Gold Takes Off! New Silver Strength!

Gold raced to six-year highs on Thursday (6/20), closing at $1,397.10. That’s a powerful one day move of $48 on news of Iran taking out a US military drone and the expectation of forthcoming US countermeasures.

The headline that best captured to action was from Bloomberg News: Gold Achieves Liftoff as Prices Rocket Toward $1,400!

Gold has now marched up more than $130 an ounce in just the last month!

Silver easily broke above $15 an ounce this week, to close Thursday at $15.49. That’s up from a low last month of $14.27. That’s an 8.5 percent move in just over three weeks.

With these moves, we are watching many of our monetary predictions and warnings about global confrontations being fulfilled.

Two months ago, in one of our frequent posts about the Persian Gulf, we wrote that “the risk of an incident, even an accident, is rising.”

Now, the incendiary geopolitics propelling gold higher is taking place in an environment in which the markets expect more Federal Reserve interest rate manipulation and credit creation, as well.

Although the Fed did not announce an interest rate cut on Wednesday following its Open Market Committee meeting, close Fed watchers concluded that lower rates were in the offing. Bretton Woods Research said it was “95 percent certain the Fed will begin reducing rates sometime during the next 91 days.”

The widespread certainty of lower rates ahead not only pushed gold up, but it also pushed the dollar and treasury market yields lower.

As we reported recently, former Congressman and long-time gold expert Ron Paul is explicit in identifying this as a gold bull market. Similar bullish calls are coming in from every direction. Even Citigroup analysts say $1,500 seems to be a reasonable target for gold. Hedge fund manager Paul Tudor Jones, who we wrote about last week, sees $1,700 gold coming “rather quickly.”

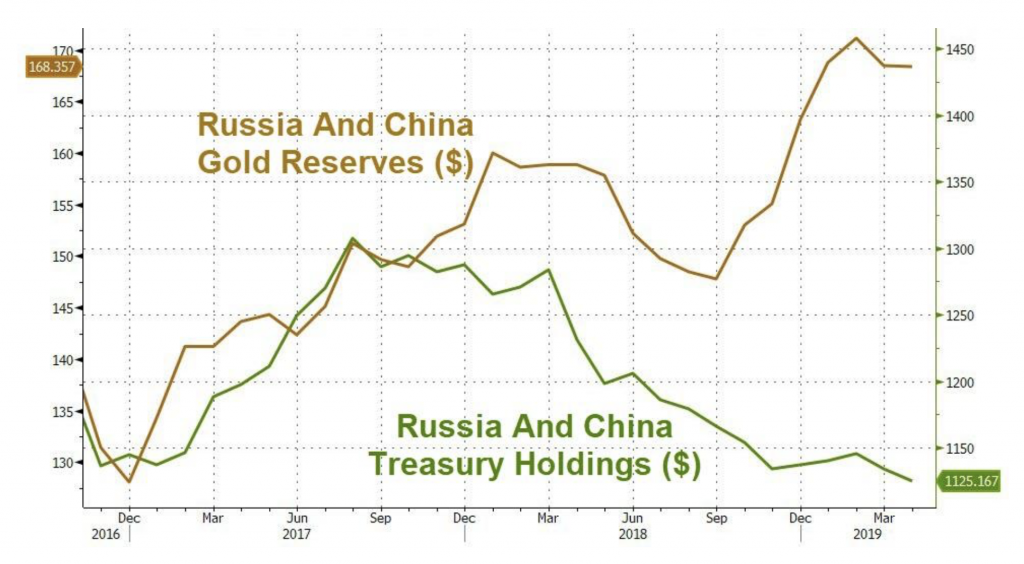

Elsewhere, China’s aggressive gold buying continued in May for the sixth straight month. The chart below from Zero Hedge illustrates this de-dollarization and the move to gold by China and Russia.

We cannot be more clear: These powerful moves in gold and silver are not accidents. The world is growing more dangerous by the moment, and central bank authorities, not just at the Federal Reserve, but in Europe and around the world, know no other course but massive credit creation and money printing.

It is a path of dollar destruction. It is a road of no return.

We advise our friends and clients to add aggressively to their precious metal holdings now.

For those who have not yet taken steps to protect themselves and their families, we urge you to read the timely advice we posted last week: Don’t Wait Until It’s Too Late to Own Gold! Then contact RME Gold to learn more. Simply call our office and you will be connected to one of our knowledgeable gold and silver professionals.