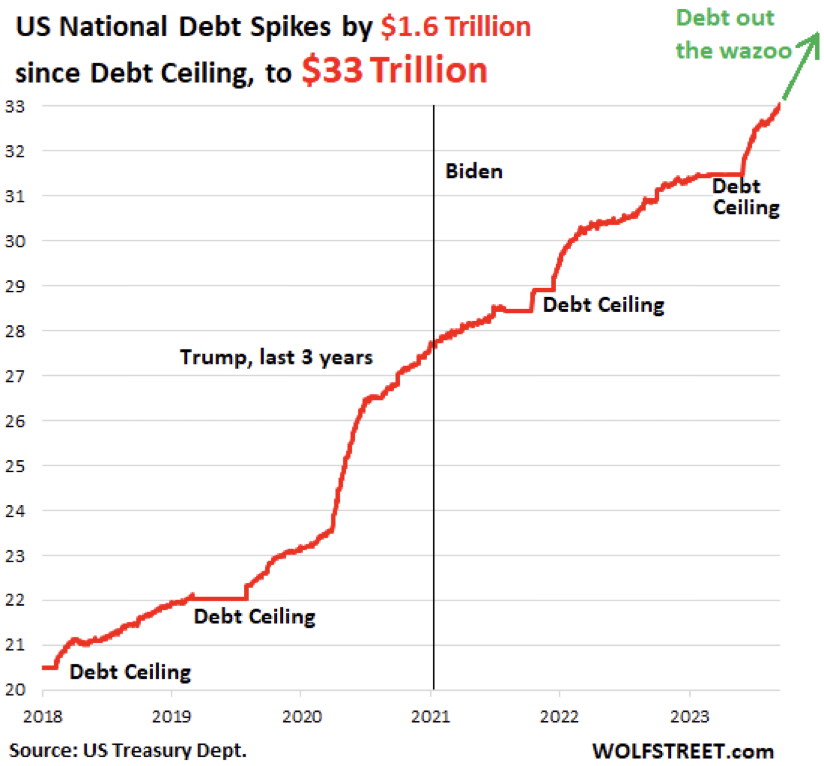

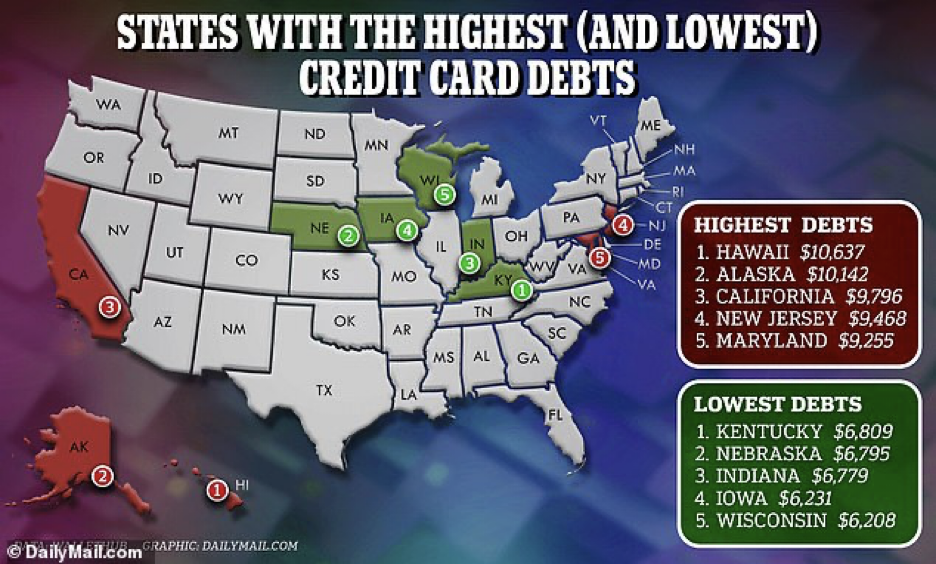

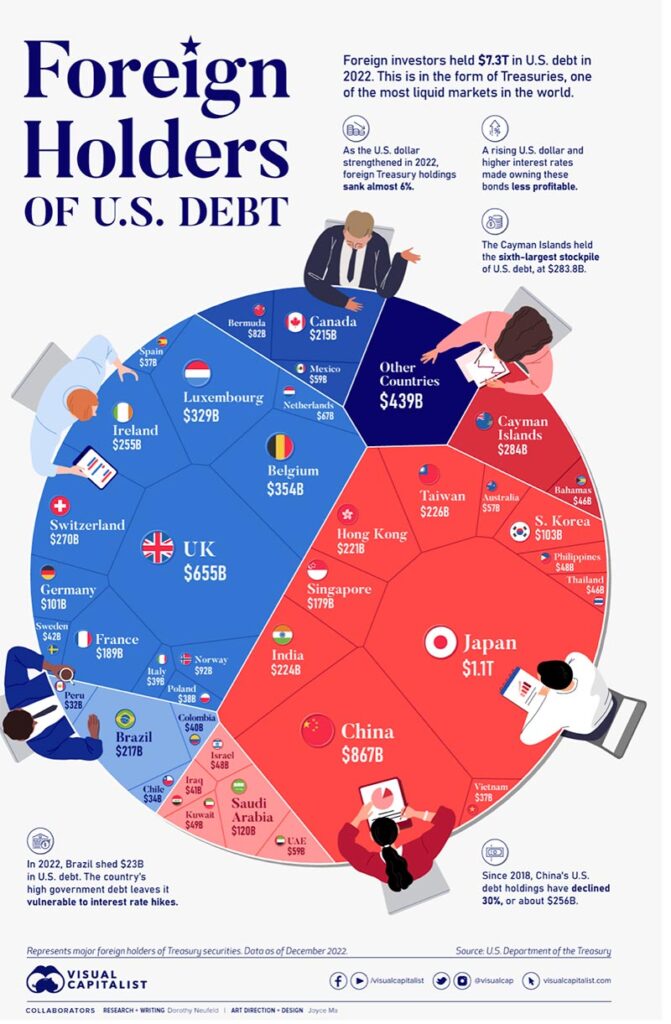

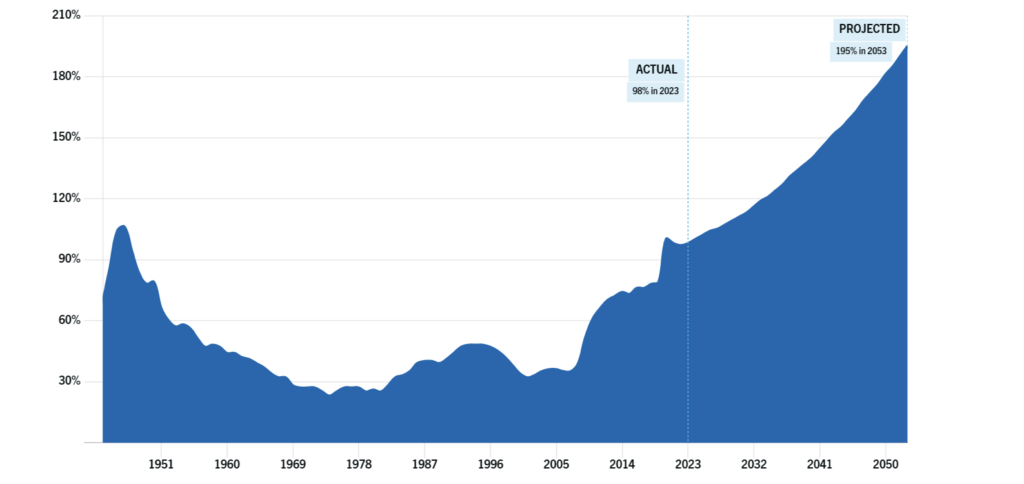

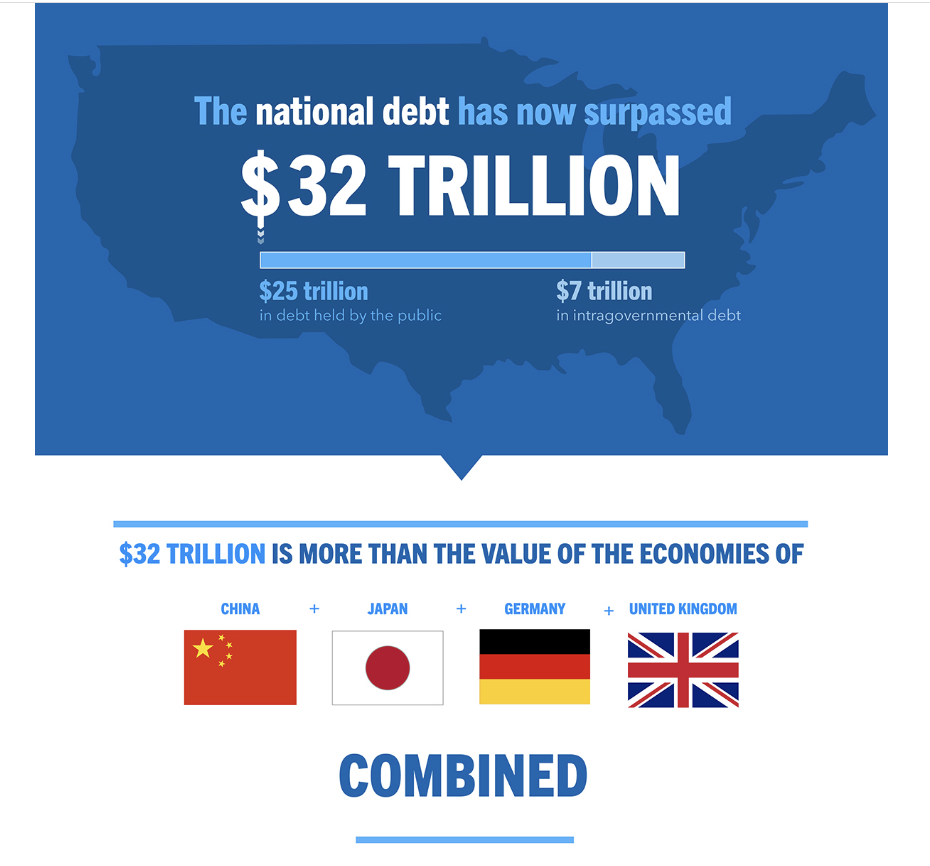

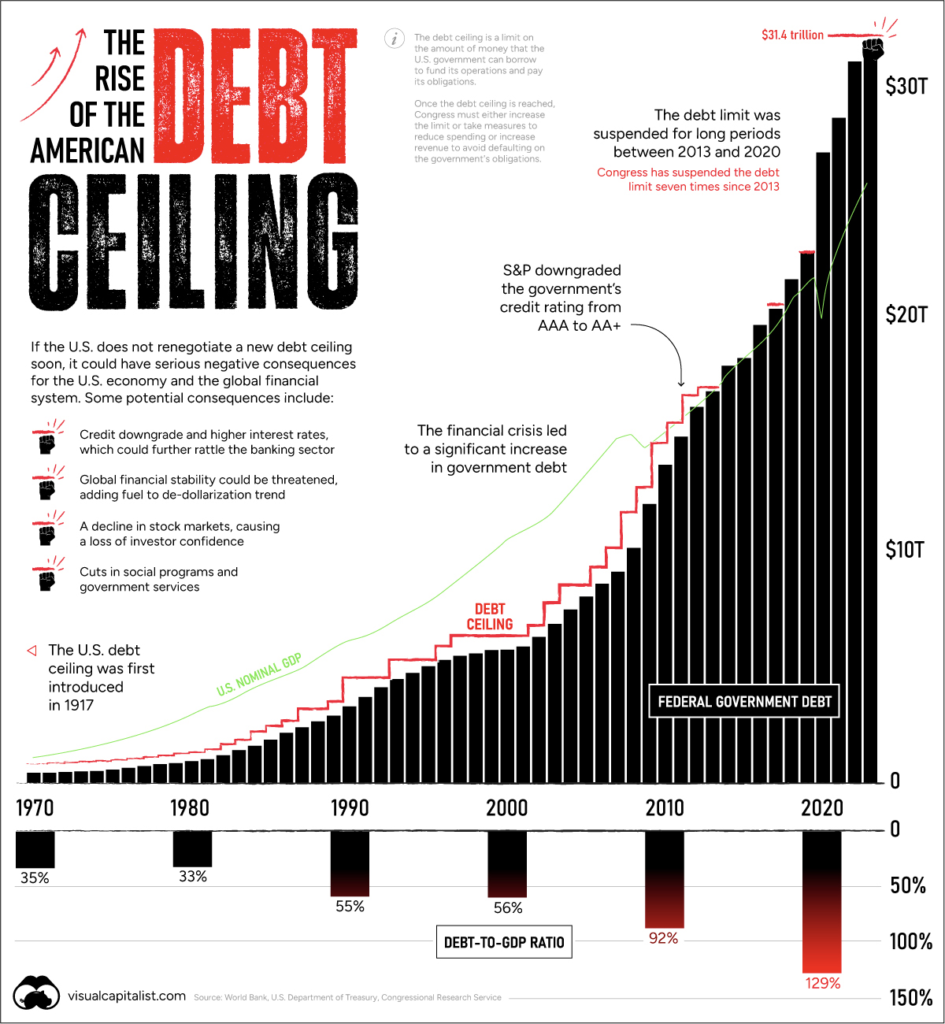

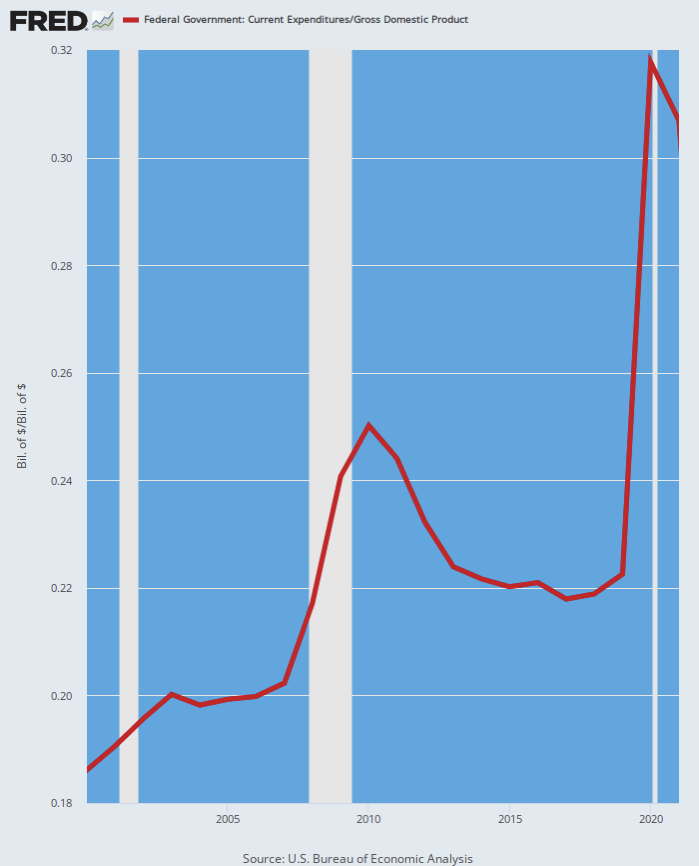

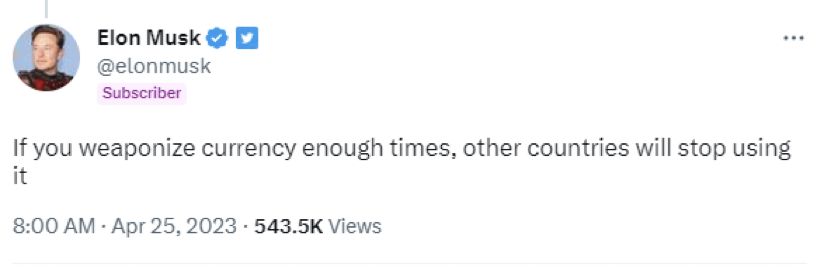

- Geopolitical risk is a major factor for asset managers to consider, especially in emerging markets. This is because geopolitical events can have significant impact on financial markets, as seen in the freezing of the assets of the Iranian Central Bank ($1.9 billion) in 2010, the Kazakhstan National Bank ($22.6 billion) in 2017, the Venezuelan Central Bank ($342 million) in 2020, the Afghan Central Bank ($7 billion) in 2021, and most recently the Russian Central Bank (estimated at $258 billion).

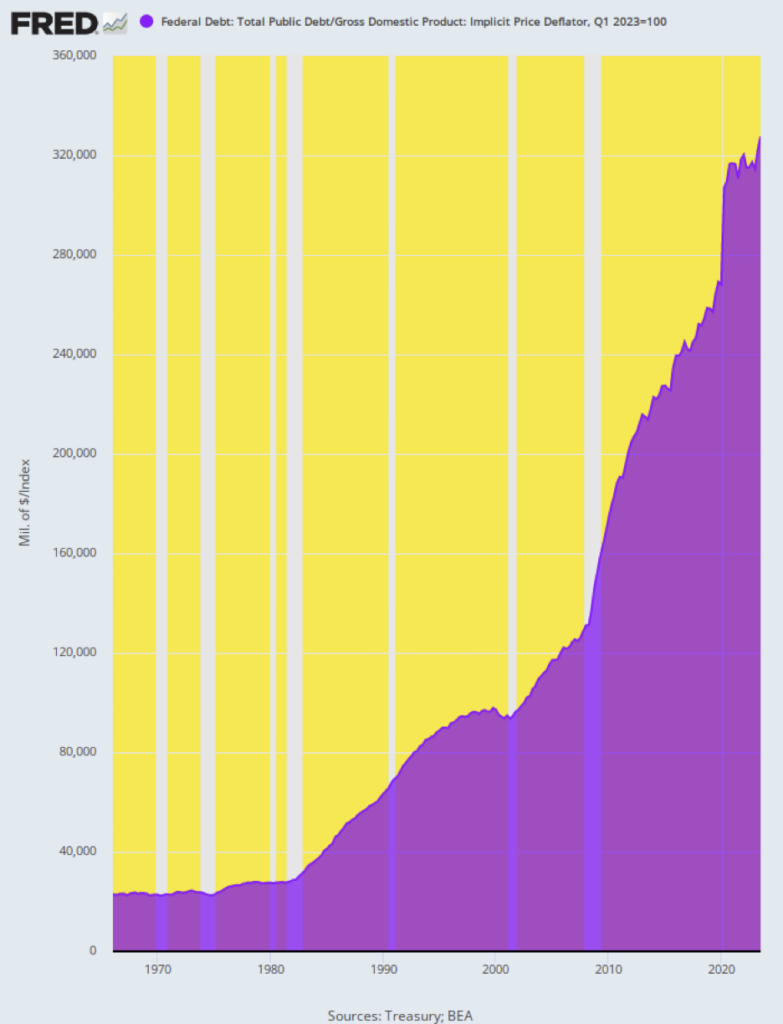

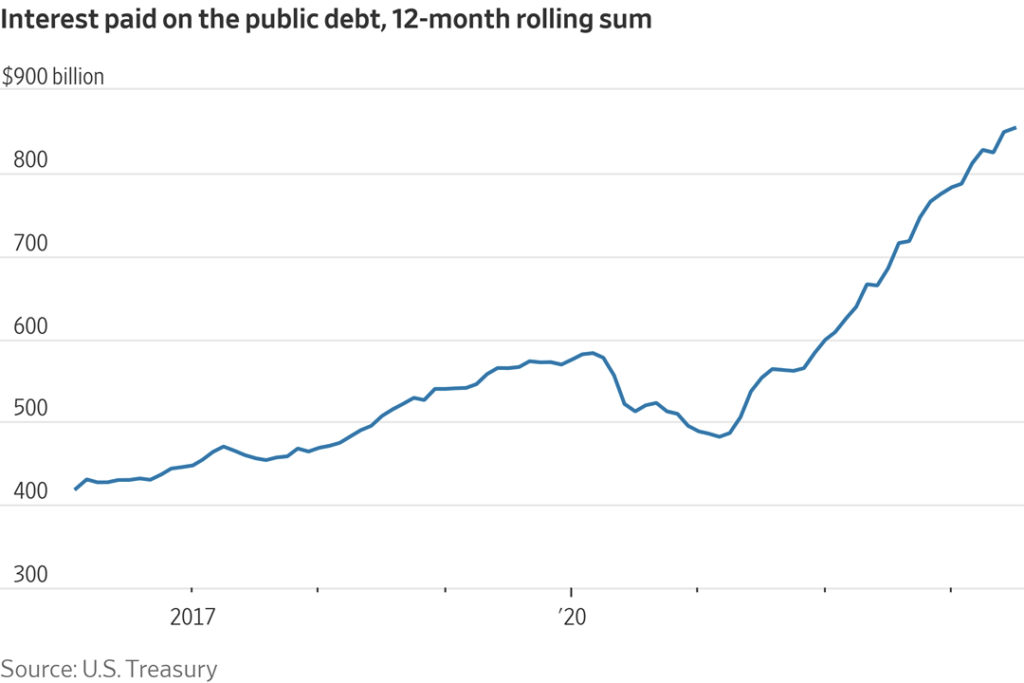

- The belief is that the Russian sanctions create incentives for central banks to abandon the dollar in favor of gold and for governments to cash in their dollar reserves for stocks of other commodities. Overall, the recent sanctions against Russia highlight the importance of gold as a reserve asset.

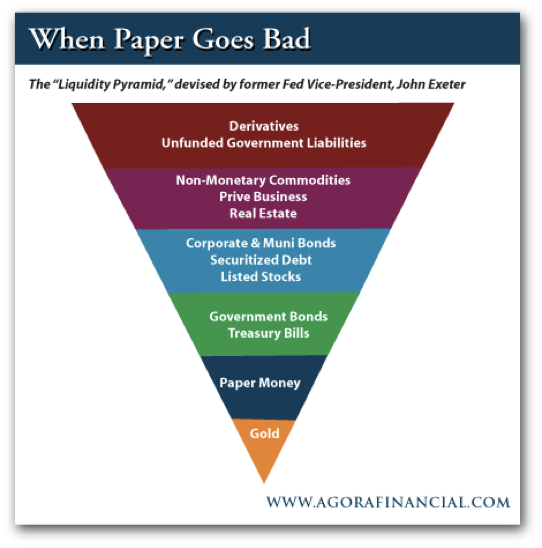

- Gold’s liquidity surpasses the major financial assets and government debt markets of many developed economies.

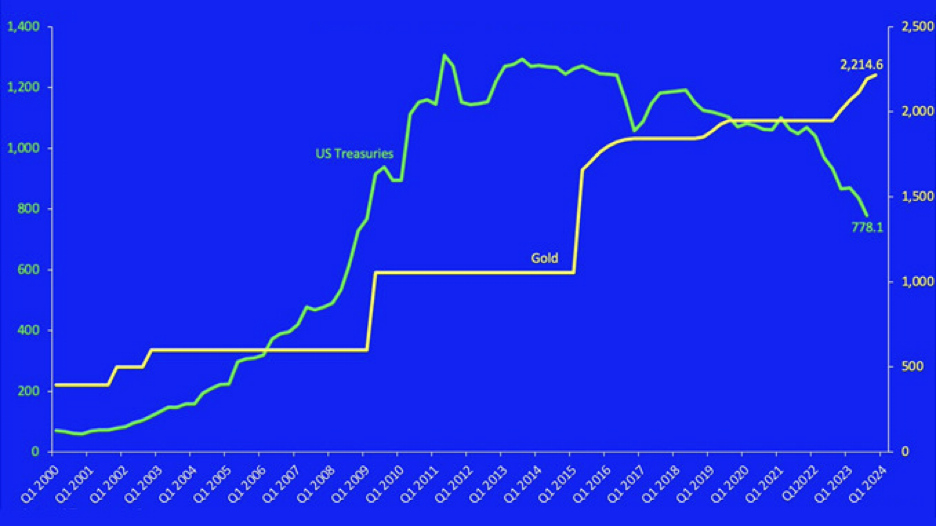

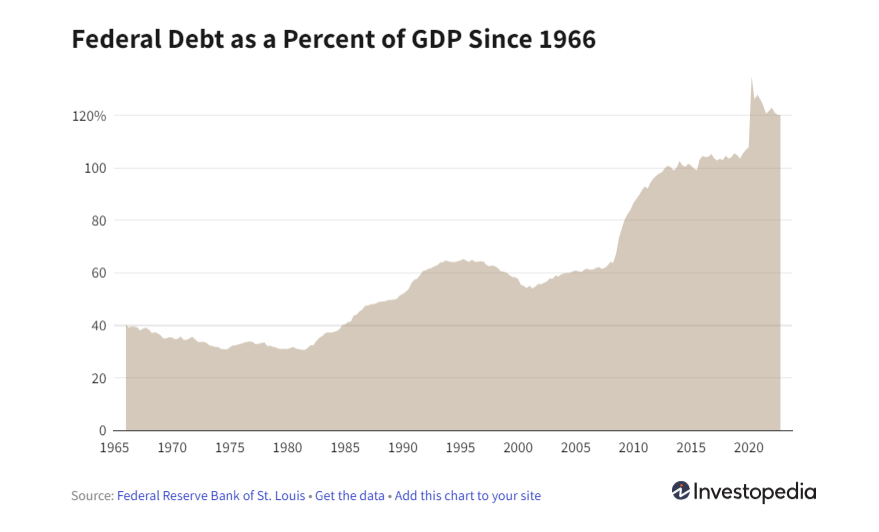

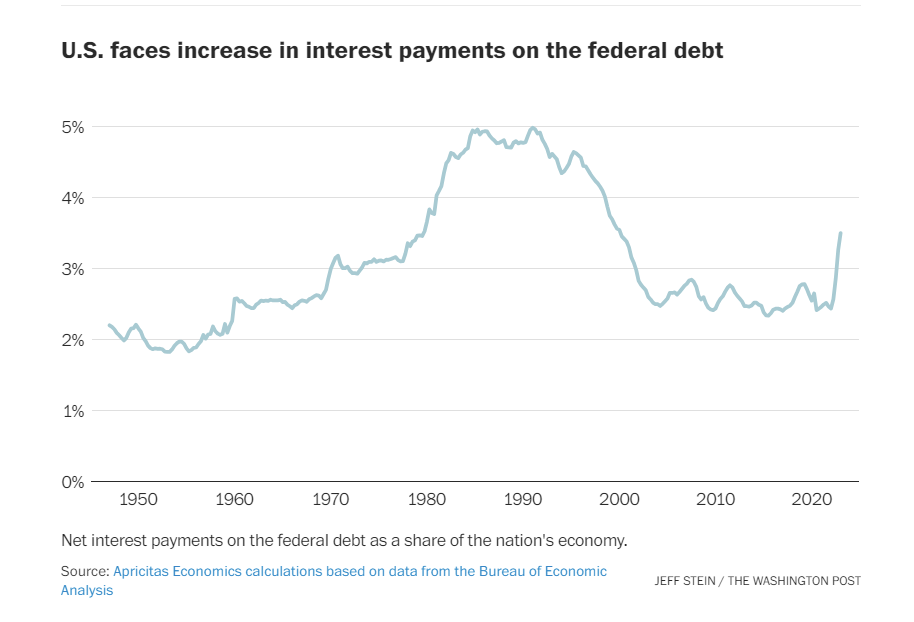

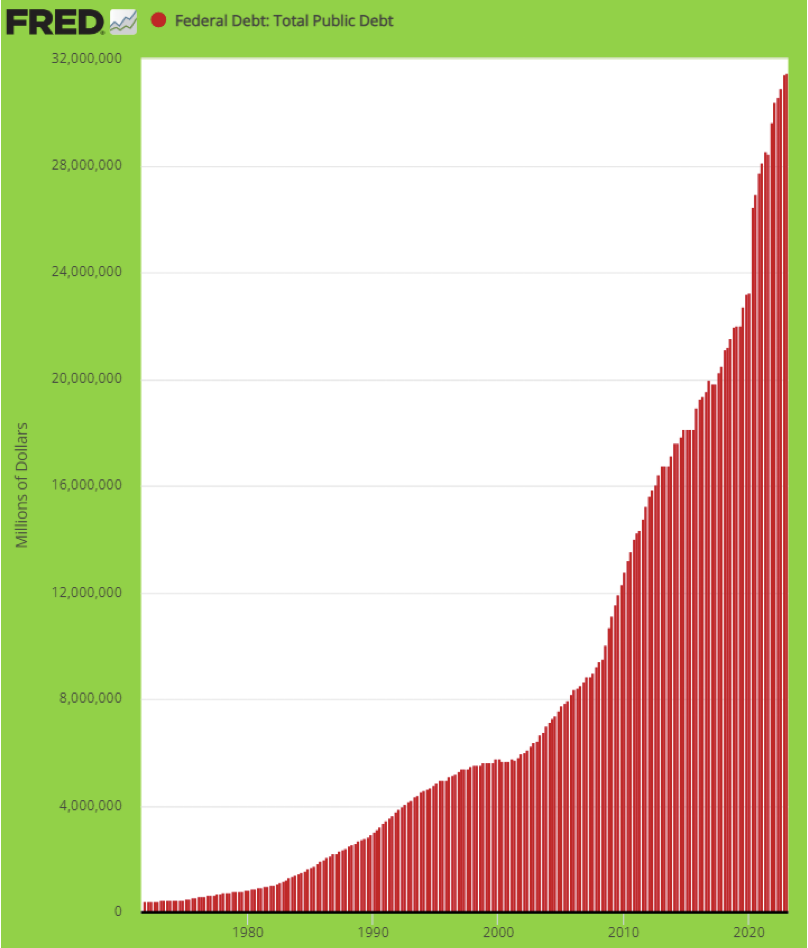

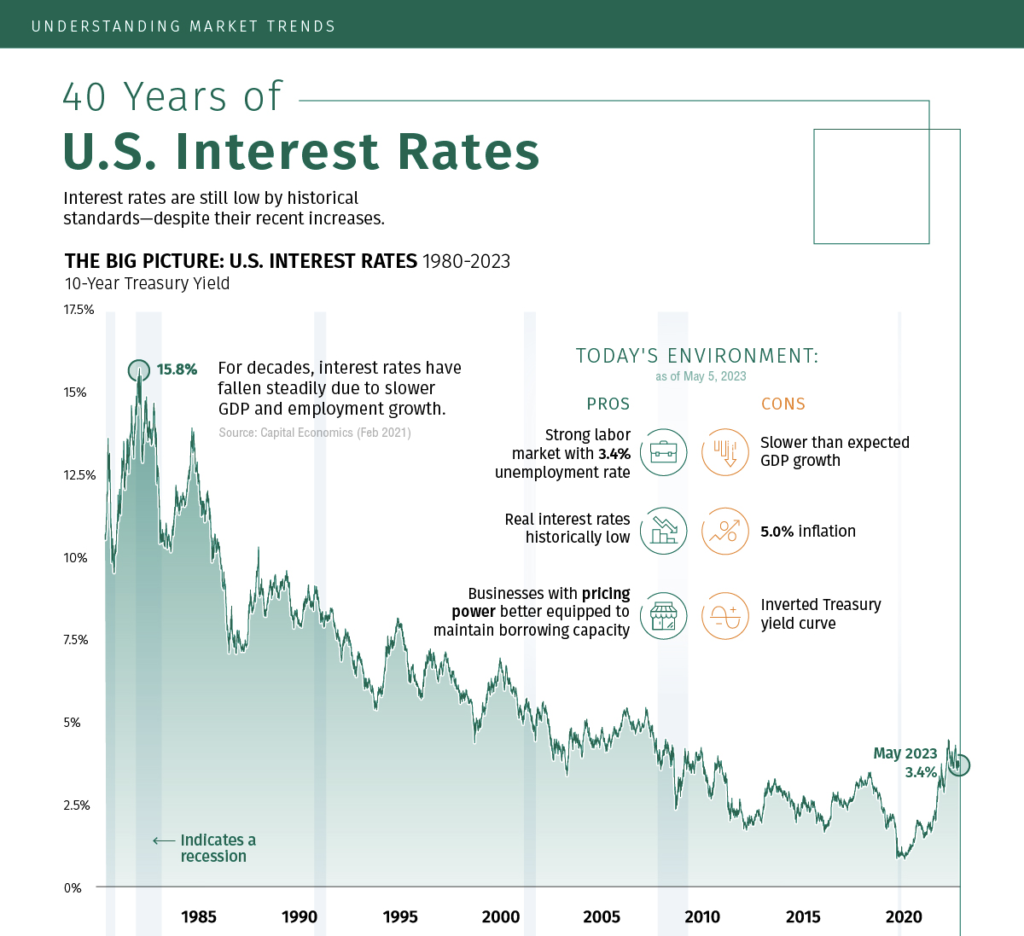

- Gold has proven to be a reliable and stable investment over the medium and long term. Since the fall of the “gold standard” in 1971, gold has delivered an average annual return of around 11 percent, with a compounded annual growth rate (CAGR) of 8 percent.

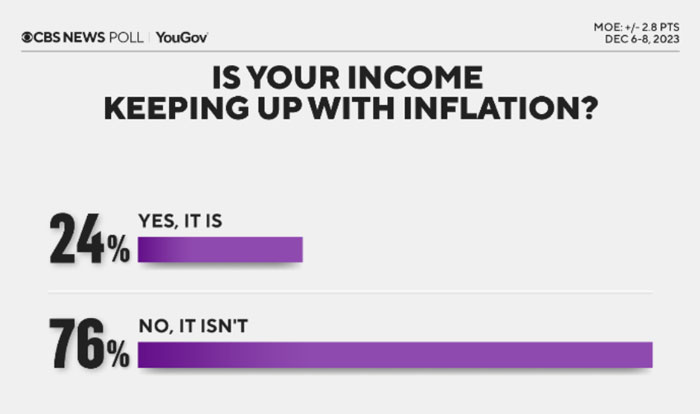

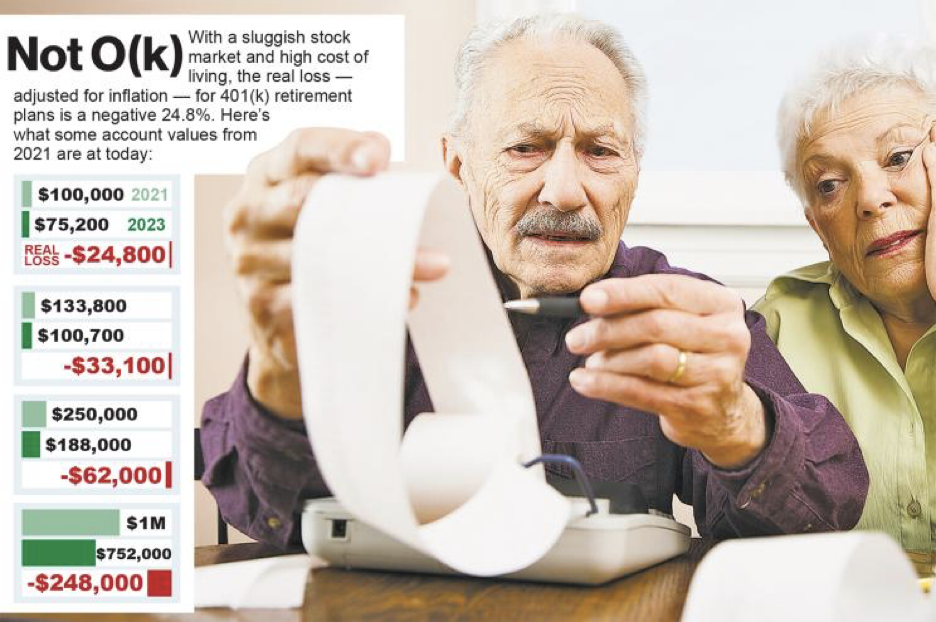

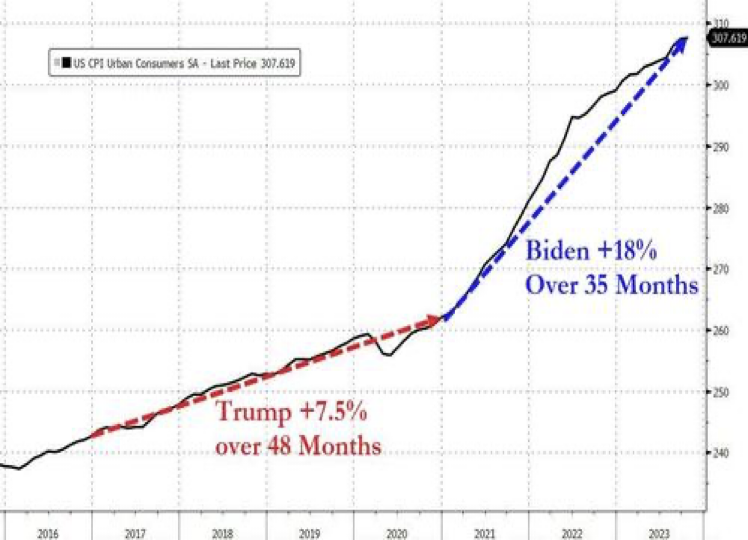

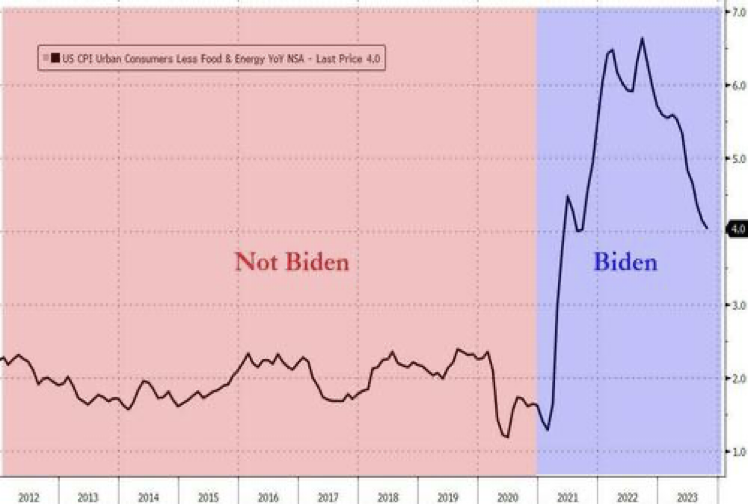

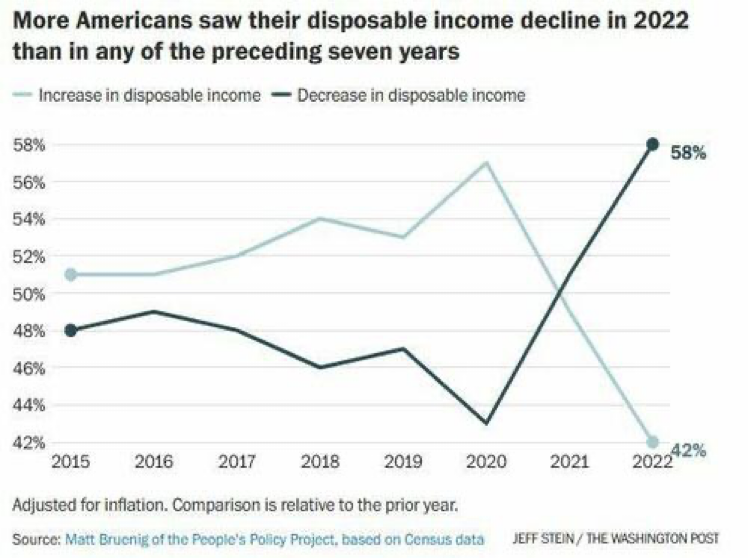

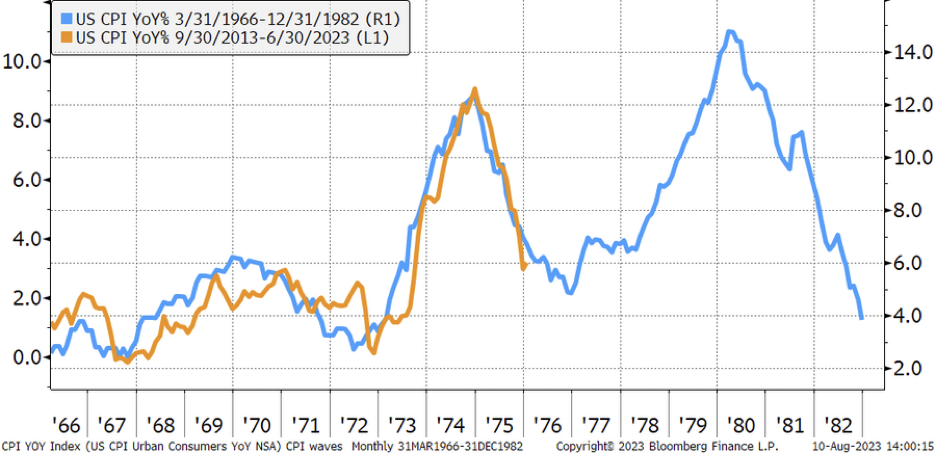

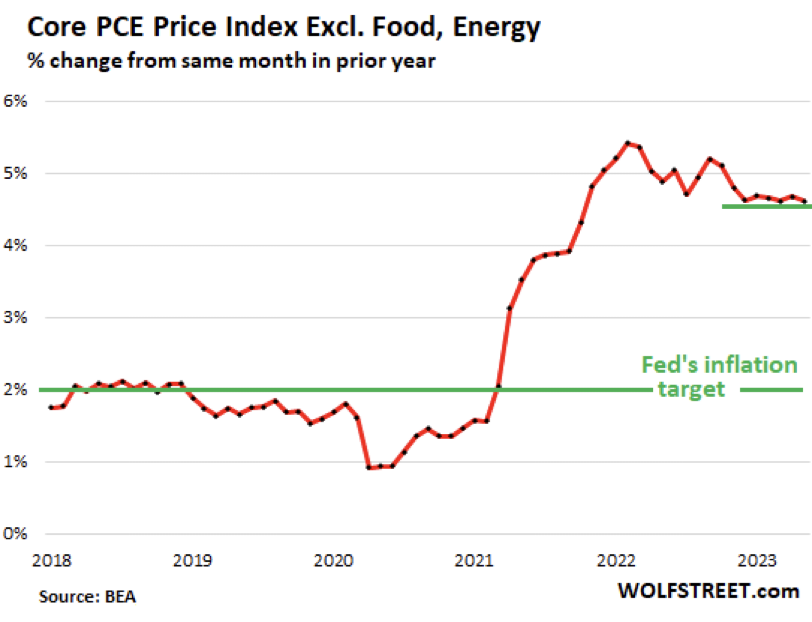

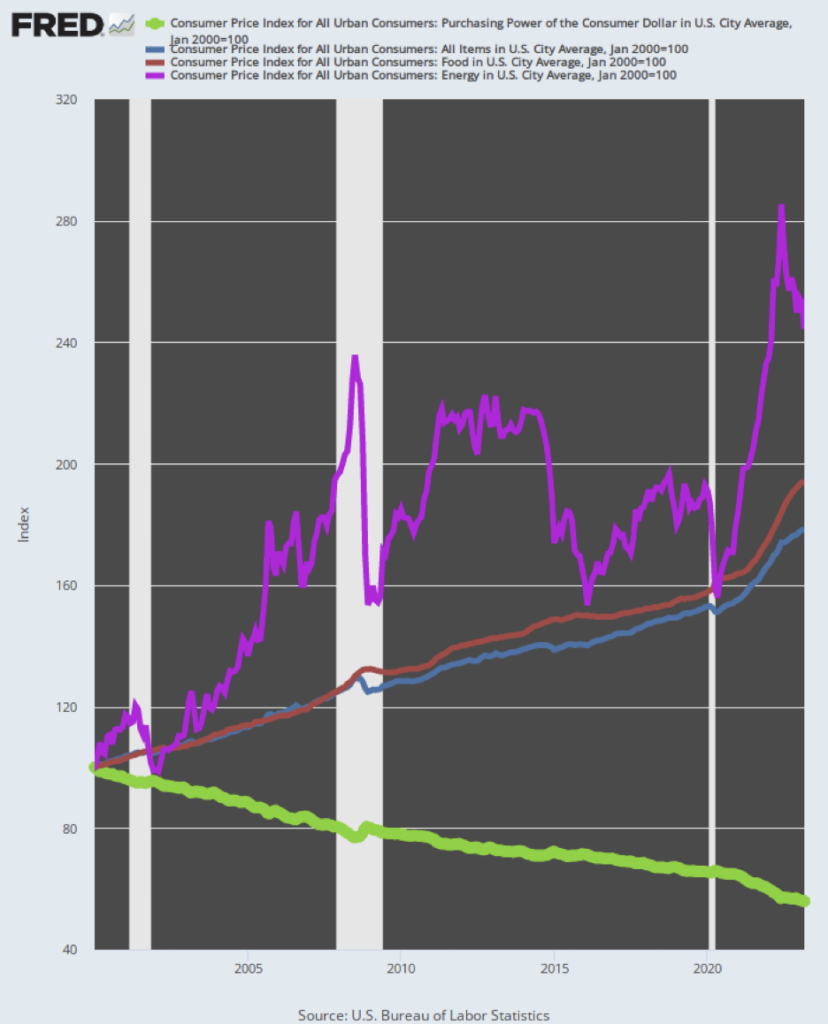

- Gold offers positive real returns during periods of low, moderate, and high inflation (Figure17). Notably, aggregate US Treasuries produced positive real returns only during periods of low inflation, whereas broad US equities, while offering high returns during periods of low and moderate inflation, typically suffer from large losses when inflation exceeds 3 percent on a consistent basis.

For protection from geopolitical risk, from government policies that prevent you from the use of your own money, for liquidity, stability, and superior returns, speak to a Republic Monetary Exchange precious metals expert about adding gold to your portfolio.